By Guo Heng

What happens when you print a powerful pre-Mending planeswalker in all his or her godlike glory? What happens if you make that said planeswalker a colorless battlecruiser who is able to carry games all by him or herself? What happens when you bolt on the most popular creature type onto that said planeswalker?

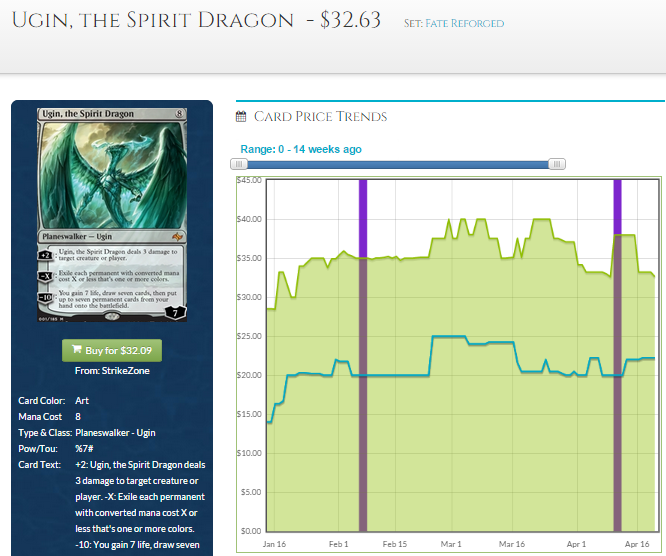

Ugin, the Spirit Dragon defied conventional Magic finance theorem on the price trajectory of planeswalkers. Planeswalkers often command a premium on their preorder price, better know as the planeswalker tax, ever since Jace, the Mind Sculptor shot up to more than 500% of his preorder price.

Most planeswalkers would have tanked in price when their hype died down upon a set’s release (Narset Transcendent wasn’t really that good after all) or experience a short-lived spike when it saw play in the StarCityGames Open or Pro Tour following the set’s release before dropping in price once supply of the card increased. The accepted norm is that planeswalkers would be nowhere near their preorder price by the time the next set hits the shelves.

Ugin, the Spirit Dragon was preordering for $30 to $35. He retained a price of $35 for the first month of his release, on the back of the success of Sultai Control, Green Devotion and Abzan Control, all of which ran Ugin in their 75. Ugin’s price hiked to nearly $40 for the month of March, before returning back to the low $30s early April and spiked back to the high $30s again briefly over the Pro Tour weekend when control decks sported a spectacular performance at the Pro Tour.

As of writing, the next set, Dragons of Tarkir is already a month old and Fate Reforged has been drafted for three months. Ugin, the Spirit Dragon stubbornly remains at $33, the same price as his preorder price. Had you been one of the prescient (or lucky) few who preordered Ugin, you would have acquired Ugin at no planeswalker tax.

Ugin’s Future

Sarkhan may have traveled 1280 years back in time and secured Ugin’s fate, but what lies in store for Ugin’s financial fate?

Ugin, the Spirit Dragon is a one-of-a-kind in design and by extension, financially. My fellow MTGPrice writers, Sigmund Ausfresser and Travis Allen wrote briefly about Ugin in their Pro Tour Dragons of Tarkir review last week and both offered different stances on Ugin’s current and future price. Jared Yost offered an insightful analysis of Ugin based on Ugin’s spread last week. I would highly recommend checking out their articles to get their opinion on Ugin on top of reading this one.

This article aims to explain Ugin’s current trend-defying price and formulate a rough prediction on Ugin’s potential price in the future. This article casts a Deep Analysis on Ugin’s financial fate.

Let’s start by having a look at the factors that kept Ugin, the Spirit Dragon at his preorder price three months after Fate Reforged’s release.

