Editor’s Note: We hear your feedback asking to make this publicly available, so we’ve decided to do just that. Feel free to share this article with anyone you think might enjoy it. – Corbin

By now you’ve all likely seen this Facebook video from Craig Berry: https://www.facebook.com/craig.berry.754/videos/10206960745401441/

For those uninterested in watching these videos, let me give you a summary with one picture.

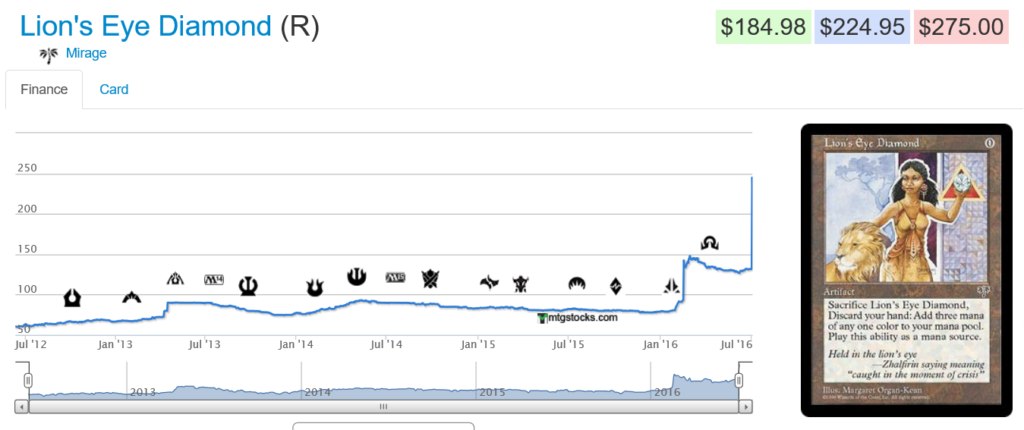

This person publicly announced his intended buyout of Lion’s Eye Diamond. When this video went public, it spawned a cascade of Twitter debates and discussion around morality and regulation. I recognize that some may already be tired of this subject, but it really requires a deeper look. This type of behavior directly impacts MTG finance whether we want to admit it or not, so I need to spend an article assessing the behavior analytically and recommending where to go from here.

Legality

Most will agree what Craig did with his video is not illegal. There are no regulations in the Magic card market. In fact, I started thinking about this further – are there any regulations that prohibit pump and dump schemes in other collectible markets? I’m honestly not sure. If someone wanted to buy out a certain artist or a particular coin I suppose they could try.

But Magic has a couple unique aspects going for it. First of all, people aren’t playing games with artwork and coins. I mean, my father and I used to play this game called “Hit the Penny” when I was five years old, but I don’t think collectible coins are something you want to line up on a sidewalk and throw tennis balls at. Magic cards have a utility outside of being collectible – when a card’s price is tampered with, it could prevent some people from acquiring copies they need for a deck.

Second of all, I think it’s fairly unique that such a small number of copies of a good that people want are available at any given time and at such a reasonable price. Buying out a 1909-S VDP penny, for example, would require far more capital than buying out LED and I imagine it would be much more difficult because there may not necessarily be a centralized website where all dealers sell. All barriers to similar pump and dump schemes.

I could also compare the LED and Moat pump-and-dump schemes to those on Wall Street. This is where things become a bit fuzzier. The Security and Exchange Commission does their best to discourage behaviors like Craig Berry’s, but is it truly illegal? An individual named Jonathan Lebed ran pump and dump stock schemes out of his parents’ basement when he was just 15 years old, making hundreds of thousands of dollars. When the SEC stepped in and prosecuted him, they settled with a fractional fine and a slap on the wrist. While many regulations are in place attempting to prohibit shady behavior with penny stocks, the reality is there lacks effective means to address pump and dump schemes by unregistered groups and individuals (according to Wikipedia).

Net, it’s extremely frowned upon but difficult to regulate when people are posting on forums every minute about their stock picks – well-intentioned or not.

Unique Enablers

I alluded to two unique aspects of MTG earlier: game utility and centralized stock. Both of these factors feed heavily into the feasibility of pump-and-dump schemes in MTG finance. Add in the “Fear of Missing Out” phenomenon I talked about last week, and you have a fairly reliable mechanism to make money.

Once vendors increase their buy lists to restock on these targeted cards, the pump-and-dump game is won. Perpetrators cash out and enjoy their profits.

