Editor’s Note: This article doesn’t necessarily reflect the views of MTGPrice, but we feel it is a topic important enough to warrant publishing this piece to kick off discussion.

By Peter Twieg

Since its public opening in 2013, PucaTrade has rapidly grown to become a key institution in the MTG trading community. There are many factors that have contributed to its rise, among them the establishment of a site currency called “PucaPoints.” PucaPoints have been integral to allowing PucaTrade to flourish as a trading platform. However, this flourishing may prove to be unsustainable in the future unless PucaTrade’s owners rethink some of its policies governing how PucaPoints are managed.

This article is an elaboration of a post I had made on PucaTrade’s subreddit over a month ago, entitled “Is PucaTrade a Pyramid Scheme?” In retrospect, this title was likely a bit too inflammatory for the sort of discussion that I was hoping to generate. Nothing in this article should be taken to imply that PucaTrade should be abandoned as a platform or that its administrators are acting in bad faith with their policies. Indeed, I love PucaTrade and will continue to use it even as the problems I’ve observed continue to manifest. Nevertheless, these issues deserve a lot more discussion than they’re currently receiving, as they will in time impact the experience of every user on the site. If you want the “short” 1000-word version of this argument, check out my post above. If you want the full 3000-word discussion, though, navigating from the principles of digital currency management to how these principles are causing issues for PucaTrade to some simple policy recommendations and advice for the users, however, read on.

Conjured Currency

Most readers will probably have some prior familiarity with virtual currencies, if not from using PucaTrade itself than from using some other website or video game that employs one. Why do these currencies exist to begin with? There are two major applicable reasons here: Firstly, by using a site currency rather than USD (as an example), PucaTrade can avoid a lot of the regulatory compliance costs that would come from serving as a real financial intermediary. They can also avoid burdening users with the costs of using a payment system such as Paypal to facilitate digital transactions. Secondly, however, by issuing its own currency the relevant monetary authority (in this case, the PucaTrade staff) can benefit from what is formally known as seigniorage. This is basically the privilege of being able to direct how currency enters the economy – if PucaTrade staff wanted to issue themselves a lot of site currency and use it to have traders send them Tarmogoyfs, then they could probably do this, although this would cause trust in the currency to collapse and kill the site. While I do not believe that the staff would do such a thing, seigniorage is an important part of PucaTrade’s functionality, as the staff use their currency-generating capabilities to institute a variety of policies that they believe will help the community. More on this later.

When an institution creates a virtual currency to be used within some economy, proper management of that currency is crucial to that institution’s success. Early online games that used virtual currencies have provided us with many salient examples of the consequences of mismanagement. Diablo II, for example, developed the infamous “Stone of Jordan economy” when its ingame currency became so devalued that ingame gold stopped being the medium of exchange in favor of the difficult-to-acquire but widely-demanded Stones of Jordan. Despite this experience, Blizzard couldn’t get things right and Diablo III ended up experiencing well-documented hyperinflation episodes as well. One of the major issues that monetary authorities must address is how to manage the money supply to avoid a devaluation of currency and the corresponding economic problems that this can create. Discussions of these topics often focus on “currency sources” and “currency sinks” – what algorithmic forces are putting currency into the virtual economy and what forces are removing it? To reference back to the Diablo examples, inflations would occur because currency would be continually generated as monsters were killed in the game, and players did not have strong incentives to do things that would remove money from the economy (such as buy items from vendors.) Inflation and devaluation will occur if the flow of money entering the economy exceeds the rate at which it’s being removed, all things being equal.

How do these concerns apply to PucaTrade? Well, it’s important to understand from the start that PucaTrade relies on fixed prices for all cards. Each card’s price is pegged at roughly TCG Mid price, and this peg is maintained regardless of how many PucaPoints are in use. But although PucaTrade fixes prices on individual cards, the PucaTrade economy is not closed. One can buy and sell PucaPoints for USD, and changes in the supply and demand for PucaPoints will impact the currency’s USD price. So the worry about excess currency in the PucaTrade economy is not that Future Sight Tarmogoyfs will go from costing 20k PucaPoints to 200k PucaPoints, it’s that the supply or demand of Tarmogoyfs at the fixed price level will be so far from the actual market-clearing price that no exchanges will occur. Before discussing why this might occur, some additional basic facts about PucaPoints must be understood.

As discussed in the Diablo case, balancing algorithmic currency sources and sinks is a necessity to ensure stability on a site like PucaTrade. What, then, are the sources and sinks of PucaPoints? Well, anyone who’s used the site has noticed that you get some currency merely for signing up and completing some basic actions like filling out your profile and sending out your first card over the site. The administrators have decided to use their currency-issuing power to make sure that every new user gets a small amount of currency. I’ve seen some individuals express concern over this, but the money supply scaling with the number of users is actually a rather smart way to prevent the currency from become more valuable simply because the userbase (and hence demand for currency) is growing. It’s also a great way to incentivize new users to try the site – from the newbie’s perspective, you can get some free cards! Additionally, one can buy PucaPoints at a fixed rate of 100 points per USD – this open-ended exchange rate essentially provides a price ceiling on the value of points. Next, and veering a bit into sketchier territory, the site has issued currency for self-promotion. PucaPoint raffles were offered for backers of PucaTrade’s recent IndieGogo campaign when it appeared to be stalling out. Site users can receive PucaPoints by getting others to sign up, which I’ve seen lead to some quasi-astroturfing for the site using hidden referral links.

