Welcome back, financiers and non-financiers alike. In last week’s article, we discussed what the definition of a “fake bulk rare” is, why it’s different than true bulk, and what you should do with cards in the category. I’m relatively proud of it as I think it’s an under-explored area in our little MTG finance alcove, so be sure to check it out.

Go ahead, I can wait.

I’ll continue to hold this awkwardly conversational writing style with myself until you get back.

In other news, Reddit continues to spark inspiration for me to write content for you all. I took a stroll through the weekly “Ask r/mtgfinance Anything” thread this morning, and stumbled upon a question that hit relatively close to home. Instead of doing a scattershot of responses to Reddit’s finance questions, this one is deep enough that I feel I can accurately break it down over the course of a whole article, instead of forcing you to jump from topic to topic with me. Reddit user emeoelmo11 writes:

Have been holding on a set of Commander 2013 for about two years now and realized that the price isn’t moving up at all, with only a handful of staples in the decks that are worthwhile to keep. Also, have not found any luck finding buyers for these at discounted prices, even.

1) Should I crack these open and sell them individually to at least recuperate some cost? Seeing more Commander products being printed every year, I am not confident any of these will go up any time soon.

2) If I were to crack one open, it would probably be for play. Which of these are best for a beginning player of EDH to delve into?

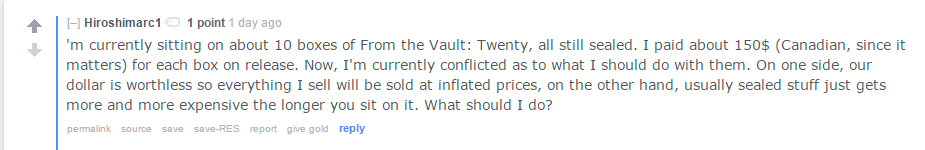

If you’ve been following my content for a billion years or so, you might remember that I used to write for Brainstorm Brewery. In particular, about a year and a half ago, I wrote an article about my own personal errors that I made when it came to investing in sealed product. Since the information in that article is pretty outdated (and poorly formatted), I’ll save you the trouble of reading it. The short version is that I made a mistake investing into sealed versions of From the Vault: Twenty and Commander 2013, when I could have capitalized on the huge spike of Legacy staples like Rishadan Port or Tundra.

In that article from August 2014, I said that I would be in for the long haul when it came to my sealed product. I had no need for emergency funds and owned plenty of extra copies of the cards that came in each of those sets. I would just continue to leave them in their plastic totes to collect dust, and remember that I owned them if someones asked for an easy way to get into the Commander format. If I happened to run out of Jace, the Mind Sculptors that I had in stock, I could crack the FTVs and just fill my binders with some of the higher-end stuff, throwing the chaff foils into my dollar boxes.

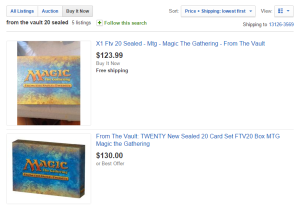

Only a couple months ago, I decided to crack open a decent portion of my sealed product (five FTV20s, and fifteen C13 decks) to help replenish some of the cheaper cards in my display case, in addition to filling a local order for a playset of Jaces. There was still no movement on either sealed product, and I was obviously never going to realistically move them while still packaged unless I wanted to lose out on a huge chunk in shipping.

Our Redditor produced a couple of solutions (well, pretty much the only two possibilities) themselves, so let’s go over those in detail.

- Crack it all. I kind of spoiled the ending a little bit, as this is obviously the move I chose to make. The cards had been sitting in storage for two years, doing nothing but taking up space and money. I finally got a request for a few individual cards that I didn’t otherwise have, so I filled those by shredding my sealed product for parts. This player is actually, well, a player, so I think they’ll get even more value out of learning the format with their preconstructed decks. Nobody ever accused the Nekusar deck of being underpowered, and you can certainly still trade the True-Name Nemesis toward upgrading whatever deck you decide to stick with.