There is a way to circumnavigate this system, or at least avoid risk of having to pay an artificially higher price for your cards. The idea is fairly simple to execute. All you have to do is prioritize what you need most from the reserve list and acquire as soon as feasible.

I recognize everyone has limited resources at their disposal, but this is where prioritization comes into play. If you focus your attention on the most critical cards – especially ones on the reserve list with low stock – then you’ll have what you need in advance of any questionable activity. After all, it’s not like these Legacy playable reserve list staples are going down any time soon, right? At worst their prices will remain flat, but you’ll be better able to sleep at night knowing you have what you need from the reserve list.

The other distinguishing factor of Magic is the centralized location of stock. By buying out a few websites, the vast majority of copies available on the open market are acquired. These sites include TCG Player, eBay and Star City Games. Once these sites go out of stock, the rest of the market quickly follows as late-comers pick up the remaining copies.

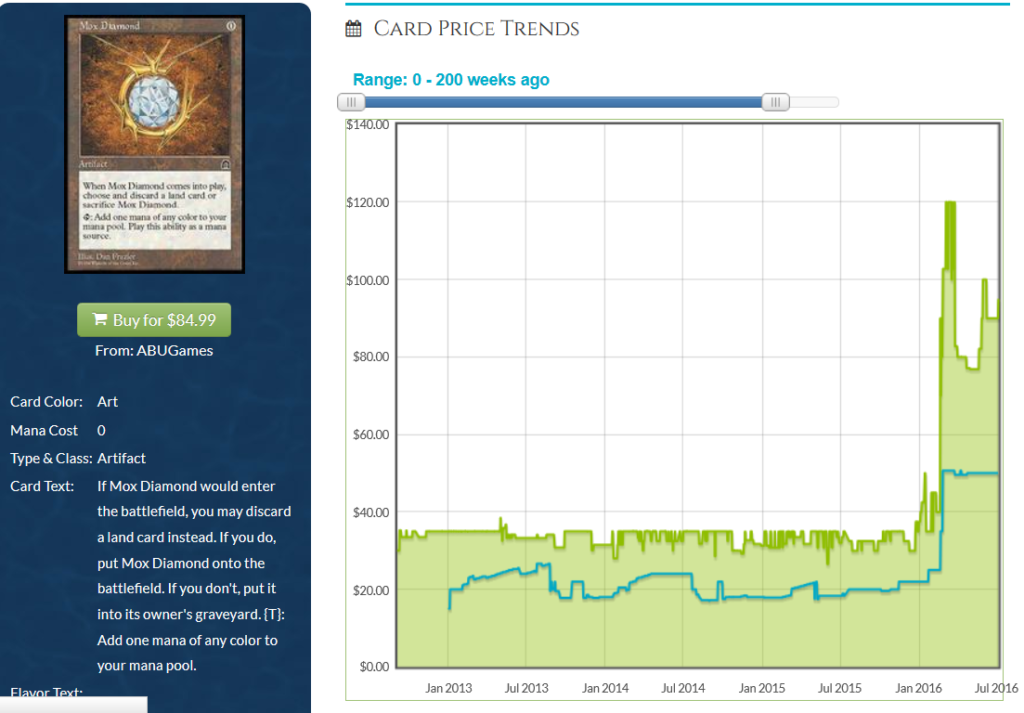

If you insist on putting off reserve list buys until last minute, I have one recommendation to offer. As soon as you see movement in a card’s price, you have an extremely narrow window to visit other sites to try and find copies at the “old price”. These are sites that don’t sell on TCG Player, and therefore would be overlooked during coordinated buyout efforts. I keep a list of these sites, and I’d recommend you do as well. Mine is admittedly short: Cardshark.com, ABUGames.com, and CardKingdom.com are the ones I visit immediately. If these are out of stock I usually give up but I know there are other, more obscure names out there. I most recently found success with this strategy when acquiring Ancient Tombs – I noticed TCG Player was drying up quickly but I found reasonably priced copies on Card Shark during the buy-out.

Planning Ahead

People really despise pump and dump schemes in MTG. But here’s the reality: it’s legal, extremely difficult to regulate, and profitable due to unique aspects of the game. Therefore, I can say without a doubt that this will happen again. If you don’t want to get burned by these schemes, you need to be prepared. That means remaining vigilant and being pro-active with your acquisitions. Investing in older cards has been very profitable over the past few years, but we need to act decisively and unemotionally if we wish to increase our returns.