Shared Fate

But what’s most overlooked here, and probably more important than any of these other factors as a long-term source of PucaPoints, is what PucaTrade calls its “100% Trade Guarantee”. This trade guarantee is a major factor in PucaTrade’s utility, as it makes trading cards via mail a very safe proposition. On most trading platform if a sender sends a card and the recipient claims to not receive it, the sender simply eats a loss on the card, especially if the package was untracked. However, PucaTrade’s use of site currency has enabled it to implement a trade guarantee whereby if a package is lost, then if the sender is considered to have done due diligence in trying to deliver the package, he will be compensated for the amount of points that he would have received if the trade had been completed normally. The receiver is also refunded the points held in escrow while the trade was being executed. So, in other words, if Alice sends a Polluted Delta to Bob and PucaTrade’s price on Polluted Delta is 2000 PucaPoints, then if Alice’s package is lost then she will be given 2000 PucaPoints and the original 2000 points will also be refunded to Bob. Both traders end up satisfied, but we’ve just seen 2000 additional points enter the system! Note that this amount of 2000 points is likely much larger than the amount of points made for Alice when she generated her account, and if she continues to use the site and the occasional card is lost in transit than she’ll continue to generate more points when the 100% Trade Guarantee is invoked. This means that by virtue of using the site and having a nonzero rate of invoking the 100% Trade Guarantee, Alice will be increasing the money supply over time.

This brings us to what I feel is the first major lesson that most users don’t know about PucaTrade: The 100% Trade Guarantee does not provide a free lunch. The 100% Trade Guarantee simply “papers over” feel-bad losses by throwing currency at users. Essentially, this is a sort of insurance policy – when Alice’s package is lost she’ll be compensated, but this comes at a cost to other currency-holders whose holdings are slightly devalued. If Alice is holding currency, then the value of that currency will decline when Bob invokes the policy, or when Carla does, or anyone else. And the costs of an individual case may be diffuse, but across many users they will add up in subtle ways, and in ways that are not only relevant to those who are directly involved in buying or selling currency. To some extent I do think the PucaTrade staff are taking advantage of users here, as the 100% Trade Guarantee is wildly popular but in large part this is because its users don’t appreciate its impact on the overall value of the currency. On the other hand, I’m also not saying that the 100% Trade Guarantee is a bad policy even in light of this – perhaps some sort of sender insurance is simply the right way to go for trading platforms, and PucaTrade has implemented a relatively frictionless version of this. However, the fact that other trading platforms do *not* offer these generous policies is directly attributable to their not having their own site currencies that can be used to subtly spread losses among the userbase.

Before moving onward, an important caveat should be given: I’m not 100% sure that any of these mechanisms are actual money sources. The staff could simply be giving out PucaPoints that they’ve acquired through sending out cards or some other means, but I highly doubt that that’s the case and they’ve had multiple opportunities to say that my assumptions here are wrong in prior discussions. The PucaTrade economy has almost no real money sinks beyond when the occasional user is banned with a lot of points in their account, and I doubt this really amounts to much. I would guess that the 100% Trade Guarantee is not only responsible for the majority of PucaPoints being generated, but that its share will continue to increase over time, as it will lead to currency being generated at a roughly-constant rate relative to the size of the overall economy, whether or not the userbase is growing or not. So what does this mean for PucaTrade’s economy, exactly?

Creeping Corrosion

The reason why I made my original post on this topic on Reddit was because I had noticed that the price of PucaPoints for USD seemed to be declining over time. While one can always buy PucaPoints from the site directly, it’s perfectly okay to sell PucaPoints for USD. When I started using the site in January, informal sales of PucaPoints tended to put the price at around 85 cents per 100. When I made my post in June, that price had fallen to 75 cents. Now at the beginning of August, the market price of PucaPoints is at roughly 70 cents per 100 and threatens to fall further – as of 8/13, I just saw my first offer to sell at 68. So here’s lesson #2: The price of PucaPoints is hugely important for what can be traded via PucaTrade. Many people wrongly believe that since PucaTrade pegs its prices to TCG Mid, then changes in the currency supply won’t affect the availability of cards on the site. Those people are wrong, because changes in the currency price will affect which cards are supplied and demanded via PucaTrade.