- Let it sit in the oven for a while longer, and accept the fact that these are basically never going to appreciate in price. Let’s get this statement out of the way right now: It will be several years before Sol Ring is ever worth more than $1.50, especially if they continue to print the card in the every yearly Commander set, encouraging its ubiquity in the format. A lot of us (including myself) incorrectly assumed that the Commander sets would be a continuous gold mine of value, following the trends of the first set in 2011. We were wrong. Wizards has learned from its mistakes.

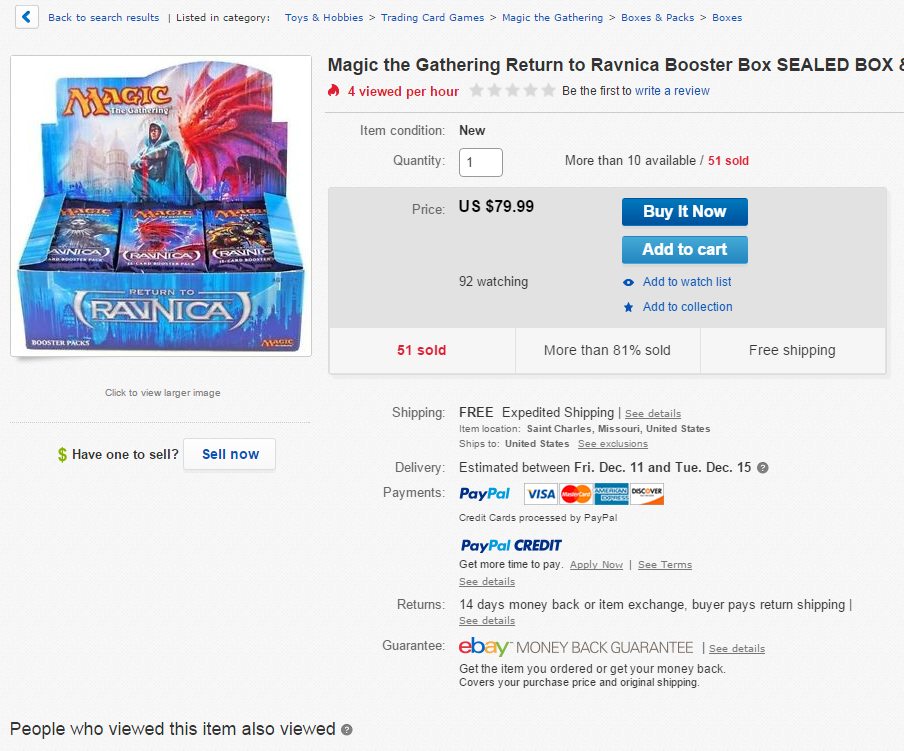

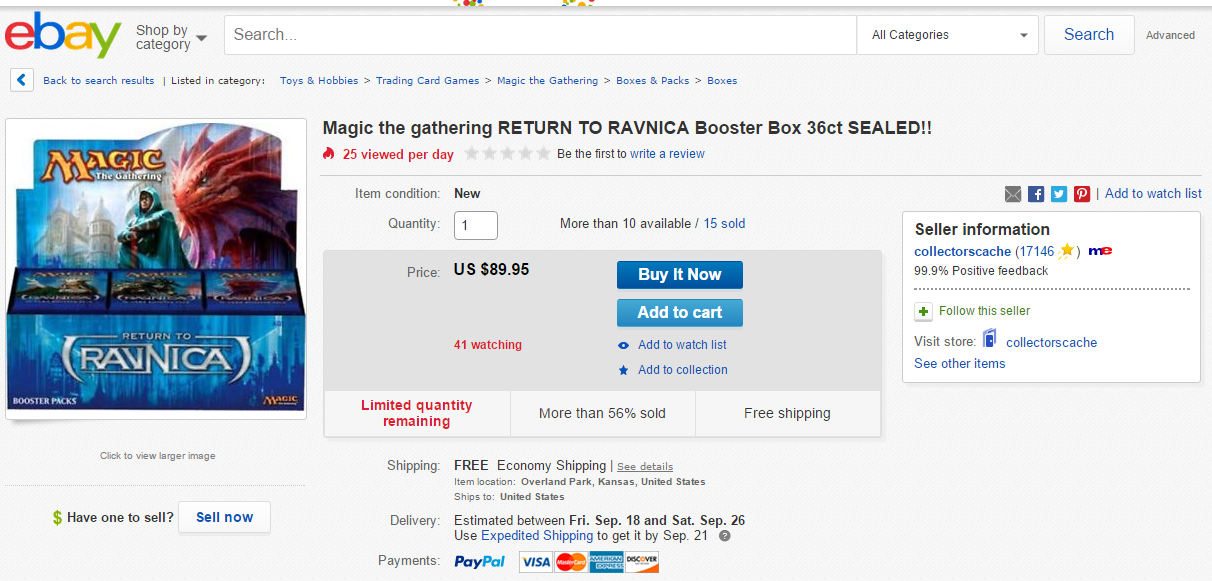

Remember these? Back in 2012, these were the go-to slam dunk for sealed product. Shock lands, Abrupt Decay, Deathrite Shaman, all at rare. If you wanted to make a 30-percent increase over a three-to-four-year period, this was what people like me would tell people like you to buy as a safe and solid investment. Now you can find them for almost 20-percent cheaper than they were back when Obama won the election for his second term.