Ugin, the Ubiquitous

Below is a table of the mythics that saw play at Pro Tour Dragons of Tarkir in the decks that finished 18 points or higher in the constructed portion of the Pro Tour.

| 24 - 27 Points | 21 - 23 Points | 18 - 20 Points | Total | |

|---|---|---|---|---|

| Elspeth, Sun's Champion | 12 | 28 | 36 | 76 |

| Whisperwood Elemental | 11 | 20 | 33 | 64 |

| Nissa, Worldwaker | 9 | 22 | 32 | 63 |

| Xenagos, the Reveler | 13 | 29 | 21 | 63 |

| Ugin, the Spirit Dragon | 6 | 20 | 23 | 49 |

| Deathmist Raptor | 6 | 8 | 35 | 49 |

| Polukranos, the World Eater | 9 | 14 | 25 | 48 |

| Dragonlord Ojutai | 14 | 13 | 18 | 45 |

| Dragonlord Atarka | 7 | 17 | 13 | 37 |

| Sorin, Solemn Visitor | 5 | 10 | 12 | 27 |

| Dragonlord Silumgar | 8 | 8 | 5 | 21 |

| Chandra Pyromaster | 4 | 8 | 6 | 18 |

| Soulfire Grand Master | 0 | 4 | 9 | 13 |

| Warden of the First Tree | 4 | 2 | 5 | 11 |

| Narset Transcendent | 0 | 4 | 4 | 8 |

| Shaman of the Forgotten Ways | 0 | 3 | 1 | 4 |

The fact that the Ugin was the fifth most played mythic among the top decks even though he was mostly played as a one-of in the mainboard with the occasional second copy in the sideboard is a testament to Ugin’s pervasiveness in Dragons of Tarkir Standard. As with Fate Reforged Standard, Ugin saw play in multiple archetypes as a top-of-the-curve finisher. Or a Get Out of Jail Free card as Paulo Vitor Damo da Rosa called him in his Team CFB Esper Dragons deck guide.

Out of the total of 116 decks that finished 18 points or better in the Pro Tour’s constructed portion, 42 sported Ugin. Ugin, the Spirit Dragon was played in 36% of the top decks at the Pro Tour. The demand for Ugin is low per player, but there are a lot of players looking for their one or two copies of Ugin. Players running Abzan Control, Blue-Black or Esper Dragon Control or the various flavors of Devotion would need access to at least one Ugin, the Spirit Dragon.

Is that low-per-person but widespread pattern of demand sufficient to keep the price of Ugin at his preorder price even when the supply of Fate Reforged has never been higher after three months of drafting and nearly two months of redemption? Furthermore a full set of Fate Reforged is appallingly cheap on Magic Online. As of writing, Goatbots is selling a full Fate Reforged set for just $44.99.

Let’s take a look at the other Fate Reforged mythics on the high end of the set’s price spectrum to see if they follow Ugin’s price traction or if Ugin is the exception to the norm.

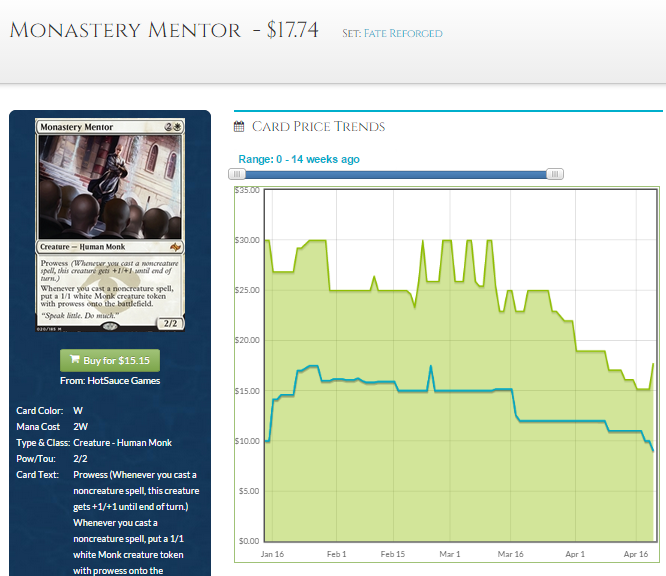

Monastery Mentor remains the second most expensive card in Fate Reforged even though he saw minimal Standard play. He is making waves (or rather, 1/1 prowess tokens) in Modern, which explains his stubborn price trajectory. Nevertheless, Monastery Mentor’s price is half that of his preorder price as of writing.

