Readers,

There were a ton of potential good specs for like half of these decks and all of them got reprinted. Instead of being good $3 cards that could get to $5 or $8 on the basis of adoption in the decks, they’re trash, bulky, bulky trash. Forever, probably. All of this made me wonder – are there any cases of cards that were good in the EDH deck they got reprinted in that went back to their pre-reprint price after a year or two? If so, could we make a case for anything in the Commander 2020 decks that look like trash now?

Sorry about the hard cut, but I don’t want to take up too much time here. Let’s just talk about some cards.

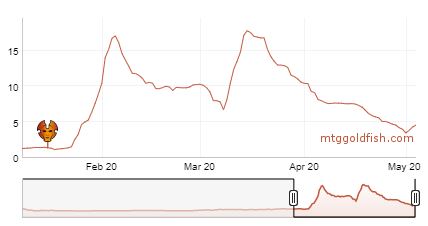

Ghostly Prison appeared in Modern sideboards and went nuts . Despite a few extra copies floating around from the Planechase 2012 reprintings, Prison was mostly really scarce really fast. The $18 was never going to hold but the Commander 2016 printing tanked the price and shattered the brief illusion of flirting with $20 it had enjoyed. Still, it went from $2.50 in April of 2017 to $8 in October of 2018. Was the same Modern usage that spiked it in the first place still a factor as it climbed back? Not really. Over the period of January 2016 to January 2018, it barely featured in a now-defunct Modern deck’s sideboard and didn’t really appear anywhere else, so its EDH play was the most likely factor for the climb. It’s since gotten a reprint in Conspiracy, take the Crown and the price is down a bit lately, but this did experience an 18 month period of solid growth despite a reprinting that wasn’t even its first. Can we find some examples of cards that weren’t helped by Modern? I’m sure we can.

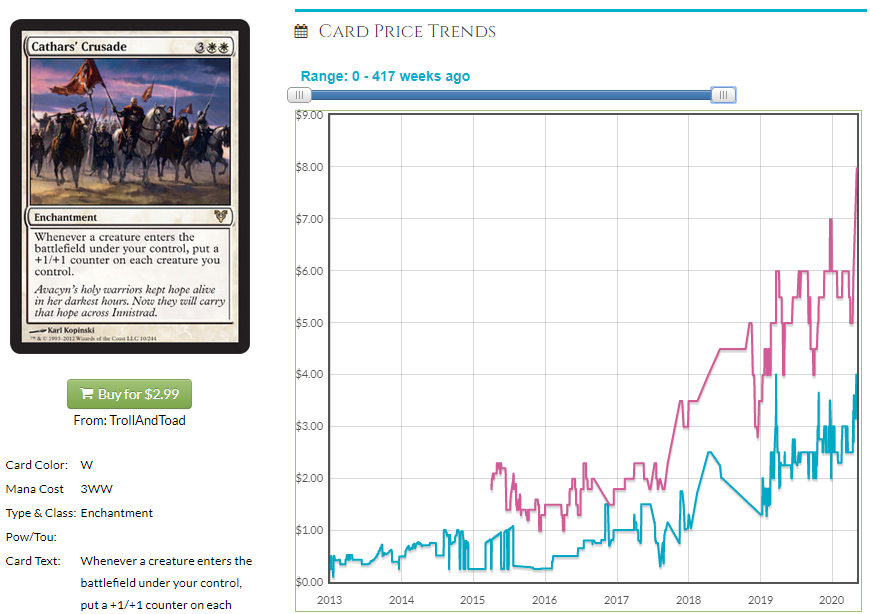

Crusade hasn’t experienced a meaningful (read not in a Commander Anthology) reprinting since 2016 and it has grown precipitously. It looked bad when it got a reprint in 2014 and in 2016 but Commander is much more of a format than it was back then and this is a $10 card waiting to happen, barring a reprint. When Commander 2016 came out, Crusade was $1.50. A year later it was $3.50. A year later it was $6. A year hasn’t happened yet but it’s on its way to $10, but who knows what Covid does? The point is, if something can impact EDH but dodge a reprint, it has upside.

