By: Travis Allen

First order of business this week: congratulations to Alex Bianchi (@gemmanite) for his Grand Prix Pittsburgh win this past weekend. Of the twelve of us that traveled to the event together, nobody was even remotely considering winning the whole thing. The dream was top eight and/or going 13-2; that was the threshold. Any accomplishment beyond that was completely out of mind. To see a friend win a GP basically out of nowhere is astounding and exciting, and of anyone in Buffalo, I can honestly say that Alex is the most deserving of this accomplishment. He’s devoted a great deal of time and effort to the game, yet has remained friendly and humble, a feat whose difficulty is evidenced by the attitudes of many road-worn grinders. (Though he perhaps enjoys strangling cool deck ideas to death with his own brand of Magic conservatism a bit too much.) To all of you, it’s just another no-name player that won one of hundreds of GPs, but to us, it’s a friend and devoted player that was finally rewarded for his commitment and passion.

Alright, on to why you bother to read this at all: my exceedingly clever word play paired with incisive and urbane observations.

Last week, I covered a lot of cards that are in difficult spots. For each, the answer wasn’t clear whether to hold on and look for more profits, or to sell and move on to something else. As long as you’re making a profit, “sell” is never a truly wrong answer, though realistically, our goal is to do so within 10 to 20 percent of the peak price. I mostly erred on the side of action: sell your cards. Most of the examples fell into one of two camps; either they had gained a great deal of value recently, or they have been losing value continually for a while and show no signs of changing that anytime soon. Investing in Magic cards, as with anything, is always a battle against opportunity cost. The question is less about whether something will make you money, but rather, if it will make you money faster than another option.

One metric served as a tool for evaluating all of the cards, and even if I didn’t explicitly mention it in each example, there was not a single time it didn’t come into consideration. Many of us writers cite it frequently, though I realize it may not be completely obvious why we do so. I’m talking, of course, about buylist prices.

Knowledge is Power

The buylist number is how much a vendor will pay you for your card. It’s the amount that Star City Games or ChannelFireball will give you in cash for a specific item. This number represents the absolute minimum value you should receive for a card at any given time.

Today, right now, Strikezone will give me $30 for an Ugin, the Spirit Dragon. Why should I as a seller ever accept less than $30 for my copy of Ugin, then? At any given time, I can stick it in an envelope and receive that amount. If I wanted $30 for the card, I’d already have it. If I haven’t yet sent it to SZO, it means that I’m either A) in an extreme hurry to sell the card, or B) unwilling to take $30 for Ugin. Scenario A comes up occasionally, but scenario B is our day-to-day reality.

Knowledge of a card’s current buylist price serves as a useful piece of information when transacting Magic, and its existence is a net positive for each actor in the small drama that is Magic finance. In fact, most markets don’t even have something so clean. The used car market, for example, lacks a buylist with the same functionality of Magic. If you decide to sell your car, there’s no obvious number that serves as the lowest cash value you can receive. You can’t just plug your car into a website, see exactly how much cash someone will give you for it, and then ship it over (or drive it over, more realistically). Yes, there’s lots of ways to hone in on what number you can expect, such as Kelly Blue Book, Edmunds, auction results, etc. These only serve to give you a rough estimate, though, and more importantly, none of those places will actually buy your car. They’ll tell you what you should expect to receive for it, but they themselves are not the buyer. You’ll still need to go through Craigslist or trade your car in at a dealer, and they may have a very different idea about what a fair number for your car is. There’s also the possibility that they’re not interested in a fair number at all. The fact that we can, on any day, put a card in the mail and be guaranteed to receive a certain dollar amount is a unique facet of the secondary Magic market.

From both sides of the deal, buylist numbers make life considerably easier. There’s no debating about what a card may or may not be worth, and no wondering whether or not you may be able to find another buyer. As the seller, you know exactly the minimum value you should receive, and it gives you a position to bargain from. As the buyer, it gives you a target. The buylist price is the absolute best price you can expect to pay for a card, and paying that price is about as close to “perfect” of a deal as you can get. Both sides having this information means that there’s a lot less haggling, a lot fewer people getting screwed, and overall quicker and more pleasant transactions.

