Last week, I shared an introduction to me, my motivations, and my risk equation. A Twitter conversation prompted the last of these, and it felt like an appropriate topic to share when establishing my investment style on a new website. In a way, it reveals what you can expect from me as a writer for the weeks and months to come.

But I’ll admit I got ahead of myself a bit. I began delving into the how before first covering the what. In other words, I haven’t even revealed what my current portfolio distribution looks like and how I came to these positions. Such an introductory piece is certainly merited, as it gives a baseline for future discussions. Additionally, the topic overlaps nicely with my general approach to resource allocation in MTG finance—a strategy I picked up from one of the greatest investors of all time.

Perhaps it is most appropriate to share the latter while integrating examples of the former throughout the column.

The Oracle of Omaha

If I had to choose one particular influence in how I structure my investment portfolios—both in Magic cards and in stocks—it would have to be Warren Buffett. The Oracle of Omaha has been a successful, active stock picker for many decades. While it is cumbersome to establish a basis for his entire strategy here in one column, I will take the liberty to highlight a few key mantras I’ve picked up through my research.

- Find the right value at the right price.

- Stick to what you know.

- Take advantage of extremes.

- Know the management team.

Applying these strategies to stock picking is trivial and systematized already. But did you know they are also highly correlated to how I conduct my MTG investing as well?

For example, consider the value equation and taking advantage of extremes. If I am confident a given MTG card or item is destined for an upward trajectory over long periods of time, then I’m most intrigued by that opportunity. The key, of course, is choosing your entry.

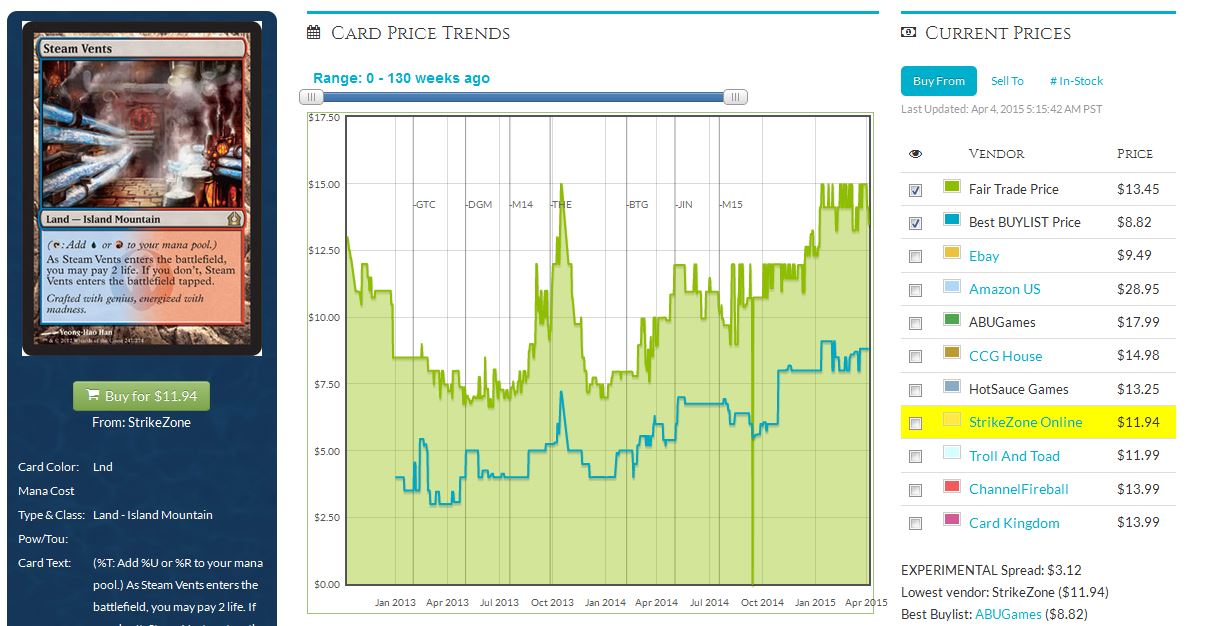

This is exactly how I approached my investment in shocklands. Recognizing the growth of the Modern format and WOTC’s dedication to helping it grow, I decided a sizable investment in shocklands was a wise move. Furthermore, the cheapest shockland during Standard block—Steam Vents—was also the cheapest for quite a while. Copies could be had for below $7 at one point!

