By: Travis Allen

Here’s the timeline of events from this past Thursday, June 19th.

12:57: Evan Erwin tweets the Sphinx’s Tutelage spoiler:

New #MTGOrigins spoiler “Sphinx’s Tutelage” pic.twitter.com/WcKCnOTPlG

— Evan Erwin (@misterorange) June 19, 2015

1:00: JR shares Evan’s tweet with the comment “Painter’s Servant sold out yet?” This is the first time I see the card. 1:00: I check TCGplayer for copies of Painter’s Servant. 1:04: I receive a confirmation email from TCGplayer regarding my order of 3 NM Painter’s Servants. 1:05: I check Star City Games for copies of Painter’s Servant. 1:08: I receive a confirmation email from SCG regarding my order of 25 Painter’s Servants. ~1:10 – 1:15: I look at Sphinx’s Tutelage again and see that it says “nonland.” 1:19: I call SCG to cancel my order of Painter’s Servants. 1:21: I tweet that Sphinx’s Tutelage is not Grindstone. This exchange led to Nick Becvar hassling me that my behavior was the same as stores cancelling orders. I disagreed, and declined to get into it with him on Twitter. I realized instead that this, in conjunction with another recent event, was an excellent opportunity to discuss some of the etiquette in customer/vendor transactions. I’ve talked before about how to behave when dealing directly with other players. Today, we’ll look at some scenarios that arise between players and stores, what you should expect, and what is expected of you. We’ll come back to the Painter’s Servants in a bit.

“Out of Stock”