As an example of why this is true, I used a thought experiment in my Reddit post: Imagine that in some horrible dystopian future Alice were willing to send Polluted Deltas on PucaTrade for 2000 PucaPoints, but also that PucaPoints could be bought at a rate of 20 cents per 100. This would imply that anyone could spend $4 to get 2000 PucaPoints, add a Polluted Delta to their “Want” list on the site, and then be eligible to receive the card from Alice. The obvious result here is that you’d have a massive excess demand for $4 Deltas on PucaTrade, and the average user would simply no longer be able to acquire Deltas – or any other staple cards for that matter – within a reasonable timeframe. As of this writing the low price of a NM Force of Will on TCGPlayer is $99.75 with shipping. On the other hand, Force of Wills can be acquired for 11202 PucaPoints. At an exchange rate of 100 points for 70 cents, this is the equivalent of $78.41. At this price, what stops everyone from just purchasing FoWs from PucaTrade? The answer is one that we see all the time in real worlds when price controls are employed: Queues develop. If you want to get a Force of Will, you will likely be waiting for weeks or months. Because of the falling price of PucaPoints and the increased demand for staples this creates, the PucaTrade dream of trading your standard chaff into Force of Wills or dual lands is quickly dying.

Ultimately, I’m very confident that the ongoing devaluation of PucaPoints is due to the monetary issues I’ve outlined above. I’m not certain how much of the growth in the money supply is attributable to the 100% Trade Guarantee, but even if it’s small it represents a mechanism that is going to continually devalue the currency even with a constantly-sized userbase. In many cases, users have responded to this devaluation and the lengthening queues on staples by offering “bounties” on particular cards – specific offers to transfer extra points to senders when a desired card is received. This is a very clumsy and non-scalable workaround to the underlying issues, but in some sense it does keep the dream on life support. If you really want your Force of Wills, you can just offer extra points for them.

But maybe declaring the dream “dead” is too fatalistic. Lesson #3 explains why the sky isn’t falling: Because the falling PucaTrade price stimulates demand for various cards, cards where there had previously been excess supply are now becoming easier to send out via PucaTrade. The previous dream was difficult to achieve because for most cards on PucaTrade – standard cards in particular – supply exceeds demand, and users would have to use tools such as MiseBot or PucaPower to try to send out cards where sending opportunities would disappear in seconds because of massive excess supply. For this reason, one could argue that the aforementioned PucaTrade dream never really existed, as the difficulty of sending out bulk cards via the site was often downplayed. In the future, if the currency continues to fall, this will simply rebalance supply and demand on each individual card – the ones that have excess demand will continue to become harder to acquire (in recent weeks users have started complaining about the difficulty of acquiring shocklands), but the ones that have excess supply will become easier for users to trade out in order to acquire whatever cards that are still acquirable via PucaTrade. This is the core dynamic that is playing out as the currency devalues, and it’s even possible that on net the optimal price of PucaPoints for the site itself and its community is somewhere around where it is now. But even if it were, if my assumptions about how the supply of PucaPoints are managed are correct, we would end up sliding past whatever ideal point that may exist as this supply continually expands due to its governing algorithms.

Illusory Gains

So why hasn’t this issue received much attention already? As I alluded to earlier, I think part of the problem is that people don’t really understand the full picture of what’s going on, and the site staff have structured the site in a way that obfuscates exactly how these policies are impacting the health of the platform. People think that the 100% Trade Guarantee is a free lunch rather than a policy that compensates unfortunate (or lazy or malicious) senders by redistributing value from currency-holders to the sender. People think that the devaluation of the currency isn’t linked to the availability of cards that can be sent or received via PucaTrade. People see the outstanding and largely-deserved growth rate of the site and think that everything is great. Indeed, rapid site growth would in fact slow the phenomena I’m worried about. However, high exponential growth in the userbase will not continue forever, and when things level out we’ll still have a lot of flowing money sources in the economy without corresponding money sinks.