A little side note about Monastery Mentor. The trend reversal at the last part of the graph could be attributed to the Mentor adding Legacy and Vintage (thanks for the tweet, Sigmund) to his repertoire over the last couple of days. He was found as a playset in the Stoneblade list that finished second at Asia’s largest Legacy Grand Prix and was present in multiple copies in five of the top 8 decks at a recent 71-person Vintage tournament in Europe , including three copies in the deck that took down the event.

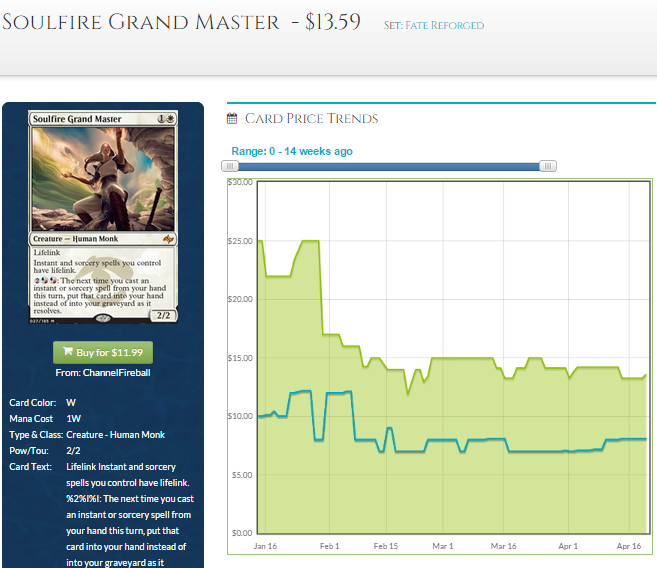

Soulfire Grand Master‘s popularity waxed and waned in tandem with Red-White builds in Standard. At $14, her current price is half that of her $25 preorder.

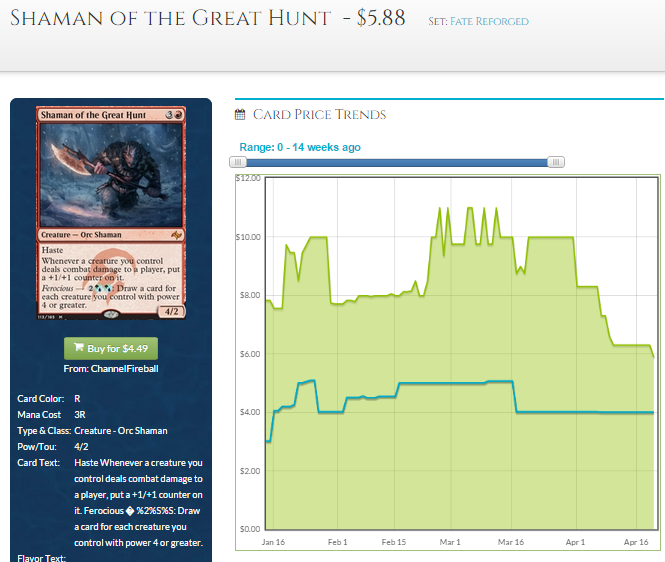

Whisperwood Elemental was a bit of a late boomer in the set. Although intrinsically powerful, the elemental did not have a home until Green-White Devotion broke into the metagame with four hundred life.

After peaking for a month, Whisperwood Elemental’s price began a descent even though the elemental started seeing play beyond Green-White Devotion and was the second most played mythic at Pro Tour Dragons of Tarkir.

You get the gist. Every other Fate Reforged mythic have tanked from their preorder price, or peak price in the case of Whisperwood Elemental, except for Ugin, the Stubborn Dragon.

Could Ugin’s price trajectory be attributed to the individually low but widespread demand from Standard players? Perhaps. After all, every self-respecting control deck would run at least one Ugin in their 75 and control seems to be king these days.

However, I suspect there is another demand that kept Ugin’s price unusually high. I think we may be witnessing the power of casual demand in action.

Ugin, the Icon

Ugin may be colorless and is the father of all colorless magic, but he is Vorthos gold. Ugin is one of the most iconic character in Magic’s lore. Since time immemorial, the ancient planeswalker Ugin has been alluded to on many occasions by flavor texts, card name and stories, and he plays an integral role in the modern Magic plotline. But yet, we have never seen him in card form until Ugin, the Spirit Dragon was unveiled in Fate Reforged.