Of course, the utility of the buylist in relation to a private-party transaction is only one component of how useful it is. The true value in buylisting is not as a frame of reference for a buyer and seller, but rather, as a gauge of overall market demand for a good.

Grey Matter

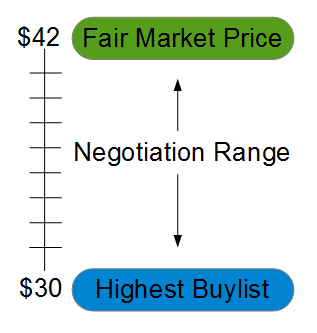

Cards generally have two prices. The first is the fair market price. That’s what MTGPrice puts in big bold text when you look up an Ugin. Some will arrive at this number differently—they may strictly take TCGplayer low or average, or just use SCG’s price (both strategies which have their own flaws)—but in essence, this number is the cost to acquire a card at any time. Fair market price is dichotomous with buylist prices, which is what an individual can sell her card for at any time, and is the second of our two-price model. The market price is how much it costs to buy this card whenever I want it, and the buylist price is how much I receive if I sell this card whenever I want. In between is where people negotiate.

What’s unquestionably useful to us as financiers is the gap in between those two numbers. Specifically, the size of the difference between the two relative to how much the card costs. That’s known as the spread. Several writers here at MTGPrice have written about spread, and understanding it is essential to being successful in this field.

Very quickly, you find the spread by dividing the highest buylist price by the lowest possible retail price, and subtracting from one.

Ugin, the Spirit Dragon Spread Equation

Best Buylist: $30

Lowest Retail: $42

( 1 -( buylist / retail ) ) x100

( 1 – ( $30 / $42 ) ) x100

( 1 – ( .714 ) ) x100

( .286 ) x100

Spread = 28.6 percent

The larger the spread, the larger the gap between the market price and the buylist price. The lower the spread, the closer the two numbers are. When it’s a negative number, it means there’s an opportunity for arbitrage.