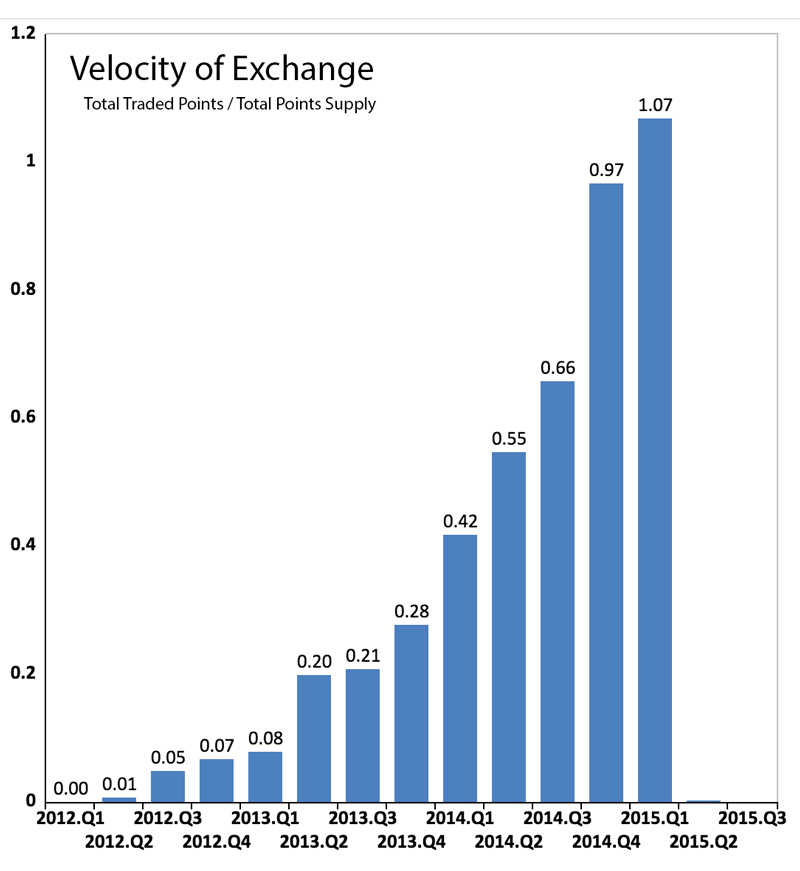

In a response to my Reddit post, site founder Eric Freytag pointed out that the velocity of PucaPoints was increasing over time, which he argued indicated that the supply of PucaPoints wasn’t keeping up with site growth. To me, this misses the point: The goal of PucaTrade’s monetary policy should not be to keep the velocity of the currency constant, but to keep its value stable at some determined optimal level. The increase in velocity, as he pointed out, is a positive indicator for the site’s health, but it’s a positive indicator that exists despite the underlying monetary issues. I waited on writing this article because I felt like rather than just arguing these points I could simply let my predictions be borne out, and I believe that this is happening. More cards are becoming difficult to acquire on the site and PucaPoints are readily available for below the 75-85 cents per hundred range that Freytag argues is the historical norm. Left unchecked, expect prices to drop below 70 cents per 100 PucaPoints by the end of summer.

Moving forward, there are many policies that PucaTrade staff could deploy to address these issues, each with their own upsides and downsides. Here are several:

- Move away from fixed prices: There are many arguments for why PucaTrade should stop fixing the exchange values of cards regardless of its currency issues; namely, this would allow for prices to equilibrate supply and demand regardless of the value of the currency. The main drawback is that money supply growth would translate into inflation, and a high inflation rate could cause problems for the site’s usability.

- Relax the 100% Trade Guarantee: This would be pretty unpopular, but a lot of that unpopularity would be based on people not understanding how the trade guarantee is really an insurance policy paid for by all currency-holders. It should be possible to implement a more-transparent insurance policy that doesn’t inflate the money supply. I hate to use the word “tax” here, but simply taking some small percentage of PucaPoints from all users every month to cover the costs of the Trade Guarantee (and perhaps offset other money sources) would stop ongoing devaluation.

- Add money sinks: A tax as outlined above would essentially represent a money sink, in that it would either remove currency from the economy or offset the need to employ money sources. While I don’t expect an actual tax to be implemented, one proposed money sink has been to allow users to purchase PucaTrade’s premium membership levels using PucaPoints rather than USD. This would remove a steady flow of points from the economy, although it might be too little or too much. The main drawback here is that this would surely have a negative impact on the site’s revenues, and administrative reluctance to do this is perfectly understandable. The dream scenario would be that this pushes the price of PucaPoints so high that it hits the 100 per USD ceiling again and the site starts selling more currency, but I am not particularly confident that this would occur.

- Do nothing: Again, the sky isn’t falling. There’s no need to sell off your PucaPoints immediately. I mean, it’ll take years for the gears to really grind to a halt on the site, and in internet terms that’s a really long time!

Enthralling Victor

If you’re managed to make it this far into the article, I’ll close with some comments on how to adapt to this changing PucaTrade landscape. As I’ve mentioned, shocklands in particular are in an interesting spot on the site right now. They’re quickly becoming more difficult to acquire through the site, but I’ve still had success in getting them. I’ve noticed a few things that help in this regard, and likely would help to acquire other cards on PucaTrade where there’s a lot of excess demand. The key to all of these is having ways to make shipping to *you* more attractive than shipping to the 50 other users after the same card. Some tips include:

- Buy in bulk: Having a single Breeding Pool or Steam Vents on your Wants list can lead to your waiting for weeks. However, if you have a full playset of shocks on your list, then someone who is interested in sending several at once may choose you as the recipient. Having a bunch of shocks on your Wants list for a week or two and having them all taken at once is incredibly awesome.

- Offer bounties: Yeah, this is costly but it does work. Even a small bounty on a card will set you apart, if you’re willing to pay it.

- Have an inviting profile: If I’m going to send out a card where there’s excess demand on PucaTrade, I always check out people’s profiles and try to find someone who appears experienced and is unlikely to hassle me over card condition peccadilloes or other possible shipping issues.