Ugin, the Spirit Dragon is the culmination of everything the casual and collector crowd love. First and foremost, he is a planeswalker. What is better than a planeswalker? A dragon planeswalker. In particularly a high casting cost dragon planeswalker who rewards its player with an insanely powerful effect for resolving him.

The Spike crowd’s initial reaction to Ugin may be lukewarm due to his prohibitive casting cost, but I can imagine the Timmies, Johnnies, the kitchen table players who comprise of the majority of Magic’s player base, jumping with joy when they saw Ugin unveiled on Christmas Eve.

Ugin, the Spirit Dragon is your very own Death Star. Ugin grants you the ability to do an Alderaan on the board:

Best of all, Ugin, the Spirit Death Star is colorless, which means every single Commander deck could run Ugin. All is Dust is cool, but not planeswalking dragon cool. All is Dust is just a board wipe, that’s all. Its not a win condition. Ugin is.

As expected, Ugin was an instant hit with the Commander crowd. And he is the Fate Reforged card that has been included the most in Commander decks, as scoeri’s monthly database illustrates below:

It is difficult to get accurate quantitative data on the popularity of cards in the Commander crowd as the majority are not as vocal as players who post on MTGSalvation and Redditors on r/EDH. Furthermore, the Commander metagame differs from area to area. Nevertheless, until we figure out a method to quantify the popularity of Commander cards, if at all possible, those are the next best litmus paper we have to assess a card’s popularity in Commander quantitatively.

If we adopt a qualitative approach to evaluate Ugin’s popularity among the casual crowd, we can compare Ugin to other high casting cost, splashy, colorless casual all-stars like Karn Liberated and the three Elzdrazis.

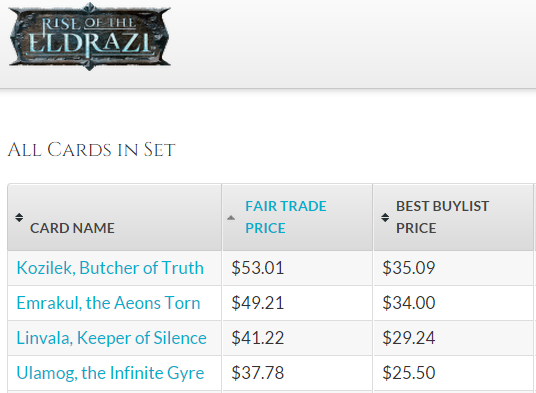

As of writing, the three Eldrazi titans are the most expensive cards in Rise of the Eldrazi.

Extremely popular among Commander players and the casual crowd, the Eldrazis also see play in Modern Tron and Reanimator variants and Legacy Omni-Tell and Twelve Post. The combination of kitchen table demand and eternal play contributed to the rise of the Eldrazis’ price since they rotated out of Standard. The gradual increase over the years depicted in the Eldrazis’ price history supported that.

The Eldrazis exude a huge Vorthos appeal. They are the big antagonists (in every sense) in contemporary Magic storyline and the events that occurred and will be occurring in future installments of the Magic plot were instigated by the Eldrazis’ awakening.

Karn Liberated was the first colorless planeswalker to be printed and is another iconic Magic character (or was, until we return to the Mirrodin New Phyrexia arc).

While Karn hovered at $15 during his Standard life before spiking twice on the back of Modern and Commander demand, I do not expect Ugin to mirror Karn’s price history.

First off, Commander was not as popular as it is today during New Phyrexia Standard. Secondly, Modern was a fledgling format during 2011, and Tron was not a viable deck back then (what good is a turn three Karn when you were dead on turn two). Lastly, Karn Liberated barely saw any play in Standard besides Ali Aintrazi’s Blue-Black Control which he used to take down the final US Nationals. All those factors allowed Karn to drop to a paltry $15 during his early years. Unfortunately, Ugin was printed in a very different age of Magic finance and I highly doubt we would see Ugin stoop to $15.

However, Karn Liberated gives us another clue on what the future holds for the Spirit Dragon. Karn is one of the most popular planeswalkers in Commander. He serves as an answer to difficult permanents that could fit into all color identity, very much in the vein of Ugin.