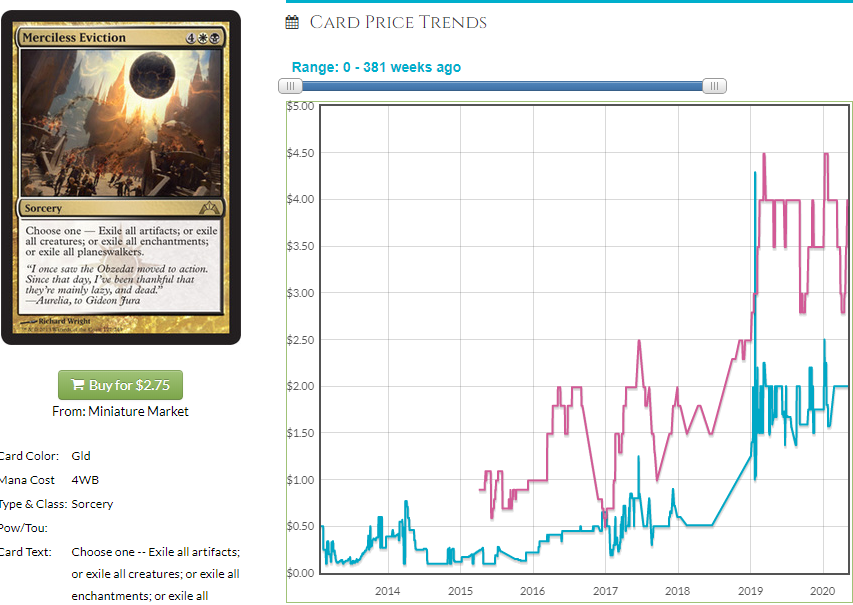

Eviction is an EDH powerhouse, sweeping away entire decks sometimes. The name is a little redundant since all evictions are merciless but this one is especially Merciless. Printings in Commander 2016 and Commander 2017 kicked the card in the ribs hard as it was getting to its feet but nothing since then has allowed it to grow mostly unbidden. The 2016 printing took it to bulk status – around $0.60. In a year, it was $2.50, then it was reprinted again. Since then, it has climbed to nearly $4.50. If a card that just got smashed by a reprinting ends up as ubiquitous as does Merciless Eviction, we could see it shrug off not only this reprinting, but another one.

There’s a problem, however.

The Commander 2020 decks, like the Commander 2019 decks, are built around mechanics. The cards that are good in those decks have a high inclusion score but also a high synergy score. A high synergy score means it’s more likely to just be good in that deck. Every Black and White EDH deck build since 2017 has to look at Merciless Eviction and either say “Yes” or “No” but I’m not going to build a deck ever that’s going to need to rule on Fluctuator or New Perspectives. High-inclusion, low-synergy cards are what we should be targeting and while everything that would be a good spec based on the Temur and Jeskai decks (they overlap so much, it’s nuts) was basically reprinted or spiked already, none of it is that applicable outside the context of decks built with the rest of those cards. It’s good that every Gavi deck will want a Drake Haven but no one else will and the price will stay bulk forever.

It’s clear there are cards that can shrug off reprints, but we will have to select them fairly carefully. Here’s what I think could be in play.

The research, by the way, was pretty painless because EDHREC put all of C2020’s reprints in their own section on the page for C2020 and sorted by amount they’re played. You’ll need to click on the individual card, select a commander for it and go to that commander’s page then find that card to find the synergy score for that deck, but something tells me there aren’t a ton of high-inclusion, high-synergy cards, it’s likely one or the other.