Sealed product is was attractive to us because it required a very minimal amount of effort. You threw money at it, moved your girlfriend’s shoes around in the closet, and deleted the memory of buying it from your mental hard drive. Four years later, you’re supposed to dig it up like a lost treasure, making a significant return on your investment by popping it up on eBay or Facebook, selling to all of the nostalgic players who want to reminisce about their favorite draft format.

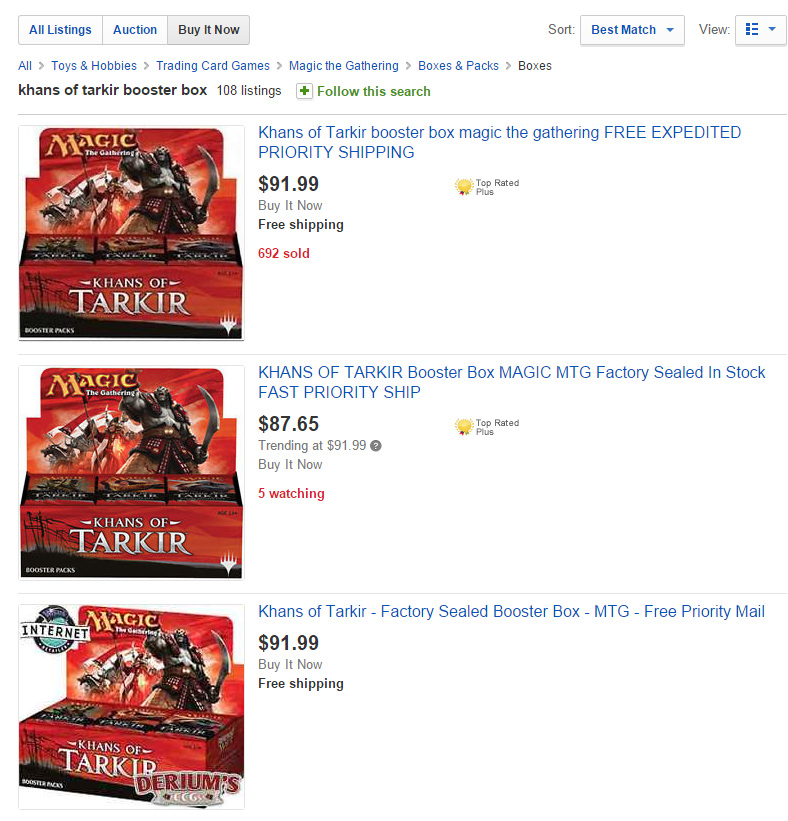

I’m here to remind you that the era of making money off of any random sealed product is long gone. Even today, I see posts on both local and non-local Facebook groups, asking the masses, ” What would the best sealed booster box be to invest in?” I see a ton of replies suggesting that you can’t possibly go wrong with Khans; you get fetches, you get….. uhhh….. uhhh…… foil Monastery Swiftspear?

Will these be $80 in three years?