Karn’s current price is sustained in part by Commander demand and Ugin’s future price could be as well. Actually, I think that outcome is given, seeing that Ugin’s current price is probably already being driven by Commander demand. Commander demand could explain the flat trajectory of Ugin’s foil price over the past few months,while most other Fate Reforged foils were gradually trending down (except Tasigur, the Golden Fang who is baring his fangs in multiple formats).

Based on the price history of Karn Liberated and the Eldrazis, we can assume there is a good chance that non-foil Ugin, the Spirit Dragon would be worth at least $30, the same level as his current price, in the long-term, buoyed by casual demand. I am not sure if Ugin would be able to sustain a price much higher than $30 on top of casual and Commander demand alone. The price of Karn and the Eldrazis were propped up by Modern and Legacy demand on top of those from the kitchen table demographic.

Does Ugin, the Spirit Dragon has what it takes to break into the eternal formats and demand a price tag beyond $30 years down the road?

Ugin, the Eternal

Although Ugin, the Spirit Dragon cannot be summoned on turn three with the assembled Tron lands in Modern, Ugin nevertheless snuck into Tron’s mainboard. Karn Liberated is one of the best threats in Modern due to the dearth of answers to planeswalkers, and Ugin is the same.

Here’s Ugin in Green-Red Tron, the combo version of Tron:

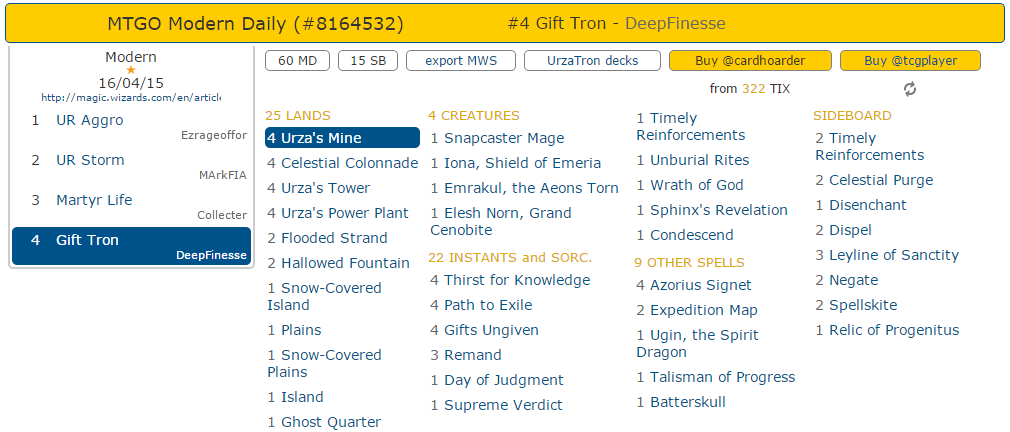

And here’s Ugin in Blue-White Gifts Tron, the control version of Tron, which has been putting up the occasional result on Magic Online:

Granted, Tron is nowhere near tier one at the moment. If the Modern metagame shifts to favor Tron, it would exert a little bit of additional upward pressure on the price of Ugin. But a bit is not enough.

How about Legacy? Can Ugin find a home in the ruthlessly efficient format that is Legacy?

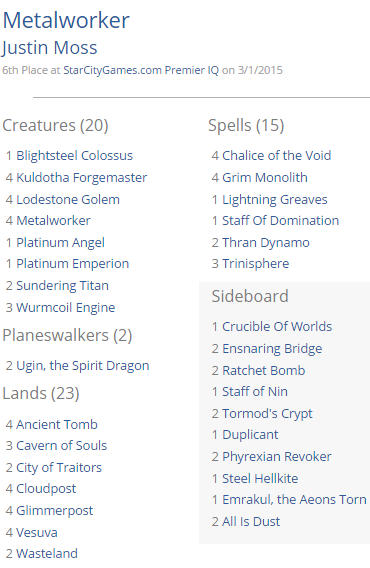

Where better to slot in Ugin than decks that generate a licentious amount of mana? Justin Moss made the top 8 of a 230-player StarCityGames Invitational Qualifier piloting a MUD deck with two Ugin, the Spirit Dragon in his mainboard. Running Ugin in Metalworker was no fluke. Hayaki Hirokazu made the top 8 of an 80-player Legacy event in Japan the week before with a Metalworker deck that sported a singleton Ugin.