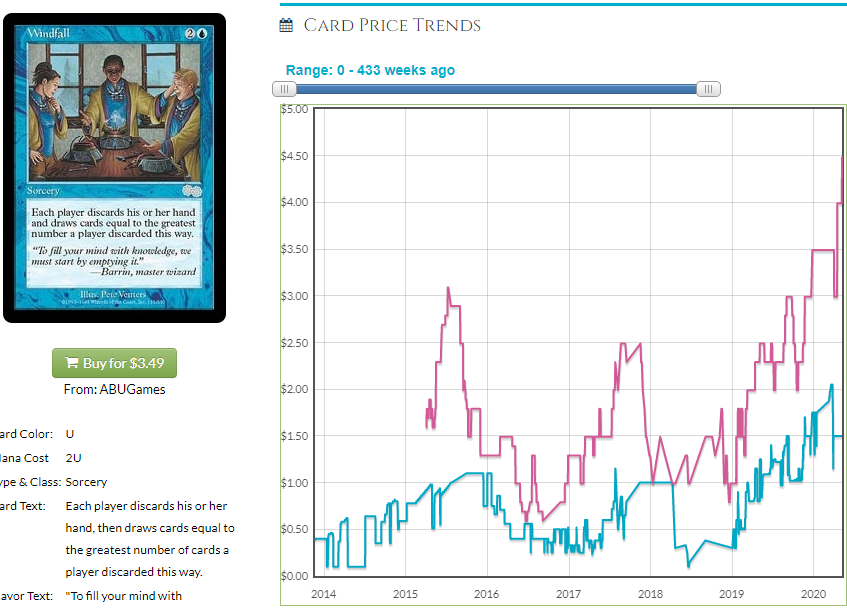

Windfall is both used in a lot of decks in the past and it’s also likely to be in play in the future. Wheel effects, forced draw and other cards keep popping up – the number of times I have made money on Puzzle Box astound even me. Windfall likely stays good, pops again on the basis of a new commander and it’s likely going to go down from where it is now once people integrate new supply from C2020 and stores open back up, but who knows when that is? I think when this bottoms out, scoop a bunch. It’s hard to reprint outside of a Commander deck and it’s unlikely they’ll make a set of commanders that wants it in the next 2 years, leaving us free to make our money back and then some.

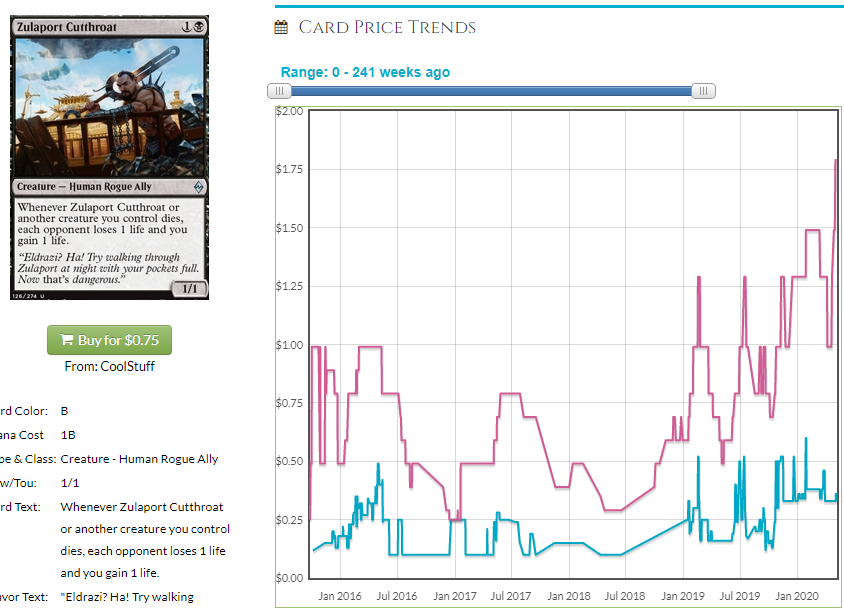

This has shrugged off a Masters set reprinting and kept on ticking. I would say the reprint risk is more significant than a typical Commander deck card, but I think they’ll likely reprint Blood Artist before they reprint Zulaport Cutthroat again.

If you’re noticing that I like a lot of the Uncommons more than a lot of the rares, it’s likely because the uncommons tend to be less specialized than the rares and able to go in more decks.

That said, here is a rare I like when its price bottoms out.