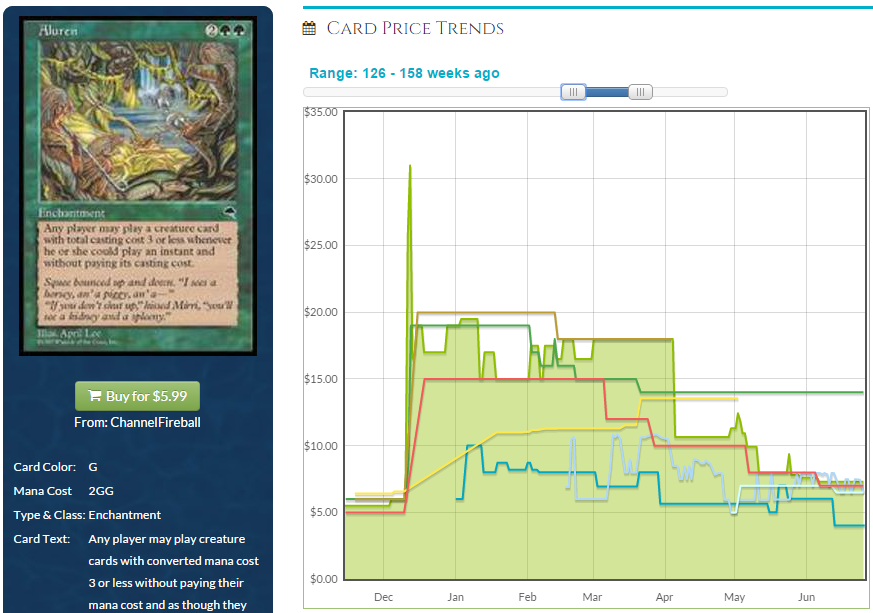

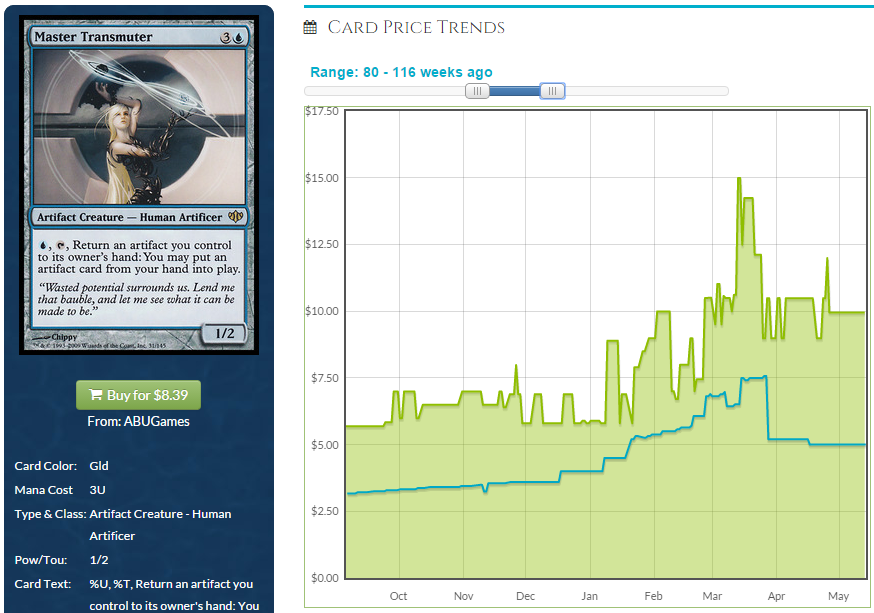

Allow me to illustrate, since I’m sure many of you are visual learners like I am. Here’s an example of a large spread.

And here’s an example of a small spread.

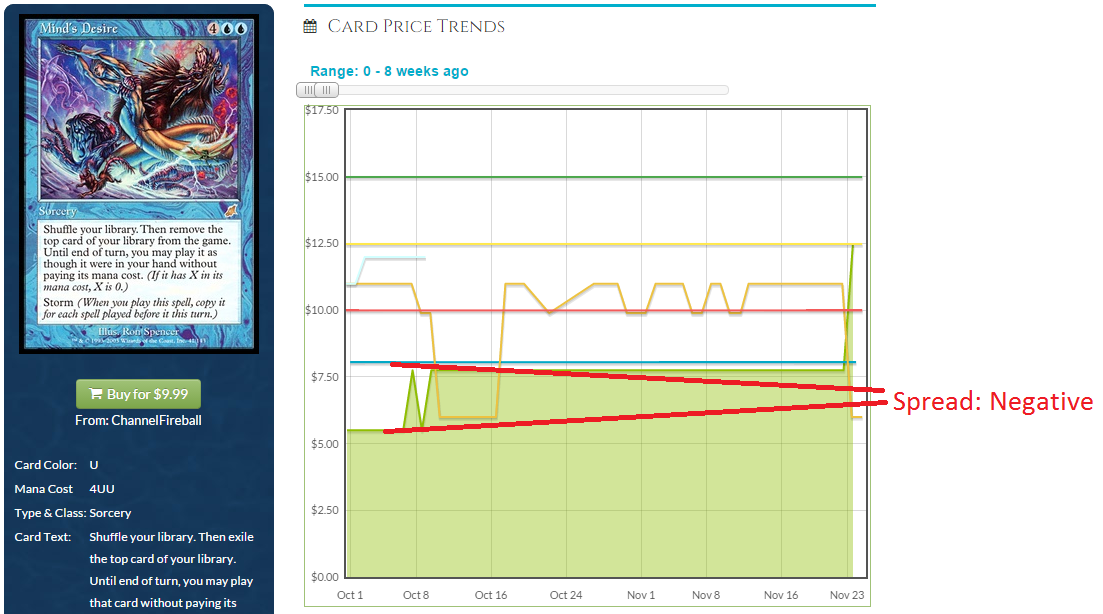

Finally, here’s an example of a negative spread.