- Buy a silver/gold membership: This is really an extension of the previous point – users with paid memberships tend to appear more trustworthy as they have some sort of investment in the site. This is hardly the only reason to buy a membership, but I think it’s a massively underappreciated one!

Conclusion

In closing, the PucaTrade system as it stands has some important cracks in its functionality, and it’s important for the community as well as the site staff to understand the nature of these issues so that good policies can be implemented without creating uninformed blowback. Importantly, I don’t claim to know what the price of PucaPoints “should” be to make the site work most efficiently for the largest number of people, but if we’re not paying attention things will slide past that point pretty quickly, if they haven’t already. Part of what I’d like to see from PucaTrade staff is more transparency concerning how much currency is being generated and how long the average wait times on various staples are changing over time. The above velocity chart is a very paltry start. I’m open to being proven wrong here if the right data can be provided. Let’s kick off a real discussion here.

Very nice article. I haven’t traded in the Puca economy, but it seems that the fundamental problem is that you have an increasing monetary base (which creates inflation) and no ability for prices to adjust in the Puca market, since they are pegged to the the TCG price.

If prices were able to adjust within the Puca market, I think you wouldn’t see the problems with the card shortages that you’re currently seeing.

The other suggestion I have is for the “Trade Guarantee” to instead be an insurance program that the seller or buyer has to opt in for, at a nominal charge of Puca Points. This would stop the “free money” from being injected into the economy.

I really like the idea of being able to purchase premium accounts with points.

Good article. I’ve been enamored with Puca lately and having good experiences. It’s good to hear all sides. I have been thinking hard able how to pull value from my Puca points, beyond the smattering of cards for my personal collection.

I enjoyed your article. I’m not particularly concerned about inflation at this point, as I price the possibility into my decisions. PucaTrade gives me the ability to trade cards for much more than I would receive at buy list from a dealer, and to trade cards that have no takers where I live. I’m willing to take small losses in the value of my “currency” in exchange for the convenience.

You might also wish to consider the liquidity of PucaPoints when you consider their value vis-à-vis USD. We should expect there to be a discount simply because it isn’t convenient to get from points to cash. How much of the discount is caused by inflation, how much is caused by inconvenience? It might be worth trying to tease these things apart.

>You might also wish to consider the liquidity of PucaPoints when you consider their value vis-à-vis USD.

My impression is that PucaPoints are fairly liquid… but they could definitely be moreso. If I had the web development chops, I’d look into creating a PP USD market site in the same way that people have done for MTGO Tix USD. I definitely think there’s an opportunity there.

But in any case, I don’t think the change in the price of PucaPoints over time can be attributed to changes in liquidity.

>PucaTrade gives me the ability to trade cards for much more than I would receive at buy list from a dealer, and to trade cards that have no takers where I live.

Yeah, just keep in mind that part of my point is that there’s a growing list of cards that you can’t reliably trade towards on PT. NM Duals are basically impossible to get at face value, and I’ve noticed in the past week or so that KTK fetches (!!) have become very very difficult to acquire ever since the ZEN fetch announcement. These problems will likely continue to deepen if the trajectory I’m predicting is correct.

True, it does seem that the “aspirational” cards have large queues at this point. In the past, though, those have been difficult to trade up to in any case. PucaTrade has allowed me to trade small cards into medium cards without any problems. From what you claim, this should cease to be possible, as any desirable card becomes a refuge for points. But in what time frame?

Mr. Twieg, As an employee of PucaTrade, I want to address a few of the unfounded claims you’ve made in the article.

1) I doubt very much that you bothered to try to interview or speak with anyone at PucaTrade, outside of making a post on Reddit. The only data you have comes in the form of a chart from Eric Freytag, which actually runs counter to your conclusion, and which you dismiss.

2) I don’t think you understand the 100% Trade Guarantee. It is NOT always the case that when packages don’t arrive, points are freely given out. In fact, many users are out of luck, but we try to be nice to ones who are traders doing things in good faith, and we insist on using tracking for expensive packages. In fact, many users are warned or banned for having repeated misbehavior or a suspicious number of lost packages. You claim that this factor is probably “more important” than the other ones in increasing supply into the economy, and you say you are “very confident,” but don’t have a smidgeon of data on that, and I don’t think you’ve ever tried to get it before making your claims.

3) Your argument seems to be: there is inflation, so therefore, it’s only a matter of time before the monetary system collapses. Would you say the same thing about the US dollar when there is 3% inflation? Of course not. Policy changes regarding the economy are always possible, including ones that take money out of the system. The free user bonuses for new users might eventually stop if we feel that we need fewer PucaPoints in the system, for example.

4) You claim to “love PucaTrade” but assert that the functionality is flawed because of economic issues — despite all evidence to the contrary that trades are taking place at a record pace. The chart here is highly instructive. Way more trades are taking place now, and PucaTrade is a vibrant trading community. If the PucaPoint is too high, people are very reluctant to request bulk and low priced items, and it becomes hard to move those — that was the case in the early days, and you can see the result on the chart.