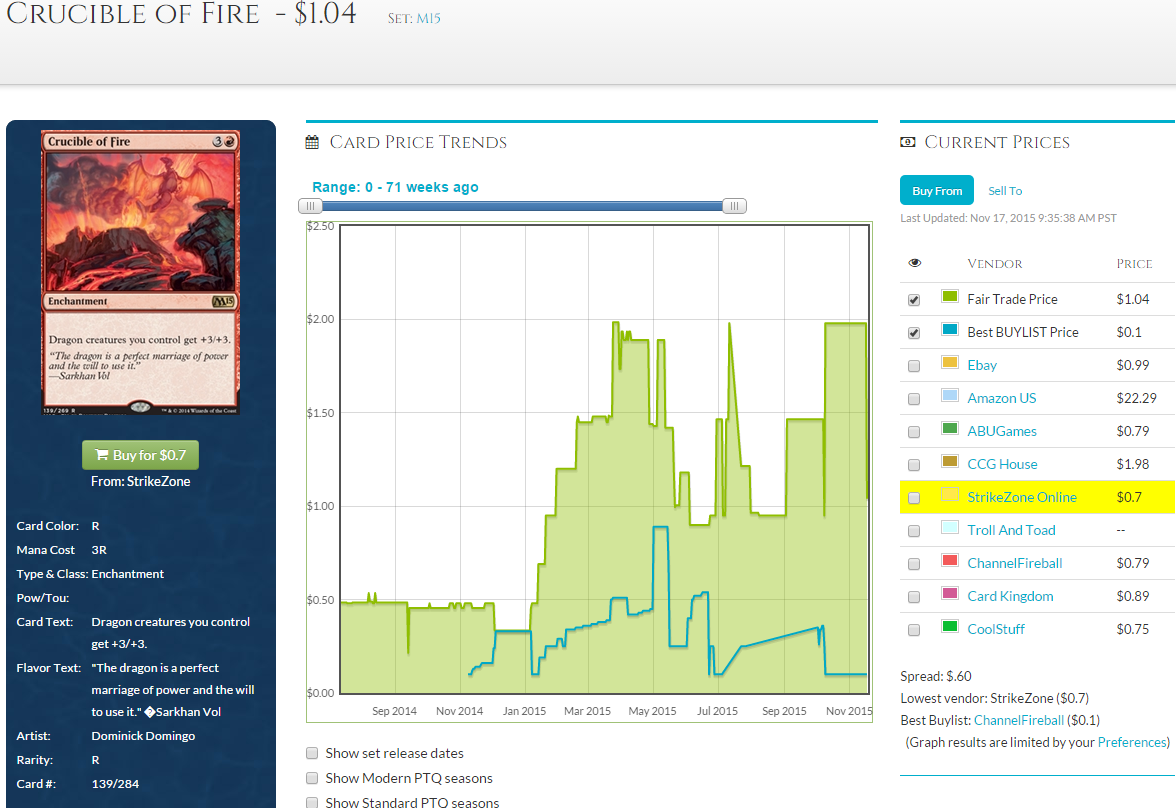

So what could you get instead of a box of KTK, that has a higher likelihood of giving you a return on investment in a shorter period of time? Well, you know, speculating isn’t my personal preference for putting money into Magic, but let’s put on our spec caps for a minute. If you really want to burn through that $90, I’ve got a couple of suggestions.