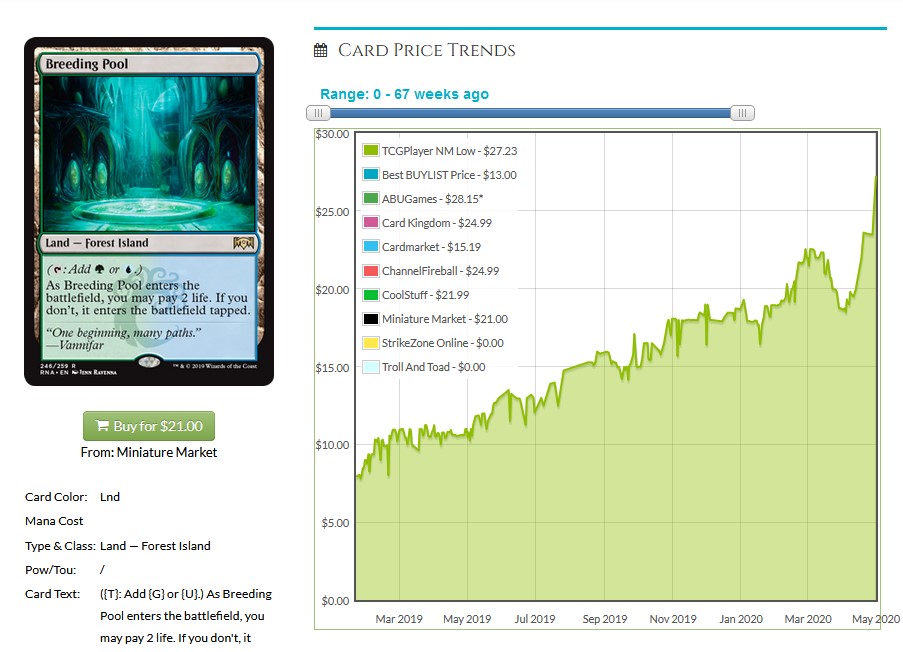

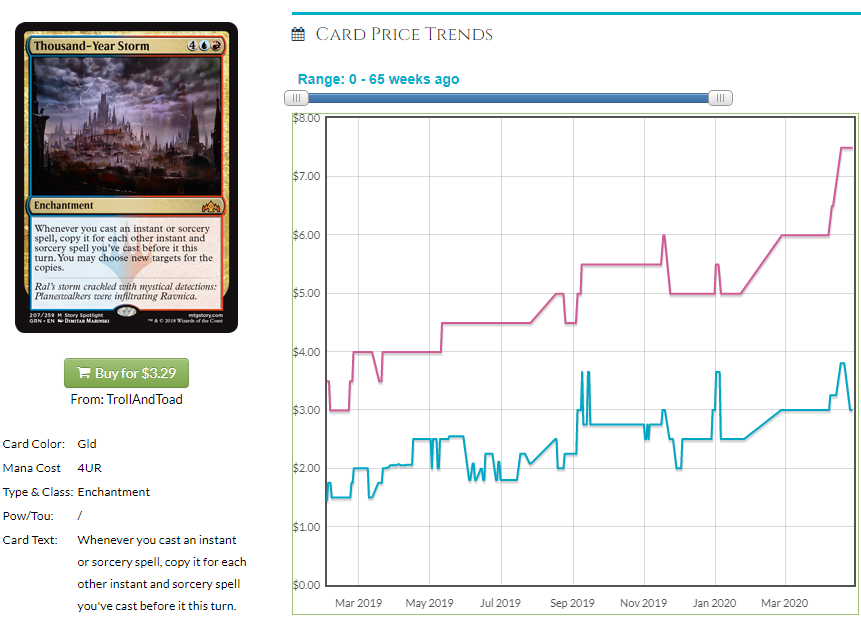

Here’s one that got a new, better-looking border.