On October 2, you could have bought foil Mind’s Desire for less money than another vendor would give you for that card. Buy it from SCG for $5.50, put it in an envelope to CFB, and they’ll give you $8.05 each. Nifty.

Arbitrage is a fun way to grind out profits, especially when you start utilizing credit bonuses for trade-ins. Sigmund has written about it recently, and I know others have as well. I’ve been doing it myself lately. Last week I found a vendor who was paying $1.81 cash for Sigil of the Empty Throne, while another vendor was selling them for $2. At cash prices I’d still be losing, but with a trade-in bonus, I was paying $2 cash for Sigil and getting $2.25 in store credit. Buy out one vendor, ship to another, and increase your overall store credit value by 12.5 percent. Do this a handful of times with an increasing amount of store credit, and suddenly you’re gaining 10 to 30 percent on a rolling ball of several hundred dollars. I’m actually finding that my store credit is quickly beginning to eclipse the total value available in a transaction. I may have $500 in credit, but no vendor wants $500 worth of Sigil of the Empty Thrones.

Indexing

Alright, that was a useful little aside, but not exactly my point. Getting back on track, spread is not only good for occasionally making money, but is more importantly useful as a tool for evaluating demand. The smaller the spread, the more “true” demand there is. Inversely, the greater the spread, the less true demand there is. What do I mean by true demand?

Imagine for a moment that you decided to make a big move on the secondary market. You’re going to corner The Great Aurora. You dutifully buy out every vendor online. TCG, SCG, CFB, eBay—you hit them all. Vendors relist, so you buy them out again. Over the course of a week, you obtain a majority share of all the loose copies in North America. Now begins your evil plan. After having paid between $.25 and $2 a copy, you relist them all on TCG for $15 each. It’s genius! If anyone wants a copy, they’ll need to pay you $15. Other vendors will scramble to match your price, unwilling to sell theirs at $2. After all, if you’re asking $15, why wouldn’t they just ask $14? You singlehandedly swing the market upwards, and soon prices across the board have risen.

Except that this is all predicated on a flawed assumption: you assume that people actually want The Great Aurora enough to pay $15 a copy. Before they were only willing to pay maybe $1 each. Why would they suddenly pay 15 times that? Someone is going to see the card, think “boy I could use one of those,” notice the price, and tweet some awful words about #mtgfinance before skipping it and moving on. While you may get a few fish to bite, nobody is really buying The Great Aurora for $15. There’s simply no true demand for the card.