We also have a more recent result:

It seems that Metalworker was not Ugin’s only home in Legacy.

It seems that Metalworker was not Ugin’s only home in Legacy.

Ugin, the Spirit Dragon do have a place in Modern and Legacy, albeit in fringe or tier two decks. And he is at most ran as a two-of. Based on those statements, we could postulate that Ugin would probably not hit the heights of $60 to $70 enjoyed by Karn Liberated who is often a four-of in Tron, but rather he would follow the price pattern of the Eldrazis, with a long-term price tag of $50, driven by eternal demand in a small numbers on top of casual interest.

An argument could be made that the supply of Ugin outstrips that of the Eldrazi titans, on the merit of being printed six years later in an era where sets have a significantly larger print run. Without access to Wizards’ print run and sales data, we could only make deductions based on public information and I think there are a few factors to consider when comparing the supply of Eldrazis to Ugin.

Emrakul, the Aeons Torn was a prerelease promo, which bumped up its supply significantly. Ulamog, the Infinite Gyre was reprinted in the limited edition From the Vaults: Legends. Emrakul is $50 even though the flying spaghetti monster is banned in Commander. The Modern and Legacy demand for Emrakul is sufficiently high to warrant Emrakul becoming one of the marquee reprints in the the upcoming Modern Masters 2015. Ulamog is $38, the cheapest of the Eldrazi titans. Kozilek, the only Eldrazi with a single printing, is the most expensive at $53.

Based on Ugin’s presence in Modern and Legacy on top of his appeal in casual formats, it is reasonable to predict Ugin to hold a $50 price tag in the long run. I doubt Ugin would stay as low as Ulamog as Ugin offers more flexibility and utility compared with Ulamog.

Ugin’s Financial Fate

Hopefully by now, I have made my case sufficiently clear to establish that:

- Ugin’s current $33 price tag is justified.

- Ugin has the potential to grow to $50 in the long-term.

Now what do we do with Ugin, the Spirit Dragon?

Ugin may be a $50 card in the long run but he is already sitting at a lofty $33 today. The Eldrazis took years to cultivate their current price tag and it would be utter buffoonery to sink in money on Ugin hoping to make $17 in three years.

First of all, if you are waiting for Ugin to drop in price before grabbing your one or two copies for your Standard Esper Dragons, Modern Gifts Tron, Legacy Metalworker or just for your myriad of Commander decks, I would recommend grabbing your Ugin now. I doubt Ugin would fall much further, and indeed fellow MTGPrice writer Jared Yost offered another perspective on why Ugin may actually be undervalued even at $33, based on Ugin’s spread.

But beware of grabbing too many copies. There is one wildcard that could ruin the price of Ugin in the short run.

The 2016 spring Duel Deck.

There is a possibility that Ugin will appear alongside another planeswalker in a Duel Deck a la Elspeth vs. Kiora, Jace vs. Vraska and Ajani vs. Nicol Bolas. If there is an event that could tank the price of the financial fortress that is Ugin, the Spirit Dragon, a Duel Deck appearance would do it.

The announcement of next year’s spring Duel Deck happens late October or early November. Looking at the price history of Jace, Architect of Thought and Elspeth, Sun’s Champion, they both experienced a second spike in the October following their set’s release, only to have their price drop a month later when the following year’s spring Duel Deck was announced. And their price never recovered.

Could the fate that befell Jace and Elspeth happen to Ugin? After a Twitter discussion I’ve had with fellow writers and financiers, I am convinced that there is a good chance we would see an Ugin Versus X Duel Deck in spring 2016.

Furthermore, the fact that Wizards already has an alternate art commissioned for Ugin increases the odds of as Duel Deck reprint. It makes business sense for Wizards to utilize the art they have already commissioned (plus we have not seen the foil version of the alternate art Ugin, which I’d imagine would be drop dead gorgeous). On the other hand, recycling Chris Rahn’s art for a Duel Deck Ugin would royally screw collectors and players who have fogged up anywhere between $100 to $200 for the Ugin’s Fate Ugin. I imagine we would see the foil alternate art Ugin as a judge foil rather than a lowly Duel Deck foil.