5) Your claims about the dream of getting Force of Wills is dying are just completely and utterly wrong. Every month we release the top trades for every one to see — last time, we had 29 Force of Wills traded in one month. In addition, we have more and more of the Power 9 Traded – so far, we’ve had Mox Sapphire, Black Lotus, several Mox Emeralds, Mox Jet, Mox Ruby, Mox Pearl, and Timetwister traded, I believe. During the last month we had 28 Revised blue dual lands traded (Tundra, etc.), as well as some from Alpha and Beta!

I hope that the average reader here doesn’t buy into your inaccurate conclusions. PucaTrade is better than ever, and we will continue to work to make it improve even more.

>1) I doubt very much that you bothered to try to interview or speak with anyone at PucaTrade, outside of making a post on Reddit.

I hadn’t. I try to qualify some of my assumptions accordingly. Would someone want to converse with me directly on this? I can be contacted at twiegp@gmail.com.

>You claim that this factor is probably “more important” than the other ones in increasing supply into the economy, and you say you are “very confident,” but don’t have a smidgeon of data on that, and I don’t think you’ve ever tried to get it before making your claims.

PucaTrade can provide data proving me wrong if they’d like. I’d be happy to see it. That’s part of why I wrote this article – if it turns out that any of my assumptions are wrong, I’d be happy to correct it.

I don’t feel like I characterized the guarantee, though. I mentioned that the sender has to achieve some due diligence requirements to be eligible for reimbursement, and this implicitly refers to a lot of the specifics you mention.

>3) Your argument seems to be: there is inflation, so therefore, it’s only a matter of time before the monetary system collapses. Would you say the same thing about the US dollar when there is 3% inflation? Of course not. Policy changes regarding the economy are always possible, including ones that take money out of the system. The free user bonuses for new users might eventually stop if we feel that we need fewer PucaPoints in the system, for example.

If the currency was becoming devalued by 3% every year in an economy where all prices were fixed, this would in fact be a serious problem. I’m very clear in this article in saying that it’s the combination of fixed prices and currency generation that are jointly creating this problem.

>4) You claim to “love PucaTrade” but assert that the functionality is flawed because of economic issues — despite all evidence to the contrary that trades are taking place at a record pace. The chart here is highly instructive. Way more trades are taking place now, and PucaTrade is a vibrant trading community.

It is. And as I said, I believe that PucaTrade is growing and vibrant *despite* these underlying issues, and that its growth and vibrancy should not distract from their importance, especially in the long term as PucaTrade’s growth spurt inevitably tapers off.

>Your claims about the dream of getting Force of Wills is dying are just completely and utterly wrong. Every month we release the top trades for every one to see — last time, we had 29 Force of Wills traded in one month.

This is perfectly compatible with the dream dying. If the site is growing, then individual cards can see higher transactions volumes while becoming more-difficult to acquire for the typical user. If you want to prove me wrong on this point, for this one card, show me how what share of PucaPoints are transferred on FoW transactions over time – is it declining? You can query this data, I’m sure. If I’m wrong, this is a clear way to show me.

I apologize if members of the PT team feel I should have reached out to them more before writing this. I tried to caveat my assumptions appropriately, and my goal is not to position this as a hit piece on PT but as something where I’m saying “this is what I’m seeing, feel free to prove me wrong.” I feel like none of your points are doing this, but I’m happy to provide criteria by which my concerns would be assuaged (eg. the FoW test I describe above.)

I’ll also add, regarding the FoW point, that as my article outlines a lot of high-value cards are being traded with bounties or for non-NM copies. These things are probably not tracked in PT’s own data, so there’s an important caveat there – if we see staples traded but on terms that are outside of the default PT rules, this is also a manifestation of the problems I describe.

The bottom-line graph that I’d like to see from PT, which I think would be very illustrative, would simply be a cumulative density plot where the x-axis was card values (from 0 to say, 100 dollars) and the y-axis was the percentage of transactions that occurred for cards of the given point value (or possibly % of transactions * the point value). My suspicion is that we would see such a graph compressing to the left over time (particularly at the 30+ dollar range.) If I were wrong on this, I would have to re-evaluate some of what I’m saying.

Re: FoW point

It should be added that the increase in the number of trades of FoW, or any other staple, should be expected considering there’s a growing userbase. However, how does that number compare as a ratio over time?

As a user, what is my incentive to trade out a valuable card that has a high level of liquidity on other markets (eBay, TCG, etc.) on PucaTrade instead? If I do, I know I’ll have a large amount of points that I can’t do much with in terms of getting other valuable staples, because they’re in such high demand that it’ll be a very long time—if ever—before I win the lottery of someone sending it to me. I know that I have to offer a “bounty,” as you described it, which inherently devalues my points. So if I know this coming into a sale, I’ll want a bounty on the card I send out to counteract my predicted inflated purchase price of another staple.