The disconnect was that Steam Vents was one of the most played shocklands in Modern. Yet the card’s price was beaten and battered due to the high Return to Ravnica print run and the low Standard demand. Opportunity was knocking, and when I bought deeply into shocklands, I made sure to go deepest on Steam Vents.

The bet paid off to an extent. Just a couple years later, Steam Vents hit retail pricing nearing $14 and buylists have exceeded the low reached right around the release of Dragon’s Maze. This represents a nearly 100-percent gain from trough to peak. That was enough for me, and I rang the register at a recent Star City Games Open.

I noticed an extreme, I considered the long-term utility of the card, and made my bet accordingly. Warren Buffett would have been proud.

Of course, the other shocklands haven’t responded nearly as well, much to my disappointment. Abzan strategies are ubiquitous in Modern thanks to the printing of Siege Rhino, yet the shocklands corresponding to black, white, and green have barely moved. Overgrown Tomb from Return to Ravnica is flirting with its all-time low established back in May 2013.

Would this worry Warren Buffett? Not at all. He recognizes that the market often takes time before realizing the mispricing of a given asset. Therefore, in a similar vein, I choose to sit on my copies and wait for the appreciation I’m confident will come. And if prices linger below $7, I may buy even more. This is why shocklands remain a top holding in my portfolio.

Stick to What You Know

Because I track the Modern metagame closely, investing in shocklands is a large bet I continue to make with confidence. I understand how the format works—particularly when it comes to mana bases—and I use this knowledge to strategize how I invest. I also recognize the risks associated with this investment and I am comfortable with the potential upside versus the downside risk.

This is directly related to another strategy of Mr. Buffett’s: sticking to what you know. Rather than chase the trendy stocks, such as 3-D printing or Chinese internet companies, Buffett prefers to invest in companies with tried-and-true strategies, large “moats,” and a history of consistent profit growth. Coca-Cola remains in Warren’s portfolio not only because of its dominant market position and global brand recognition, but also because he understands the company’s business model: make delicious soda consisting primarily of water; find an inexpensive way to bottle the product and distribute it globally; profit.

Do you believe me when I say this strategy is also directly applicable to Magic finance too? I use it all the time!

You may have heard me claim ignorance of Standard in the past. Nine times out of ten, the format bores me, and the constant fluctuation in which cards are legal and which aren’t can be bothersome. One month you could be battling with the best deck in the format, and then a new set could come out with cards that completely redefine the format. Worse yet, Standard could rotate, nullifying half your deck.

Because I avoid researching Standard, I also tend to avoid investing in cards from the format. Sure, I’ve had some successes in the past: the Innistrad checklands, Terminus, and a few others were very profitable for me. But I’ve also missed nearly as often as I’ve connected, making Standard a very suboptimal investment area. I simply can’t predict which cards will be good enough. The only buying of Standard you’ll likely see me do is pick up cards on the cheap for a quick flip during a pro tour or new set release. I almost never buy deeply into anything Standard.

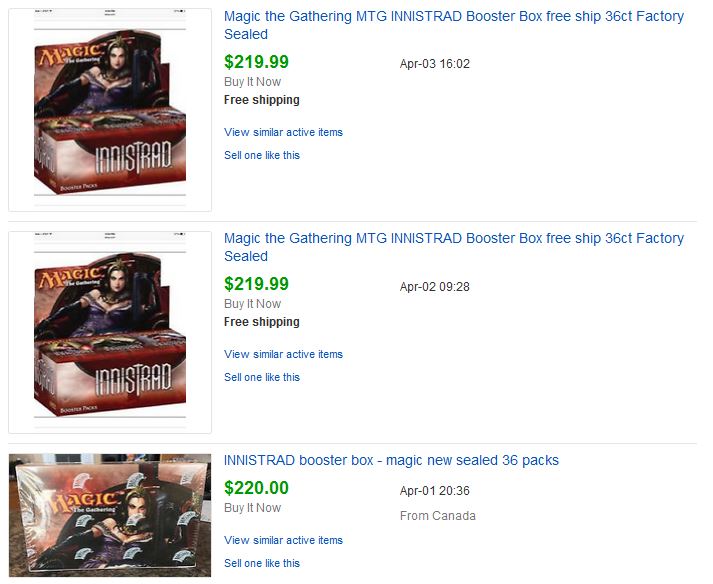

On the other hand, I’ve done thorough research on sealed booster boxes. Over time, I was able to identify which sets were most attractive for investing. Once I was confident that certain boxes were undervalued and destined to go higher, I made my buys. The most significant investments I made were in Innistrad and Return to Ravnica booster boxes, though I dabbled in a few other sets as well.

