As a response to the Great Recession of Wall Street, the Federal Reserve initiated a multitude of stimulus programs. They initiated a massive bond buying program and they lowered interest rates to virtually zero. These two actions were done in an attempt to stimulate our economy and drive healthy motivation for investment in stocks.

The jury is still out on how sustainable the program was (is). Some dissenters will likely criticize the stimuli for years to come no matter the outcome. But regardless of what your political leaning may be, the resulting market performance since is impossible to argue with.

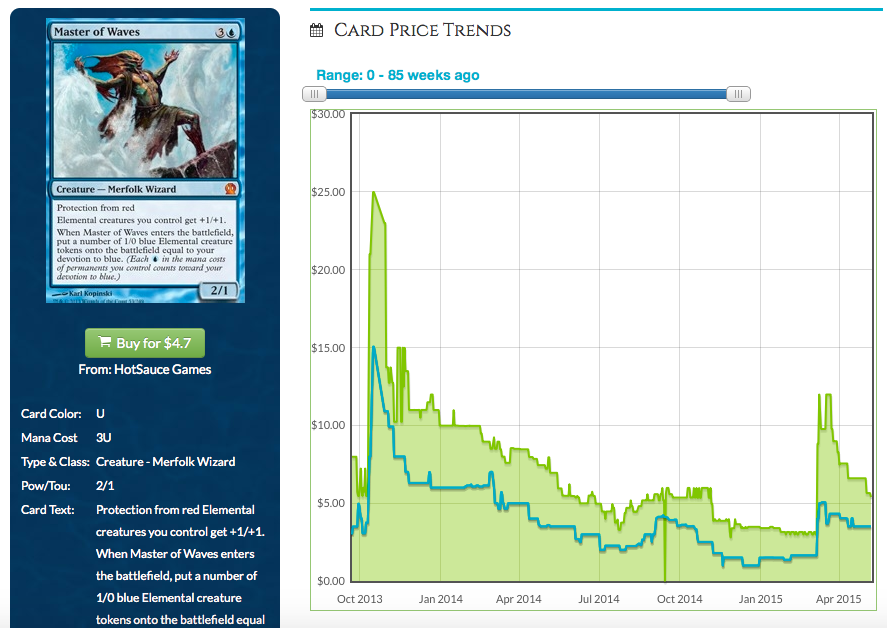

Turning back to MTG finance, one could argue that some particular cards have also been going through some economic turbulence. Original dual lands come to mind immediately – especially the out-of-favor color combinations. Other Legacy staples have also pulled off their recent highs by a measurable amount. Some Modern staples have also spiked recently, only to retreat to a lower price point.

What’s to become of this developing trend? Could Magic be due for a Great Recession type of pullback?

Certainly not. The game is as healthy as ever. In fact, this week I present a new thesis that supports a new surge in some card prices. Allow me to explain.

Modern Masters 2015

Who’s excited for the release of one of the highest EV sets upon release of all time? Who’s pumped up to participate in or watch the largest MTG tournaments ever? Who’s eager to draft this set, which will definitely be a Limited crowd-pleaser?

No matter your perspective, it’s difficult to argue with the hype behind Modern Masters 2015. Even if you are a complete skeptic, dripping with disdain for some of the wasted rare slots in the set (Endrek Sahr, Master Breeder?!), you’re likely excited about the future prospects of the cards that dodged reprint this set. Speculators have been very busy lately…