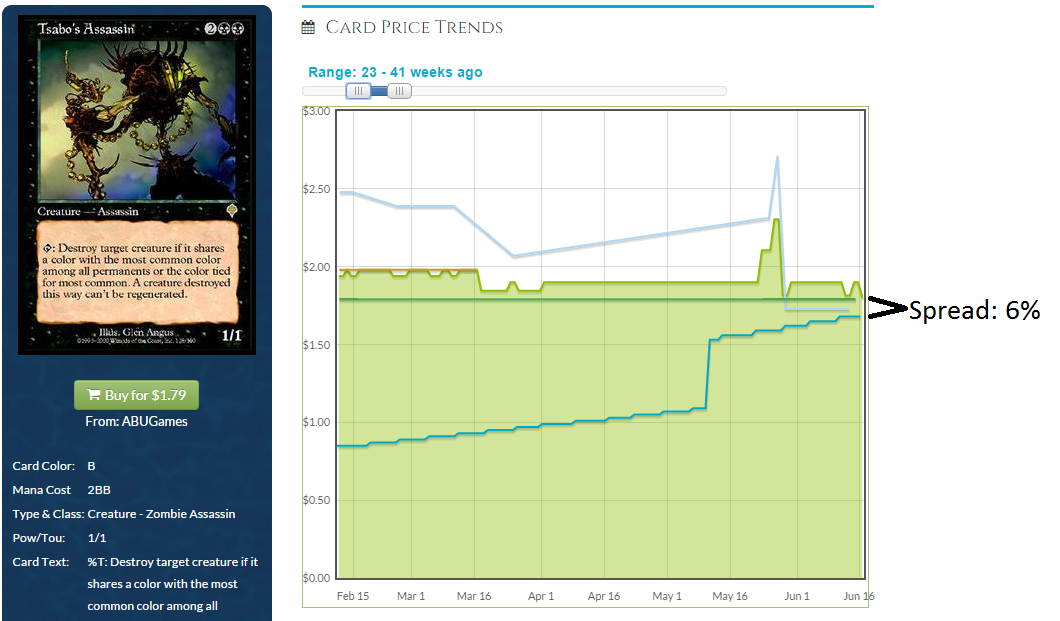

While this is all happening, vendors are trying to keep up with the market. They’ll dig a few copies out of a collection they have yet to sort and they’ll list them for between $10 and $20. They’ll keep their buylist extremely low, because they don’t actually know if this card can sell for that much yet. As copies of The Great Aurora continue to sit in their inventory, unsold at $10, their buylist will similarly sit where it was pre-spike. The only reason to raise that number is to get people to sell you copies. But if you can’t sell the copies you have, why would you buy more? People will see a massive spread looking at MTGPrice, with the market price north of $10 and buylist prices of $.25. As people continue to not buy $15 copies, individual sellers and vendors will keep dropping their prices until somebody bites, and it won’t take long before the card finds itself at $1 again. People will look back at the incident and see a huge rise in the market price on the graph, but the blue buylist line won’t have budged. No stores will have been offering more money for the card because nobody was in turn buying it from them.

On the other side of the spectrum is true demand. A dealer lists its Flooded Strands at $17. They are completely bought out within a few hours. Their buylist is at $10, but they’re not receiving many copies at all. They raise it to $12, and someone sells them three Strands. The dealer relists those copies, and they’re gone again almost immediately. Dealers across the market are realizing that Flooded Strands sell quickly. Cards that sell quickly are great as a dealer, because you make your money in volume. The more Strands they can pass through their store, the more money they’ll make. The buylist will rise. A small margin between what they pay for the card and what they sell it for doesn’t matter much, since their goal is to sell as many as possible. Market prices will rise too of course, but not as fast as the buylists will. Eventually you’ll end up with dealers selling copies at $21 and paying $18. Sure they’re only making $3 a copy, but if everyone is selling you their Flooded Strands, you actually get to keep them in stock while your competitors run dry. The margins are small, but so long as you’re churning through as many as possible, you’re making money. If you start paying less money for them, or charging more, people will stop selling to you or buying from you accordingly.

In the first example with The Great Aurora, we see possibility of how the secondary market price can explode while actual demand from the player base hasn’t truly increased. It’s highly unlikely that the scenario is in actuality committed by someone hoping to corner the market in such a diabolical fashion; that scenario simply served to illustate the point.

In the Flooded Strand example, we see how the player base has a rabid hunger for Flooded Strand, and how that drives a narrowing gap between buylist prices and market values. Because lots of real human beings (if you can call Magic players that) truly want to own Flooded Strand—unlike The Great Aurora—stores will continue to up their buylists. Spreads will shrink, and the gap between the green line and the blue line will narrow.

Understanding this process is key to understanding the future of a card’s financial trajectory. Let’s look again at a card I advised selling last week, Scavenging Ooze.

Notice how in the last two years, the best buylist has only dropped. More importantly, since December of last year, both the market price and buylist price have remained completely stagnant. Neither has shifted appreciably in either direction. For the last year, Ooze has been at perfect equilibrium. If there were a great demand for this card, we’d see a slowly rising buylist, accompanied by a market price growing either slowly or spiking. Either way, we’d see dealer confidence in Ooze increasing. But we aren’t. Dealers aren’t any more confident they’ll sell this card today than they were a year ago. That means they aren’t selling that many copies, and that there simply aren’t that many people out there buying it.