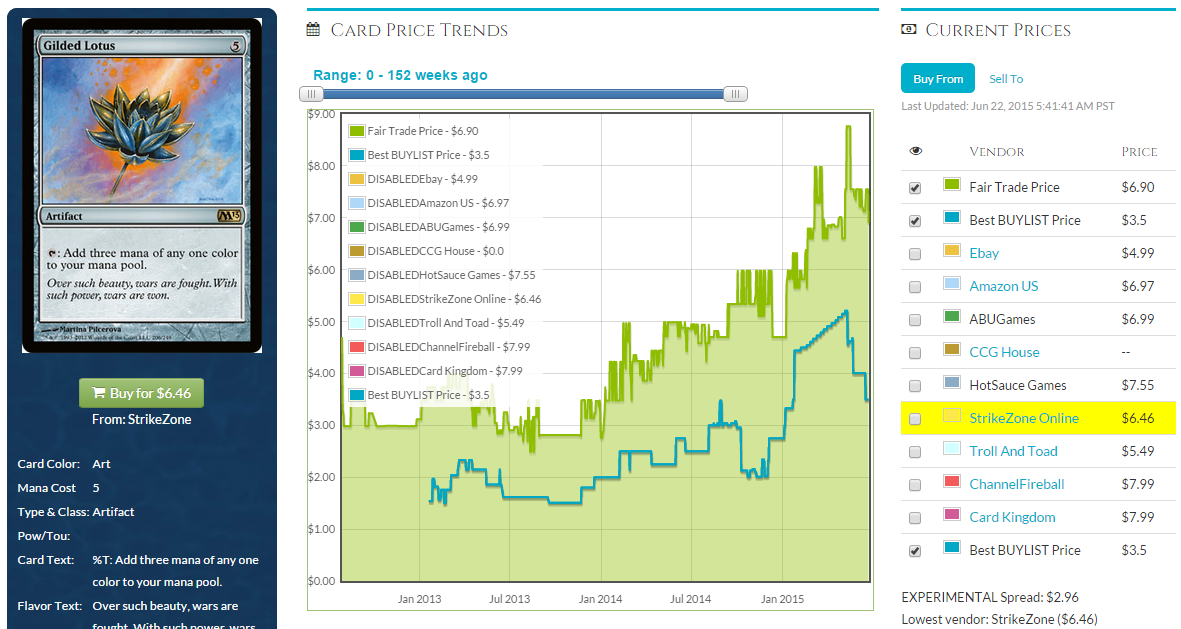

This is hands down the most commonly heard complaint regarding players and stores. A card’s value increases dramatically in a short period of time—ban list changes are a frequent catalyst of this—and players overwhelm stores to stock up on copies. (It happened with Golgari Grave-Troll and Worldgorger Dragon. And Bitterblossom. And Land Tax.) People order ten copies of Worldgorger Dragon at $1.90 each at 11:00am EST when the B&R article goes live, and by 1:00pm, the price is $30 on TCGplayer. Then comes the email. “Sorry, we’re out of stock on Worldgorger Dragon. Your order has been cancelled. Our apologies!” The player, who was already counting the money he was going to make, is semi-justifiably upset. He might take to social media to decry these unscrupulous charlatans. I’ve done it myself on more than one occasion. Salt is added to the wound when the vendor that was “out of stock” magically has ten copies available the next day at the new ten-times-higher price. As an online vendor, it’s extremely unprofessional to cancel orders you have the stock for, lie to customers, and then relist the items for greater prices. It’s an awful business practice, and there is even an entire forum for vendor reviews here on MTGPrice in order to alert others about this behavior. If someone places an order for your posted price and the price skyrockets, it’s your duty to sell it to them for the listed price. If you’re that worried about losing a few potential bucks on cards spiking, hide your inventory ten minutes before the B&R article goes up and preemptively remove unbanned cards before people can order them. It’s absolutely not worth your time as a vendor, but if you feel compelled to not let anyone get a good deal, it’s better than cancelling on people. Having said all of this, it’s important for us as customers to remember how this works on the other side. Depending on the software a vendor is using to manage their inventory, it’s entirely possible they do oversell through no fault of their own. If a flurry of orders all come in for the same product at the same time, there is software out there that will sell 30 copies of a card when only 11 were in stock. Through no fault of their own, the vendor is now forced to tell several people they can’t fulfill that order. It comes up when product is listed in multiple locations as well. Some vendors will list on their own web page, on eBay, and on TCGplayer. This makes it extremely easy to suddenly sell three times more stock than you have available. You can debate whether or not listing product in this fashion is appropriate, but for the time being, accept that it happens, and that it’s not necessarily the store being scummy if they have to cancel orders. As a customer, it’s entirely fair to be upset when a store cancels your order on a card that just spiked in price. It sucks when perceived profits suddenly evaporate just like that. Just remember that not all stores that cancel are doing so for nefarious purposes.

“Whoops N/M”