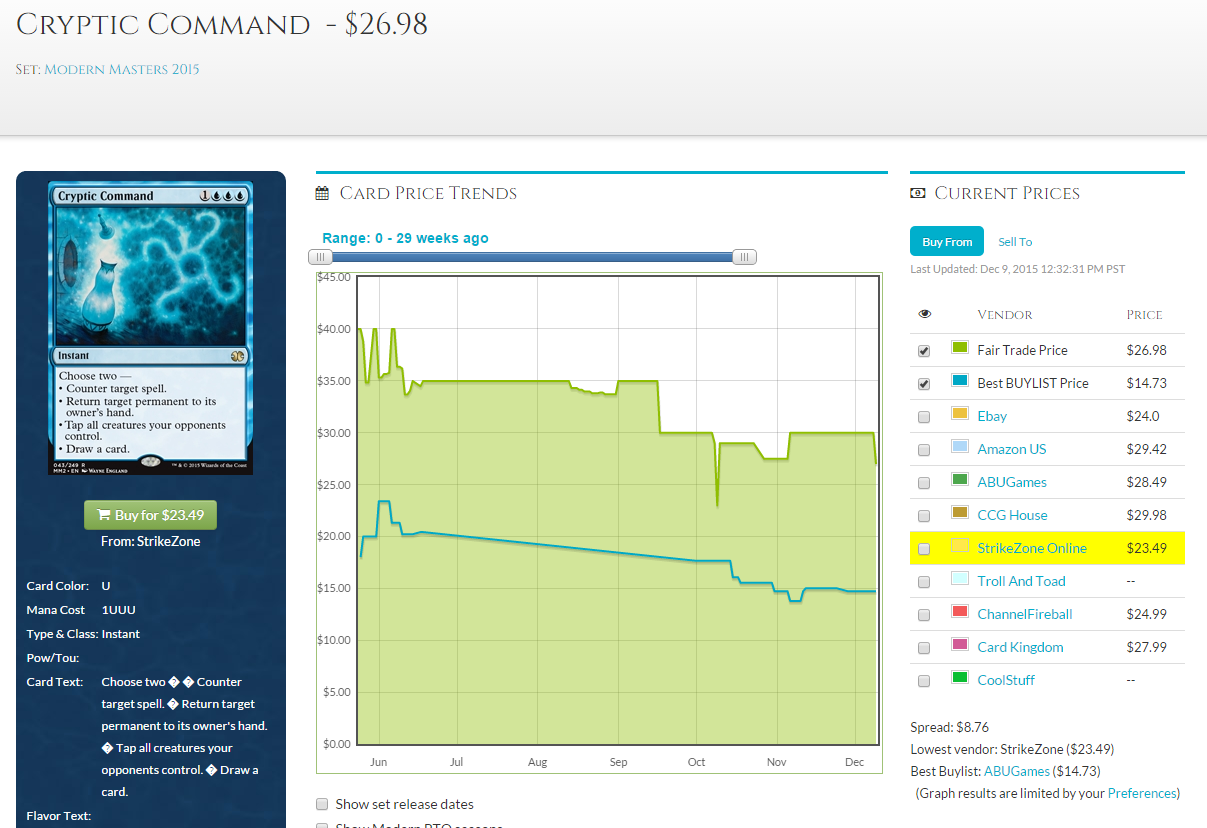

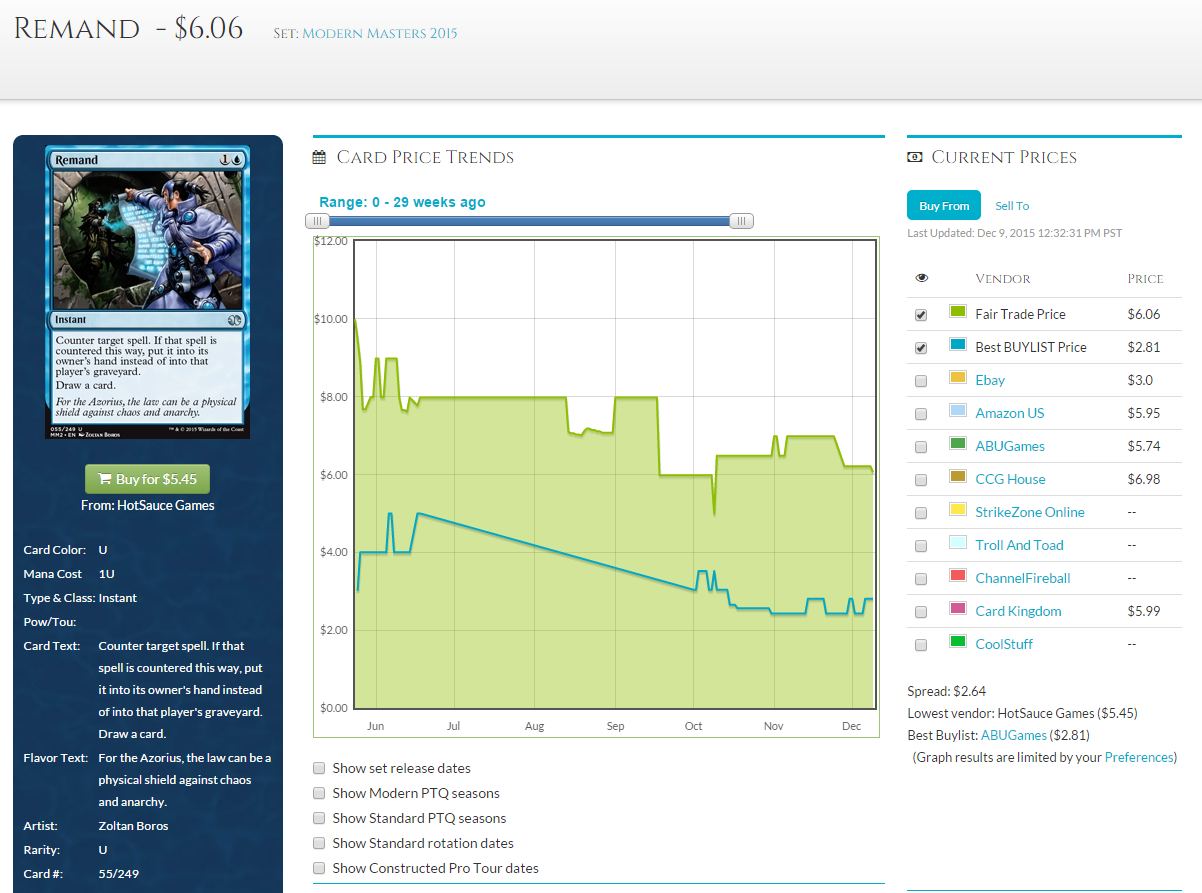

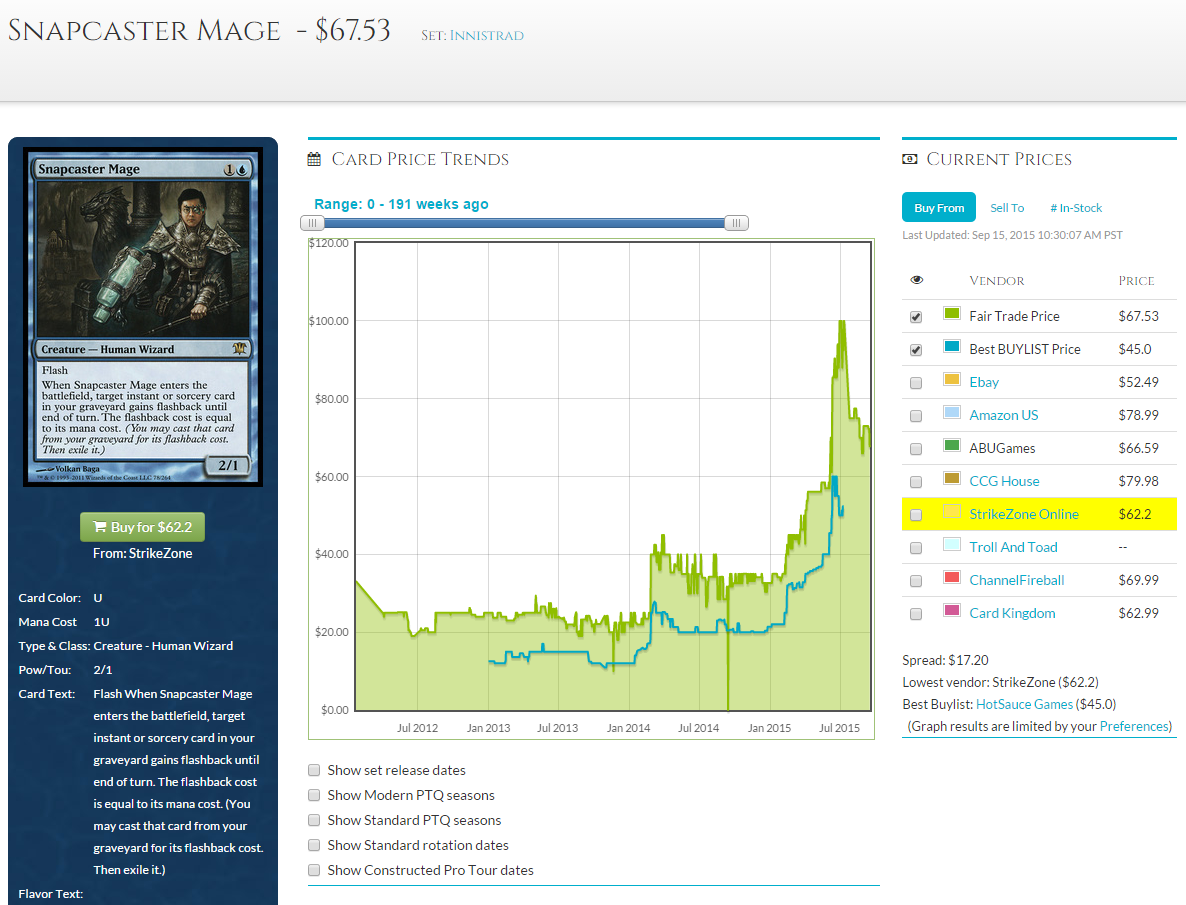

You can buy Remands on TCGplayer for $4.50, NM with free shipping. Seriously, that’s a thing. Remember when these were $15 not too long ago? To make it even more appealing, the buylist prices that vendors like ABUgames pay are close to $3, making the spread relatively low for a cheap modern staple. Cryptic Command has followed a similar trend, hitting its all-time low yesterday (and today, and probably tomorrow…).