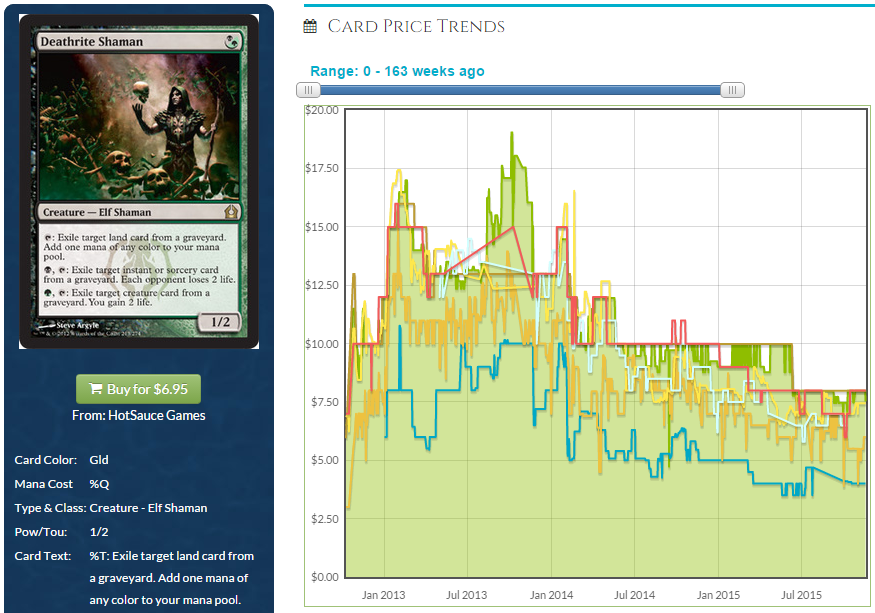

Scavenging Ooze has a poor buylist trend, as does Deathrite Shaman, two cards that I advised you sell. When buylist numbers look like that, there’s simply no reason to be holding onto copies.

Ooze is showing no signs of gaining, and DRS is only losing ground. You can tell me until you’re blue in the face that Ooze is a great spec target for Modern, and I don’t fully disagree that eventually it may be worth quite a bit more than today. I’m looking at the data, though, and the data is telling me that right now we have no reason to expect Ooze to move anytime soon. Once that buylist starts creeping up, that will be the time to revisit it.

Forecasting

Let’s now look at the Expeditions copy of Flooded Strand. It’s quite a new card, and the data is not plentiful yet, but we immediately see a trend.

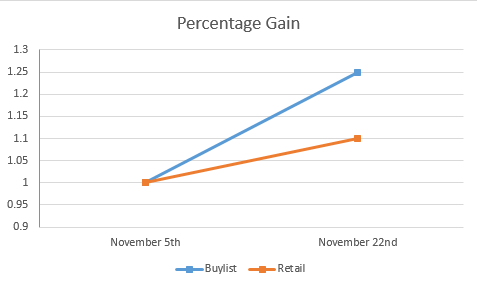

As of November 5, the buylist was $100. As of the 22nd, it was $127. Over the course of three weeks, dealer confidence in this card rose by 25 percent. At the same time, the market price rose from $200 on the 7th to $220 on the 22nd. That’s a rise of 10 percent. Here’s that comparison in graph form.

Expeditions copies of Flooded Strand are growing in dealer confidence faster than in market price. That’s extremely useful information, because it tells us that dealers are selling through their copies of this card and they want to own more of them. When buylists are rising at a faster rate than the market price, we’re due for a price correction. Flooded Strands are not going to be $220 market for much longer.

How about another example?