For starters, I would examine the reserve list and compare it against stock on TCG Player. It’s best to “think like the schemers” to try and identify what may be targeted next. By no means am I advocating launching a scheme like this yourself. But if you are in need of a reserve list card for your deck and you notice stock is low, please don’t ignore it. This way if a buyout does happen, you won’t be caught unprepared, wishing you had made your purchase the week before. If there’s an inverse of buyer’s remorse, surely this must be it.

I’m not going to offer up suggestions because I don’t want this article to be construed as another pump-and-dump scheme. I recognize there are many readers of MTG Price’s content and it is not my wish to incite another buyout. I will, however, mention one specific group of cards because they should not be a surprise to anyone: Dual Lands.

With the printing of Eternal Masters, the most desirable Dual Lands are returning to their all-time highs. If this was a stock chart, I’d begin looking for a break-out cup-with-handle pattern.

Alas, I’m not sure if such technical analysis can be applied to Magic cards (perhaps that’s an article for another week). What I am sure about is that the demand for Underground Sea is very strong. I am currently in the market for a copy to complete a deck, and I’m having a difficult time finding an attractive deal. TCG Player starts in the $240’s for heavily played copies, which I don’t particularly like. Any time a copy is listed for less on eBay it’s immediately bought. And copies on Facebook groups are bought relatively quickly as well.

There are plenty of copies at Star City Games (making a pump-and-dump scheme expensive) but their stock is already priced above going market rate. For example they’re selling Moderately Played copies for $350 even though copies in similar condition start in the $260’s on TCG Player. Similar trends can be found with other blue duals as well, showing the recent swoon in dual pricing is over.

Again, I’m not advocating rampant speculation in these cards. But if you have been sitting on the sidelines for the past few months debating when to acquire I’d recommend making the move once you have the resources available. There are other vulnerable targets out there, but duals are the only one I’ll mention in this article to avoid inciting rash buying behavior.

Wrapping It Up

There’s no reason to believe the recent pump-and-dump effort with Lion’s Eye Diamond was an isolated incident. Rumors abound call out the same group as responsible for the recent spike in Moat. It’s hardly a stretch to suspect similar culprits for other buyouts such as Library of Alexandria and The Tabernacle at Pendrell Vale. Because of how profitable this act is – along with the fact it’s legal and virtually impossible to regulate – we have every reason to believe this will happen again.

Your best defense against this behavior is a good offense. That doesn’t mean you should find the next buyout target and coordinate your own scheme. Instead, I advocate that you prioritize cards you need by evaluating their presence on the reserve list and availability on TCG Player / Star City Games. If a card is sparse and cannot be reprinted, it’s vulnerable to a pump-and-dump scheme. By acquiring these as you need them and not procrastinating, you can rest assured you have what you need to play with (while also reaping the reward of a more valuable collection).

If you insist on ignoring these behaviors, then the best I can offer is my list of less-known sites where you can purchase copies of a card at the “old price” during a buyout. This doesn’t work all the time, but it’s worked enough to justify visiting Card Shark, ABU Games, and Card Kingdom on a regular basis. These are all great sites to use even for ongoing needs, so I have no qualms advocating for them.

Lastly, I encourage you to plan ahead. Think about cards you will be needing in the future and think about what you’ll do if they start to sell out. By having this forethought, you’ll avoid emotional buying. FoMO is a powerful influencer, and it could lead you to making suboptimal decisions with your money. I never advocate chasing these buyouts at higher prices, and a well-thought plan in advance will ensure you never have to, no matter how manipulative market movers become.

…

Sig’s Quick Hits

- When Triskaidekaphobia spiked, I noticed Star City Games increased their price from around fifty cents to $1.13. This was an amusing shout-out to the card’s flavor, but the price tag was short lived. Now copies are up to $1.99, which is as high as I see this one going. If you bought copies near bulk before the spike, your window to profit is closing as we speak. I would recommend flipping those copies now and moving onto the next target.

- “Open a Tarmogoyf, need three more” was the active phrase used to describe Modern Masters’ impact on Modern prices. It would appear the Tarmogoy of Eternal Masters is Force of Will. The card’s price didn’t stay low for very long, and Star City Games is completely sold out of all non-foil copies: $90 for Alliances and $100 for EMA copies. If Legacy interest is truly rising due to Eternal Masters, my push to acquire duals becomes even stronger.

- Dodging reprint has propelled Infernal Tutor to all-time highs. Star City Games is sold out of English copies of this Legacy staple with a $28 price tag. Honestly, I see no reason this card won’t keep climbing since it’s a 4-of in the popular Legacy storm deck and could one day become relevant in Modern. If Legacy demand alone is enough to buoy this card’s price higher, then expect Eternal Masters to drive more interest rather than less.