The Innistrad boxes paid off very well, and every one of mine are already sold.

Although I did make profit on this venture, I’ll be the first to admit I sold way too prematurely. With cards like Snapcaster Mage and Liliana of the Veil hitting record highs, and the set being one of the most enjoyable to draft of all time, I should have trusted my gut and held longer. A tough lesson learned, but one worth exploring more deeply in a separate article.

What I did manage to hold onto are my Return to Ravnica booster boxes. This set was also talked highly of by Limited aficionados, and the set contains an array of eternal favorites including shocklands, Abrupt Decay, Deathrite Shaman, and Supreme Verdict. While none of these cards have hit the same price point as Snapcaster Mage, they all have significant upside as the set ages further. Eventually, these will hit a turning point and boxes will move higher. In fact, they’ve already shown some appreciation—when I bought in, it was around the floor price of $80 to $85. Now boxes are consistently selling for just above $100. It won’t be long before these go even higher, just like every booster box with eternal cards and a good drafting reputation. Applying this insight after thorough research has helped me make well-informed investment decisions.

Of course, investing in booster boxes isn’t all sunshine and roses. There are some major pitfalls I have also learned about. I’ll share details in a separate article some time, but I wanted to add this disclaimer here before a reader gets trigger-happy and randomly buys ten Khans of Tarkir boxes or something. There’s a reason I’m not buying more boxes at this point in time: the investment could still pay off, but I think there are better opportunities elsewhere. The key is sticking to what you’re most comfortable with.

Know the Management Team

You may be wondering how I could possibly tie this Buffett-ism to Magic investing. Sure, it’s good to have trust in a CEO like Bob Iger who has helped Disney grow substantially over the past few years. But there really isn’t any “management” team in Magic, is there?

Perhaps not precisely, but there is a parallel. Consider who the key decision makers are, and you can begin to understand their motivations. These motivations could have a profound impact on MTG investment choices.

Allow me to elaborate. Who is the “boss” of Magic? If you ask me, I’d venture that the Hasbro management team is the answer. They’re the ones cracking the whip and demanding certain profit numbers be hit by the WOTC team. So when they demand consistent profit growth of their brands, WOTC does what it can to deliver.

And boy, oh boy, has the company succeeded: recent sets have been blockbuster hits and supplemental products like Commander and Modern Masters have bolstered sales even further.

Of course, sales are surely augmented when Wizards dangles a carrot in front of us, right? Khans of Tarkir was hugely attractive because of the Onslaught fetchlands that were reprinted in the set. Commander products give us cards like Containment Priest and Flusterstorm, sure to delight any Legacy player. And I don’t have to tell you how easy it is for Wizards to sell a product with $200 Tarmogoyfs in the mix.

In other words, Wizards knows that reprinting money cards and creating new staples results in more product sold. That’s the management team on which I am focusing. It is their motivations that inform my investment decisions.