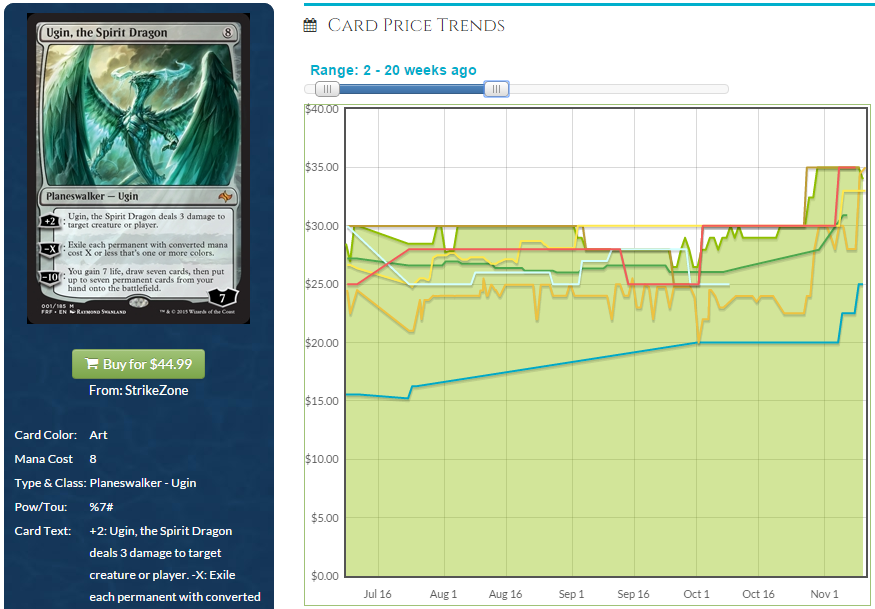

Here’s a segment of Ugin’s price history, from two to 20 weeks ago. On July 24, the buylist was $16 and the market value was $28, for a spread of 42 percent. On October 2, the buylist was $20 and market value was still $28. That’s a 25 percent increase in the buylist value, with no change on the market price. Unsurprisingly, the market price had jumped by October 30 by 25 percent—exactly the buylist change that had occurred over the last three months.

And one more just for kicks.

Who Watches the Watchmen

This isn’t a call for you to buy Flooded Strands (although it’s probably not a bad idea), but rather to illustrate that rising buylist values relative to market prices indicate increases in true demand, which will eventually lead to those market values adjusting appropriately. There’s a massive card-buying community out there, and they aren’t all hopping on Twitter to tell you what they’re purchasing. In order to know what cards people actually want and subsequently what prices are going to rise, you need to watch buylists. Rising buylists tells us that real people are buying cards, and being on top of those trends is the most surefire avenue to make a profit in this business.

Think of buylists as a poll of Magic players as a whole. Buylists are a way to measure the silent majority, to observe card-buying trends of a population that would otherwise be invisible to people like you and I. SCG and CFB are large enough to analyze their own sales data and see what’s moving, then make decisions based on that. We don’t have that data, so instead we look at vendors who do have that information and what they’re doing with it. They have a bunch of data, and that data is telling them to pay more money for Expeditions Flooded Strands. If you don’t have access to raw sales figures, your next best strategy is to observe the behaviors of those that do.

We can sit around all day long speculating on cards that we think will rise or fall. Scavenging Ooze is going to spike this spring! This is Necrotic Ooze’s year! 2016 is year of the ooze! While I do my fair share of this, and I enjoy it, recognize that some specs are based on the potential for a breakout performance, which will cause prices to skyrocket, and some specs are based on increasing demand, which lead to slower, sustainable growth. Trying to nail the breakout specs is amusing, but it’s extremely difficult and really just a crap shoot.

Our more reliable venture should be identifying cards with increasing demand and getting in ahead of market corrections. Holding onto Scavenging Ooze is neither of those things—we aren’t going to see any breakout performances, and at the same time, the buylist is telling us there’s been absolutely no growth in demand for two years now. Expeditions Flooded Strand has a growing buylist relative to its market value. We’re seeing the seeds for a growth in market value. There are plenty of cards like this out there, you just have to find them. That’s the type cardboard you want to own.

Watch the blue line. It will tell you where to go.