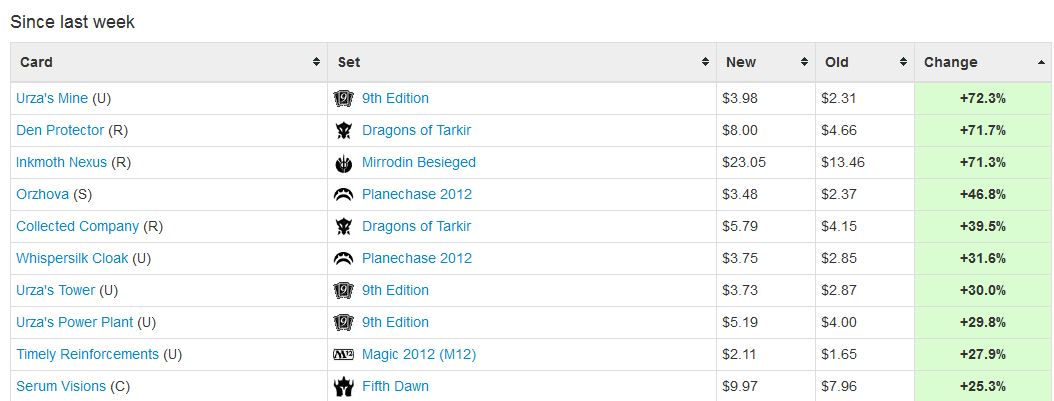

Six of the top ten price gainers last week were Modern cards that dodged MM2015 reprint. The Tron lands were noteworthy absences, and clearly Inkmoth Nexus and Serum Visions are strong buys on the news. Or at least, they were strong buys before the market overreacted, sending copies up excessively high overnight.

My conclusion for Modern Masters 2015: while I’m personally not ecstatic to be opening $10 packs with a high likelihood of obtaining a sub-$1 rare, the swirl this set is generating amongst the MTG finance community is nearly tangible. I’m delighted to witness hours of debate on Twitter about card prices. The buzz should continue through GP Vegas without a hitch.

If ever there was a time to engage in MTG speculation and finance, now would be it. And with the return of a Modern PTQ season, we’ve got even more reason to get excited about Modern.

MTG Stimulus: Part 1

When the Federal Reserve bought up many billions of dollars of bonds, they infused a large amount of cash into the economy. Then they reduced rates so low that there was practically no good place to park money other than into investments. The result: a rapid decline in unemployment and multiple years of double-digit gains in the stock market.

Turning back to Magic, we need to recognize how tentative people were with buying into Modern with the knowledge that a massive reprint set was on the horizon. It’s always a feel-bad when we buy cards only to watch them tank in price due to reprinting. Therefore, I suspect players and speculators held cash on the sidelines waiting for Modern Masters 2015 to be fully spoiled. Only then would there be high confidence in which targets would be safe to buy into.

Well, last Friday we received the complete spoiler from WOTC. Various absent cards created quite the surprise – namely, Tron lands, Serum Visions, Aven Mindcensor, Blood Moon, Inquisition of Kozilek, Azusa, Inkmoth Nexus, and more. It’s no surprise that many of these cards are on the move as players and speculators acquire copies for the upcoming Modern season.

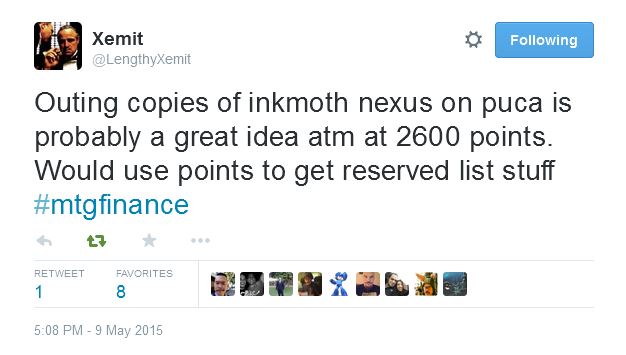

In rapid-fire fashion, everyone is infusing cash into the MTG economy as they scoop up copies of the “safe” cards. This pseudo-stimulus is a combination of self-fulfilling prophecy and pent-up demand. Now that speculators know what cards are likely to further increase in value, they can invest with confidence. After all, what better place was there to invest funds than something like Inkmoth Nexus once we were certain it wasn’t in MM2015?

Now Inkmoth Nexus is a $20 card, and it will likely climb higher in the coming months. As speculators cash out on the movement they’ll have additional funds with which to work. What are they going to do with all their newfound profits?