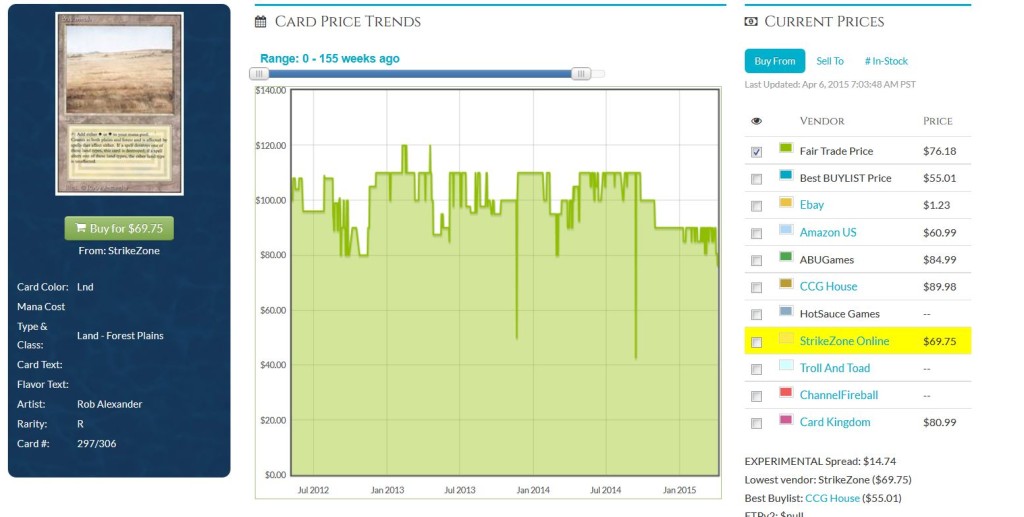

So how am I using this information to allocate MTG resources? WOTC continues to focus on reprinting to improve barriers of entry for Modern and, to a lesser extent, Legacy. Therefore I’m focusing resources on eternal staples which are either a) likely to dodge reprint in the short term (e.g., shocklands), or b) guaranteed to dodge reprint (e.g. dual lands).

In fact, the largest position in my entire portfolio—exceeding my shockland and booster box holdings—is my dual land position. I completely understand what drives their demand, I believe in their long-term price growth, and I know “management” won’t reprint them. It may take some patience, but dual lands have to be some of the safest investments one could make in MTG at the moment. And with recent pullbacks in pricing, certain duals are the most attractive they have been in many months.

These two duals in particular have drifted lower since their peaks in May 2014. Just because white-green and blue-green strategies are out of favor at the moment doesn’t mean they can’t ever return to center stage. Legacy is an eternal format, and I have to believe eventually the metagame will shift yet again, yielding to new dominant strategies. For now it’s red-blue strategies that seem to show up most frequently, but in the future, who knows? All I know is that I want to build up my position of duals now while they’re flat, so that I have them during their next inevitable spike. As long as “management” stays true to their word and doesn’t reprint these cards, then we can be confident in their long-term success.

Wrapping it Up

Hopefully, this Wall Street-centric approach to MTG investing makes at least some sense. To me, it’s the most logical approach. I could try chasing the buyout of the day or flipping cards quickly for short-term profits. I could also try the slow, steady grind, trading with the sharks at major events. But both of these approaches are time-consuming and arduous.

I would much rather use my time wisely by investing in cards with good long-term value, confident growth, and a wide moat. I trust in an investment like dual lands because I don’t think they’ll ever be outclassed and their demand is very steady while supply marches lower little by little over the years. This same reassurance just isn’t available for a short-term investment.

And when I find these opportunities—especially the ones with high upside potential and low downside risk—I make a decisive move. In a way, this is also related to a Buffett type of strategy. Once we find a great opportunity, we shouldn’t be afraid to move in with our resources. Consider how Buffett’s current stock portfolio is very heavily weighted towards four individual stocks, making up 62 percent of his portfolio!

I follow this same weighted approach in my own stock investing. But I also allow this principle to guide my MTG investing as well. This is the reason I’ve got over 50 percent of my total MTG portfolio tied up in three primary investments: shocklands (foil and nonfoil), Return to Ravnica booster boxes, and dual lands. These are three asset classes I’m confident in, and so I’m allocating my resources appropriately. While I have plenty of smaller bets, just like Buffett, I try to place larger amounts in the areas I feel best about.

I may not make the most profit ever by following such a conservative approach, but I know I won’t be losing money either. And seeing as my goal is to make money to fund a college education, I can’t afford to be losing money too often. Therefore, I won’t be deviating from my strategy any time soon—in both my stock market and my MTG market investments. To do so would be bad for business.

…

Sig’s Quick Hits

- Want to play blue-black in Tiny Leaders? Don’t look to Star City Games, then—they’re all out of the only blue-black leader legal in the format: Sygg, River Cutthroat. They’ve been sold out of the creature for weeks now with that same $6.19 price tag. I’m waiting for the inevitable price bump.

- Ad Nauseam strategies seem to be showing up a little more frequently in Legacy top eights since the banning of Treasure Cruise. Perhaps this is why Lion’s Eye Diamond is once again sold out at SCG with a price tag of $86.29. As long as it doesn’t get banned, you could do worse than to pick up a copy or two in trade if you’re looking for a long-term investment beyond dual lands.

- Need Rift Bolts for your Modern Burn deck? You’re not going to find any at Star City Games. Despite being reprinted a couple of times, the card is completely sold out at the major retailer. Prices range from $1.85 for the MMA copy to $3.99 for FNM and Time Spiral versions.