Regardless of whether Wizards comes up with an Ugin Duel Deck, I would still recommend grabbing your own copies of Ugin right now if you intend to use him. The announcement of next spring’s Duel Deck would happen in late October or early November, giving you a whole six months to play with your Ugin before the possibility of his price dropping. You may even get to flip your Ugin for a slight profit in September and October, if Ugin follows the trend of Jace, Elspeth and Kiora and sees a September to October spike.

While the price of Ugin would drop due to the Duel Deck, I am confident that Ugin would be a $50 card within a few years. Even if Ugin drops to $20 (the lowest I could imagine for a planeswalker of Ugin’s stature) you would have paid and extra $13 per Ugin for a full six months of play, and in a few years time you would probably not regret getting in on Ugin at $30s.

If you are looking to speculate on the next Eldrazi, it may be prudent to wait until this fall to see if there is an Ugin Duel Deck next year. I would buy my speculation copies of Ugin instantly if we do not hear an Ugin Duel Deck by this December, of if the Duel Deck turned out to be Sarkhan vs. Sorin, Sarkhan vs. Narset (aww) or Sarkan vs. Sarkhan. If there is an Ugin Duel Deck after all, I would buy into my speculation copies of Ugin upon the release of the Duel Deck.

One more thing.

Foil Ugin, the Spirit Dragon interests me because, well check out the price of foil Eldrazis. A foil Emrakul, the Aeons Torn commands a 4x price multiplier and a foil Kozilek, Butcher of Truth 3x. A foil Ulamog, the Infinite Gyre only commands a 2x multiplier, but Ugin is more Emrakul and Kozilek than Ulamog anyway.

Foil Ugin, the Spirit Dragon interests me because, well check out the price of foil Eldrazis. A foil Emrakul, the Aeons Torn commands a 4x price multiplier and a foil Kozilek, Butcher of Truth 3x. A foil Ulamog, the Infinite Gyre only commands a 2x multiplier, but Ugin is more Emrakul and Kozilek than Ulamog anyway.

Sigmund Ausfresser illustrated in his article yesterday how the price of Modern, Legacy and/or Commander playable foils have a strong staying power in the light of reprints. I would highly recommend reading his article if you are looking a compelling reason to invest in the right kind of foils.

I am of opinion that Ugin falls in the right category of foils to invest in. Ugin, the Spirit Dragon is Commander gold and sees play in Modern and Legacy. I could not phrase it better than Travis did in his discussion of Ugin last week:

When was the last time we saw an iconic mythic character that pinged every single player demographic in every single format?

And I wholly agree with Travis’ statement. I can’t recall the last time we had a planeswalker that fits those criteria above.

I think we still have slightly more than a month to go before we hit peak supply of Fate Reforged. I admit I do not know how much foil Ugin would drop, with Ugin assailed by omnidirectional demand. The impact of a Duel Deck reprint on foils of a multi-format mythic planeswalker has yet to be recorded. Duel Deck reprints killed the price of foil Jace, Architect of Thought and Elspeth, Sun’s Champion because they were not eternal-playables. I am tempted to propose that the price of set foil Ugin would suffer from a Duel Deck Ugin reprint, but then again, how many Duel Deck needs to be sold to satiate the foil demand from the Commander and casual crowd, the Modern Tron players and the ramp fanatics of Legacy. Oh and Cube as well. Cube players fancy foils don’t they?

I can’t tell you when is the best window to acquire your foil Ugin because I do not know it myself. I would recommend at least waiting until the end of May, when Fate Reforged hits peak supply before buying or trading into foil Ugin. If you want to play it really safe, you can wait and observe the impact of an Ugin Duel Deck on the set foil, or even if it is in the pipeline. As for myself, I acquired my personal copy above from Magic Online redemption.

Thank you for going through the 3,600 plus words above about Ugin, the Spirit Dragon. Your thoughts and comments would be highly appreciated. Feel free to leave them in the comments below or catch me on Twitter @theguoheng.

Update: I’ve added a couple of sentences highlighting Jared Yost’s analysis of Ugin’s spread from his article last week, which provided important insights to the discussion of Ugin’s current and future price.