You know that my strategy is “never buy Magic cards at full retail,” but I just have a bad taste in my mouth when I personally sell Remands at $4. I’m holding onto the rest of my copies until Modern season hits, because I think these creep back up to at least $7, maybe $8. Cryptic could hit $30 to $35, which is certainly a better ROI than a box of either RTR or KTK.

End Step

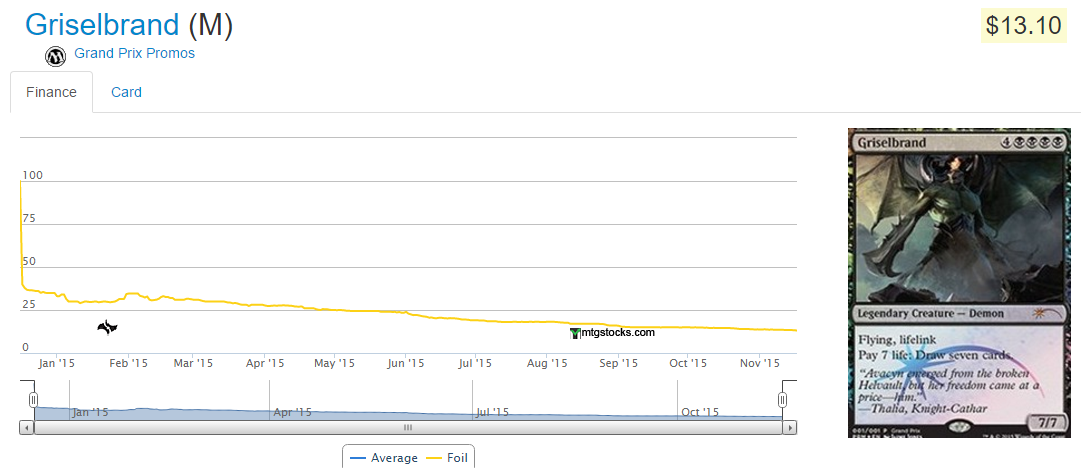

In other news, Stoneforge Mystic is the next Grand Prix promo. Someone on this website who cares a lot more than I do will probably write about that.

Awakening Zone has moved up almost 25 percent since I wrote about it last, before the Battle for Zendikar set release. It’s certainly had a stronger track record than From Beyond. I still wouldn’t touch From Beyond at $1—I think A-Zone continues to be a better train to hop onto if you really need copies for EDH.