How to deal with Buyouts should be public information.

The #mtgfinance community is creating a very real bubble that could pop with the glance of fakes that pass all tests but loupe (which is coming unfortunately) as we would see a mass exit.

It would be great to have this article for everyone, since this debate has been a boiling point for a lot of mtg players.

I’m all for making this public. I’ll talk to the bosses to see if that can be enabled. Appreciate the comments!

There’s nothing immoral about speculative buying on the LEDs. The buyer is assuming a lot of risk so therefore derserves any reward.

No one forces anyone to pay their asking prices so they assume people will be willing to.

Instead of constantly trying to figure out how you’re going to become hundredaires overnight by speculating on magic cards just acquire them and enjoy. Full disclosure I own somewhere between 12 and 12 LEDs along with multiple copies of every card listed here and beyond.

Thanks for making this public!

You’re welcome, thanks for commenting and sharing your concern!

Yeah, thanks for making it public. I’m sharing it on my region’s FB page, hopefully it will encourage players to think ahead when building/acquiring the cards for their decks.

Thanks for sharing, Ben! Happy to answer any questions that come up as well.

I’m not sure bringing up the Lebed investigation really serves this discussion.

I get the idea of it representing the huge grey area in regulation, but the Lebed investigation was more a witch hunt on the part of the S.E.C. to maintain credibility, not only their own, but the credibility of the market in the public’s eye. Some rank amateurs lost money listening to Lebed, many of the reasons I will touch on a bit later in my rambling. And of course, since the general level of arrogance in American society is rather high, someone had to be blamed, and naturally, it wasn’t the investors who refused to believe that the real issue was that they simply sucked at investing, and needed to piggy back off someone who didn’t suck. None of this means that Lebed was lying or that he was wrong with regards to any particular equity.

I could take an hour or more to regurgitate the rest of the relevant information, but I am not going to do that. There is plenty of investigative articles on the matter, and quite frankly, the Wikipedia article is very, very lacking in 99% of the relevant facts.

The bottom line was this, Lebed wasn’t guilty of very much, and certainly wasn’t the heinous criminal the S.E.C. made him out to be. People, as many will, adopted the herd mentality, listened without question, didn’t bother to engage in any kind of DD, didn’t bother to consider that those who pass along “tips” are much more capable, much more nimble, than they were at getting in and out of investments. They see dollar signs, a way to make a quick buck without having to turn in a 40 hour work week in order to do so. And that’s something I think we can all relate to, but that’s no excuse to not pay attention to what one is getting themselves into.

We see the very same with MTG finance authors. I will use Mr. Chillcott as an example. He has a lot of connections, and a lot of resources that the average financier doesn’t have. Because of those, and other factors, he is able to get into positions quickly and generally at much lower prices than most of us. He understands when to buy, how to buy, and where to buy, as well as when to unwind his positions quickly and profitably. Yes, he isn’t always correct, and I am sure he would be the first to tell you that.

But, in all honestly, how many people actually consider these things when they listen to what he has to say? I would bet that most financiers fit into that category, yet most wouldn’t admit it for a number of reasons.

People can get on social media and rage on about whatever. The simple fact is, 99% of these folks simply are not as good, and not as capable as they like to think they are. So when the shit hits the fan, of course, since they are self-proclaimed experts, there can not possibly be any other reason why they are wrong, or lost money, other than its a scam or manipulation on the part of one of us filthy, dirty speculators.

It’s an excellent discussion that is sullied by the fact that the average person seems incapable of keeping their emotions and subjective opinions out of the discussion.

At any rate, this is an excellent article on a hot button topic.

This is a brilliant comment and I wholeheartedly appreciate your taking the time to share this background. I’ll admit Wikipedia was the extent of my research on Lebed. The details you share here only magnify my point on pump-dump schemes: they’re poorly regulated at best.

Your point about James’ resources and connections is well-taken. I personally don’t have much in terms of connections…I try to network and develop connections but largely I’m underconnected at best. Still, I think some sound preparation and acceptance of the facts is what everyone can benefit from – so that’s what I tried to discuss in this week’s column. Emotion-free, data-based. That’s how I try to think about MTG Finance.

Your comment merits a thorough response, but in reality my time is limited as I type this during a lunch break at work. But I do plan on thinking more about this in time for my article next week. I think it’ll be an interesting one.