MTG Stimulus: Part 2

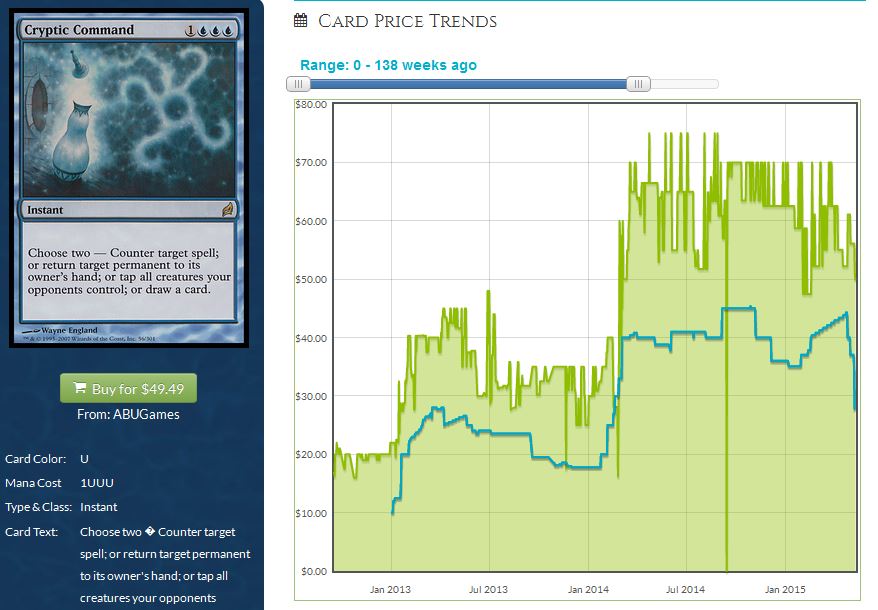

I’ve got a couple ideas of where this money will go. First of all, there will likely be some great buy opportunities on my radar once MM2015 hits the market: namely, the popular reprinted cards. The Modern staples of the set are likely to sell off a bit in the coming weeks, due to both panic and the increased supply. The same thing happened with MMA on a card like Cryptic Command.

Modern demand sent this card up to around $45 in Spring 2013, but the MMA reprint caused a rapid decline back to the $30 mark. But about eight months after the sell-off, Cryptic Command rebounded like never before, shooting up to $70.

Now once again, we’re seeing a rapid sell-off. The blue instant is already back down to $50, with momentum suggesting this could go even lower. But this begs the question: will history repeat itself? Will Modern grow in popularity even more, sending Cryptic’s price right back up to new highs in eight months? It’s certainly not impossible, and I’d wager this was WOTC’s plan. They are hoping to support and stimulate interest in the Modern format with these Modern Masters sets, and time will tell how successful they will be with round two.

Either way the reprinted cards in MM2015 are bound to sell off, but eventually they’ll bottom. When that happens, we as speculators should recognize the buying opportunity screaming at us. And with their newly-minted coin from the recent movement in non-reprinted cards, they’ll buoy the MTG economy into these headwinds.

If you’re not bullish on the Modern format, or if you’re concerned about further reprints in other sets, I have some good news. MM2015 reprints aren’t the only solid buys once the dust settles.

As players discover their Inkmoth Nexus and Serum Visions are suddenly worth a bunch more, they’ll be likely to sell/trade excess copies away. Additionally, [lucky] players will suddenly come into all kinds of money when they pull Goyfs, Cliques, and Bobs in their MM2015 packs, not to mention a lineup of Eldrazi. What will the lucky ones do with their valuable pulls?

While it’s true some players will determine that opening a Goyf is the perfect motivator to sleeve up Abzan Midrange in Modern, I suspect many others will be cashing out of their valuable pulls. After all, if we are assuming the Modern Masters 2015 reprints are likely to lower prices, that means the market must see increased supply. That’s natural supply & demand logic – for the price to drop, demand must drop (not likely) or supply must rise. If supply is rising, that must mean people are selling more copies. Likely this will mean their newly-opened copies…after the initial panic, such as what we’re seeing in charts like Cryptic Command and Noble Hierarch.