This, as well as the desire to come out ahead in PucaPoints to make up for my shipping cost, means there will be inflation. In fact, Mr. Twieg, I would be very interested in your thoughts on how shipping costs impact this entire discussion. After all, if senders rather than buyers pay for shipping costs, there is n incentive for senders to try to get more points than the card is worth. Early in the PucaEconomy that wasn’t hear of, but today, where bounties are becoming more and more mainstream, this is now an achievable goal.

Perhaps the greatest factor in PucaPoint inflation is actually how the shipping agreement is set up.

>In fact, Mr. Twieg, I would be very interested in your thoughts on how shipping costs impact this entire discussion.

I don’t think they’re very relevant.. at least not in a direct sense. Basically the existence of shipping costs means that if I’m going to send something out for 2000 PP, then I have to actually value the card at at most 2000 PP minus the shipping cost. Higher shipping costs would lower the transaction volume (since the aforementioned condition would be harder to fulfill), which would slow currency growth from the Trade Guarantee, but…. I don’t think that’s particularly important.

I certainly don’t think that the incidence of shipping costs (does sender or receiver pay?) is likely to have an impact here.

Peter, great article! I absolutely agree with your thesis and believe that the puca problem is real but has been largely obscured by growth in the site. I also believe there is a second problem which you touched on: people trading up.

Because so many people essentially hoard points to acquire bigger staples, you end up with the huge supply side shortage on those cards and a huge demand side shortage on standard cards. I agree that pucatrade should untether points from tcg value. We would probably end up with something resembling buy list prices, where standard cards in particular are very cheap and older staples are expensive. This effectively has happened on older mtg trading sites like MOTL, where people who list trades will only send big cards in exchange for standard stuff valued at 10-25% of retail. Pucatrade probably does not want to go that far, but a slide in that direction might help the problem.

I also really like the trade guarantee being paid for by an optional point tax, which would provide a currency sink as michael pointed out.

Again, excellent work sir!!

Also regarding James comment: I did try to write this article a year ago and reached out to Eric and the @pucatrade handle to discuss the underlying economics of the site. And I was met with… Silence.

I don’t think Peter’s article is that the site doesn’t work at all, just that there are some disturbing trends that may get worse as time goes on. The fact that the site creators refuse to have an open discussion about the underlying economics of the site helps fuel speculation that the gloomier predictions are correct.

James, on the USD, I’ve very little confidence in it. In the last 6 years we’ve seen the price of most commodities *double*. Ground Beef used to be $2.15/lb, now it’s well over $4, in some cases $5. Example after example.

I use Puca (when I’m not breaking down a massive collection and buylisting the non-NM stuff). But the thing with any amount of inflation is, the prices don’t float. A Force of Will or any other card will always (near as I can tell) be roughly TCG mid x 100 in pucapoints. If inflation happens, then eventually fewer and fewer will be willing to get rid of their FOW’s for TCG mid x 100, instead demanding TCG mid x 120 or something. If the price can’t float, then added currency can cause problems.

That said, I actually think, counterintuitive as it sounds, the problem we see in pucapoints right now is an insufficient amount of liquid points. People who want to get cards on there don’t have points, and others are hoping to get bigger cards have points they’re waiting on.

In an economy, those who are holding points aren’t actually “holding” it in most cases, they’re investing it in something/someone else who’s using that money for the time being, with the intent of giving them more than their original investment after a period of time. That doesn’t happen in Puca.

Maybe that’s an option somehow. Allow people to lend pucapoints “officially” to other members at some interest rate. If I’m sitting on mine, I’ll loan 25,000 points to someone for 3 months with the intent of receiving back 28,000 points from them. And if they can’t cover the points, they have to buy them back directly from puca (or something, I don’t know).

I would suggest though that there be some form of “tax” (0.1% or something, not sure) to “pay” for the reimbursement costs of the 100% trade guarantee. Make it on the receiving end perhaps.

Considering the receiver doesn’t have to pay shipping on cards sent out, this might actually be a viable cost addition.

Great article Peter. I was wondering what you did with all of your draft cards but it looks like now I know! In terms of the article it is a fascinating tip of the iceberg looking at a digital currency. In an interesting way I think we missed a few points, and I’m sure there are many many more out there from a macroeconomic perspective. One point that you make is that the currency is tied to TCG mid prices. In this way it is like what the U.S. used to have in the gold standard. Now, the U.S. Is off the gold standard and is for all intents and purposes a fiat currency. Without a strong central “bank” controlling the levers of an interest rate and pushing against economic entropy the currency is left to the shifting waters of capitalism run amok.

I’m not an economist but it would seem to me that having a money sync is essential for a stable currency – the fed does this time and time again. It purchases money from banks businesses and other governments. You also need a stable inflation rate as well so you don’t have seismic swings in interest rates….

I think one of the biggest successes in digital currency is the system employed in world of Warcraft. I’m not sure how they nailed the stability of it all but I don’t think it can be particularly useful in describing how the trading economy works with Magic.