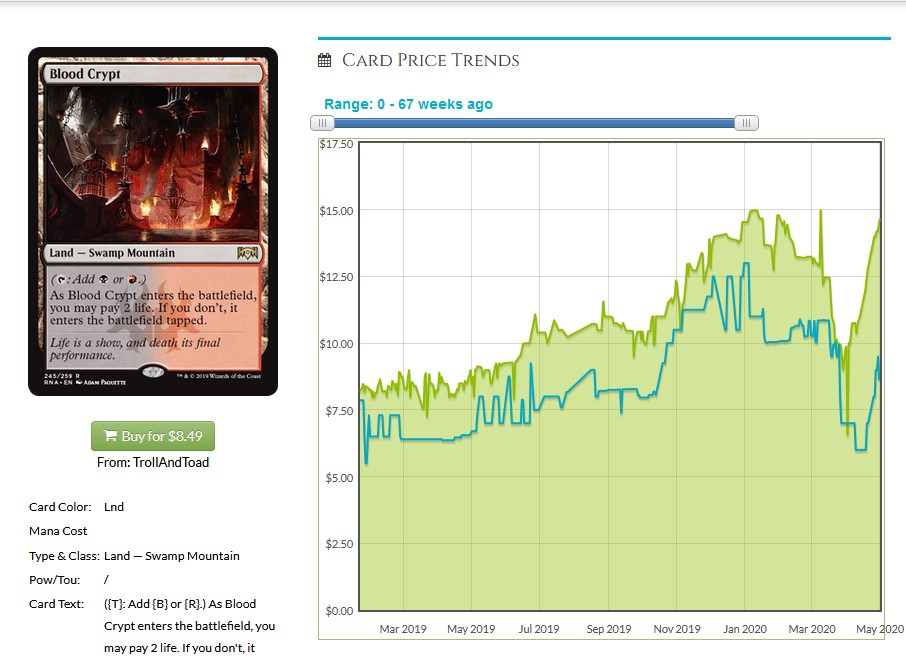

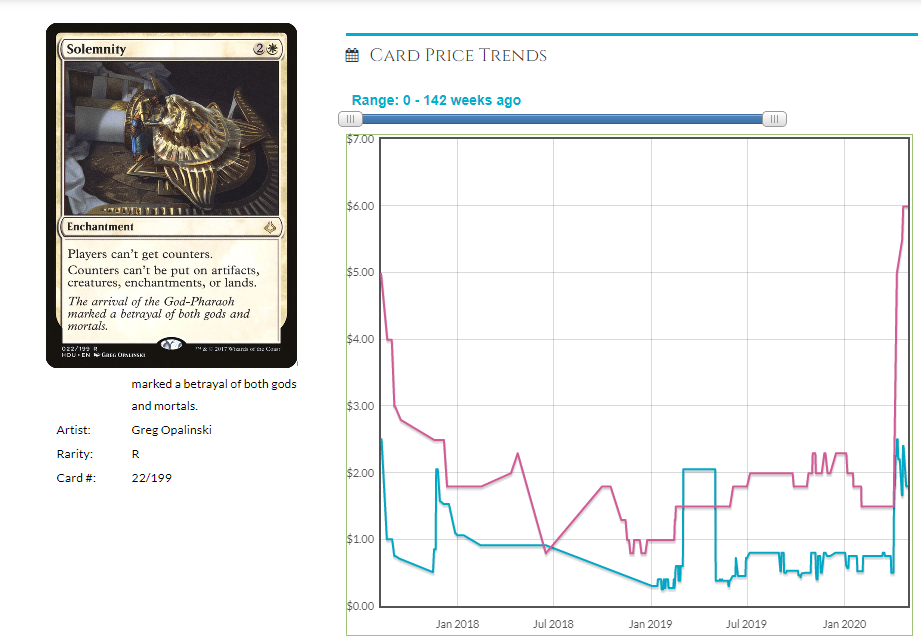

And here is a great longer-term spec/grim reminder that Covid-19 is the least of our worries.

I think you should be able to find a few more cards that aren’t just good in one deck that are likely to rebound in price and you should be able to pick them up, especially locally in trade from people who busted the decks and don’t want most of the cards, if that’s ever a thing again.

That does it for me. Really study the set lists from this year as well as years past to see what cards have managed to recover and I’ll be back with more next week. Until next time!