As players cash out of their Modern staples, what do you think they’ll look to buy? I saw a well-phrased tweet last weekend from an individual I have high respect for in the MTG finance community.

I can’t vouch for Pucatrade specifically, but I condone his overall strategy 100%. Judging by all the favorites this tweet received, I can tell we’re not alone in this sentiment. Moving high-dollar Modern cards into equities on the Reserved List is a brilliant strategy. You’re basically capitalizing on short-term price fluctuations in the Modern market by moving into cards that will never see reprint again. Even if Inkmoth Nexus does rise to $30 during Modern season, we know it will see reprint eventually, right?

Meanwhile, Tropical Island will never see reprint.

This particular dual land has been out of favor for months now, but perhaps the recent stimulus of MM2015 is just the catalyst needed for movement. Although not on the Reserve List, Wasteland is another Legacy staple that could use some stimulus – the Nonbasic land has stumbled over 50% from its highs.

If high-end Legacy staples aren’t your forte, then picking up other Reserve List cards may be a more optimal strategy. We just saw Ragnar jump in price on Tiny Leaders speculation; why not grab a couple Lady Evangela? I hope to in Vegas, in fact. Or better yet, pick up a couple Old Man of the Seas (Old Men of the Sea?). These have been gaining traction lately. I even see casual stuff like Divine Intervention and Island of Wak-Wak show up on the MTGStocks Interests page on occasion. Not only is this on the Reserve List, there’s really nothing else like it. I have a sneaking suspicion Wizards will never again print a card that forces the game to end in a draw. And what casual Reserve List discussion is complete without mention of my favorite Magic card of all time, Shahrazad?

You’ll never see a sudden buyout of this card, but it’s worth noting how the top buy list price has gradually been on the rise for the last 2 years.

No matter your personal preference, moving out of spiking Modern cards or recently-opened MM2015 goodies and into Reserve List favorites is a tried-and-true strategy I recommend. It’s a great way to lock in profits and reduce risk at the same time.

Wrapping It Up

A significant amount of money is going to exchange hands this summer. Speculators will rampantly acquire non-reprinted Modern cards. Players will be opening high-dollar cards left and right. This will lead to a sudden surge of value in the MTG economy – a type of stimulus.

My prediction: this stimulus will be just what the MTG economy needed for the past few months. Modern interest will jump and demand for Legacy and casual staples will go higher as well. If you want to get ahead of the curve, consider moving into cards on the Reserve List now, as Xemit suggested. I’ve provided a few sound suggestions, and I’m sure there are many others worth considering.

The tide will rise once more, lifting all ships. Therefore it is a great time to have exposure to MTG assets. My portfolio is currently the largest it has been since I sold out of Legacy over two years ago, and I look forward to seeing my holdings appreciate in value in the coming months thanks to this unofficial stimulus.

…

Sig’s Quick Hits

- If you have a large quantity of Modern stuff to move, one sound acquisition target is Bazaar of Baghdad. In fact in the last couple weeks Star City Games increased their price on the Vintage staple from $399.99 to $449.99 for NM copies. It’s a steep price of entry, but you can be confident in this long-term investment’s prospects should MTG continue to grow.

- One Modern/Legacy card that is not seeing nearly enough buzz is Slaughter Pact. The card managed to dodge reprint in MM2015 (unlike in MMA), meaning we’re not getting any new supply of this rare. Every time I search for the card on SCG’s site, it is out of stock. Today is no exception, and the $10 price tag is almost guaranteed to rise as we head into Modern season.

- Lion’s Eye Diamond gets very little buzz in the MTG finance community, but the Reserve List card has been a Legacy staple for years. Currently SCG is sold out of this one as well, with a NM price tag of $86.29. There are probably a few more exciting pick-ups to target with newfound profits, but no one can argue with the low risk of LED. The card is off its highs much like other Legacy staples, and this stimulus could help rekindle interest.