Anyway. I don’t have any solutions. And I don’t use the site yet because I don’t have enough time to do all that is required but it would seem to me that PT needs a point sync system in conjunction with a way to manage the inflation trends so they can pull the levers of the economy appropriately.

Knowing that MC = MR is almost never feasible we need to take part in an economy where we have trust in the central “bank”. While that metaphors brings up other discussion points the issue of will the site be a stable platform for people to enjoy their hobby is salient one.

Just a bunch of random throats from a hobbies the with an MBA.

Great article! I thoroughly enjoyed it!

Somebody send this guy a FoW already 🙂

Now this is a well written and well explained article! Understanding it is an hypothesis, the business and economic side of the coin was a great read. It was sound and, I find, in now way condescending to the Puca model. PucaTrade is a great outlet for financial traders to rid themselves of cards when all else fails. I currently use it to offload foreign cards, which have an important currency arbitration associated relative to local markets. This allows me to trade off cards at a higher price when the € is close to par with the US$.

Articles like these are a real value adding feature to my subscription. Keep up the good investigative / market analysis, Peter

Great job! I had tried several times to write out my concerns about pucaFlation, but each time the tone came accross as a completely negative article. I am glad you were able to put it forward in an even tone. I would love to talk over detail if you plan on another follow up piece. @jtempkin

One note : it is already common place for folks to pay above asking price on Puca, the inflation seen in selling points is already creeping into trades.

PucaFlation…….more like PucaNation!

I find this article very interesting and wanted to add something. From what I understand, all analysis and predictions that WOTC has with each new set release is a volatile one. 1. Their information largely is received through tournament play and 2. Player base (roughly) to create estimates on what would be an appropriate prediction. One of the hardest things to account for, and I think Mark Rosewater stated it this way at one points, are the casual players and their role in the market. I think he called them the “Silent” or word to that affect. Although they are hard to evaluate in demand, their are trends of course that show “casual appeal” cards, and they are thrown around often casually. (pun intended)

I believe their is another form of “silent” attributers in the puca-economy. Although you’ll always have your fetch-FOW demand and other Modern/ Legacy staples. It is important to note the casuals that still buy up “casual cards” “bulk” if you will, for the reason for shear entertainment purposes. EDH, Cubes, etc. They’ll impact pucatrade just as they have in many ways given some users enough points to sell up into staples. This of course is pitted against the supply and demand of the users on the site, but it is something that I think will impact pucatrade’s website in the long run. If puca-“sharks” and selling up users become the dominant user-base of pucatrade, and the casuals leave, then their will be a problem. It’ll be fetch-for-fetch or other equal value card and it will reach a point where you won’t be able to obtain FOW or other hard to come by cards, unless those who want to get rid of the FOW are receiving their “equal value” card all the same.

Just some thoughts. Action for action.

BTW, I’m an avid pucatrader since November of 2014, and although I still believe pucatrade to be the best trading platform today, I’m convinced that it is still relatively new and that other “businesses” that are willing to do it better will arise will come. It’s still important to look into flaws/ possible mechanism design to insure high trader-base and overall satisfaction.

>If puca-“sharks” and selling up users become the dominant user-base of pucatrade, and the casuals leave, then their will be a problem.

Yep, one reply I’ve seen to this argument is that the demographics of PucaTrade might be changing with its growth in such a way that exacerbates some of these problems. But the fall in the currency price should serve as an equilibriating force, then, as it makes trading up harder and makes various forms of arbitrage which I imagine some users are trying to engage in less-lucrative.

I’ve been told by some of the Puca mods on Reddit that there isn’t really a 100% trade guarantee. I’ve had two envelopes end up missing (under 200 points each) and yes both parties did get their points back but I was sent this message by the mod that gave me the points back:

“On PucaTrade, it’s the sender’s responsibility to ensure that the card arrives at the correct address, in a timely fashion, in the correct edition and in Near Mint condition. You can read more about your responsibilities as a trader here:

https://pucatrade.com/rules

For now, we’ll go ahead and credit you the full PucaPoints for sending the cards, but we may not be able to do so again in the future. For this reason, we strongly recommend that in the future you take advantage of services such as tracking to ensure accurate and timely delivery of packages you send on PucaTrade.”

He says that they “may not be able to do so again in the future.” regarding refunding us both points for a lost envelope. He says I should probably get tracking (for a less than 200 point envelope? No thanks).

So… there’s that.

The points this article brings up are likely discussions that need to be had along the way, although it doesn’t change the fact of my experience with PucaTrade that I could have never otherwise experienced…

I joined PucaTrade in December 2014 and have since traded out over $6,000 worth of cards via PucaTrade. I would have never been able to do this at my LGS or through eBay or other outlets. As a result I’ve been able to get everything I wanted for my Commander, Modern and Standard decks. Just this month I received a playset of Tarmogoyf’s via PucaTrade.

Even Kush Singhal, one of the site’s main dispute managers, offers bounties on cards: https://pucatrade.com/profiles/show/3377