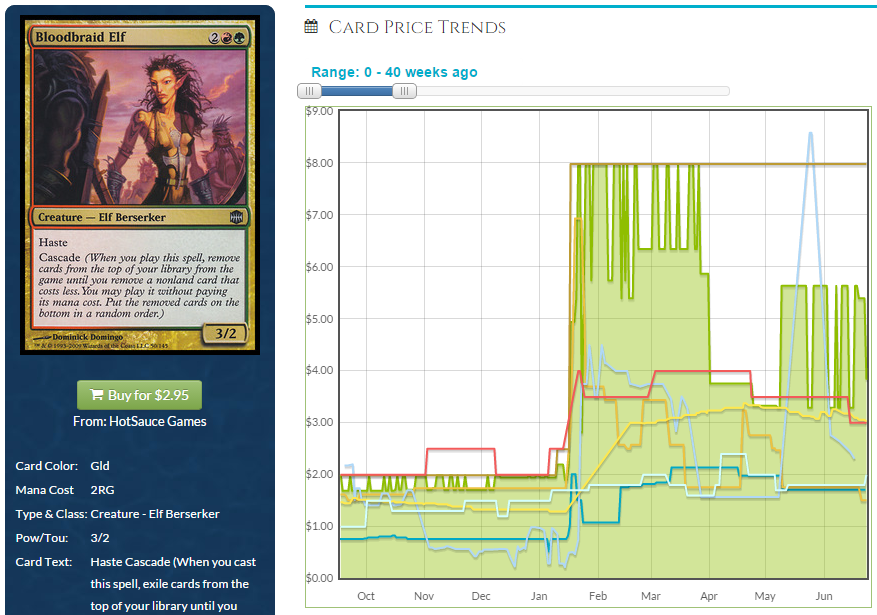

On the other side of the order cancelling coin is when a customer changes his mind. The most egregious example of this came to me across Twitter a few banned and restricted list updates ago. (I forget who originally shared the story. If you remember—or if it was you—be sure to tell us in the comments!) This was back when everyone was expecting Bloodbraid Elf to be unbanned. Now, there wasn’t any actual evidence to support this claim, but the hive mind had collectively decided it was time. BBE’s price rose accordingly:  Then 11:00 a.m. EST came, it wasn’t unbanned, and suddenly all those elves were not worth what people had started paying for them. A vendor then shared a snippet with us all. Some customer had ordered a bunch of BBEs, probably over two or three playsets at least, and now wanted to cancel his order—except that the cards were already in the mail, since he had ordered them a few days prior. The customer had ordered all of these cards, then as soon as they weren’t unbanned, cancelled his order. Was the vendor supposed to honor that? The parallels here are what made this amusing. We were all so used to stores cancelling orders on us when a card is unbanned, but what about a customer cancelling an order because a card wasn’t unbanned? I’m not sure what the outcome was. I know a lot of us were hoping the vendor would refuse to cancel the order, as some form of symbolic striking back against frustrating business practices. I’m guessing he did cancel it, though, and he probably should have. In the business-customer relationship, the burden of service is on the business. The business exists to make profit: to take money away from the customer. While a business’s identity exists only in relation to its customers, a customer is a person that exists independent of the business entity. A person is not defined by his or her capitalist relationships. Because of the nature of the interplay between the two, it’s the economic responsibility of the business to provide service to the customer in any way it can, even when the customer is at fault. If the business messes up, it owes it to the customer to make amends. If the customer messes up, the business owes it to the customer to help them clean it up. This is starting to get into philosophy of capitalism, and I don’t want to go too deep down that path lest the comments become littered with libertarians raving about how the destitute ghost of Ayn Rand compels us all to sell our cards and donate the money to R[on/and] Paul. My point, which I’ve taken my sweet time getting to, is that “the customer is always right” is not just a business strategy, but almost a moral compunction.

Then 11:00 a.m. EST came, it wasn’t unbanned, and suddenly all those elves were not worth what people had started paying for them. A vendor then shared a snippet with us all. Some customer had ordered a bunch of BBEs, probably over two or three playsets at least, and now wanted to cancel his order—except that the cards were already in the mail, since he had ordered them a few days prior. The customer had ordered all of these cards, then as soon as they weren’t unbanned, cancelled his order. Was the vendor supposed to honor that? The parallels here are what made this amusing. We were all so used to stores cancelling orders on us when a card is unbanned, but what about a customer cancelling an order because a card wasn’t unbanned? I’m not sure what the outcome was. I know a lot of us were hoping the vendor would refuse to cancel the order, as some form of symbolic striking back against frustrating business practices. I’m guessing he did cancel it, though, and he probably should have. In the business-customer relationship, the burden of service is on the business. The business exists to make profit: to take money away from the customer. While a business’s identity exists only in relation to its customers, a customer is a person that exists independent of the business entity. A person is not defined by his or her capitalist relationships. Because of the nature of the interplay between the two, it’s the economic responsibility of the business to provide service to the customer in any way it can, even when the customer is at fault. If the business messes up, it owes it to the customer to make amends. If the customer messes up, the business owes it to the customer to help them clean it up. This is starting to get into philosophy of capitalism, and I don’t want to go too deep down that path lest the comments become littered with libertarians raving about how the destitute ghost of Ayn Rand compels us all to sell our cards and donate the money to R[on/and] Paul. My point, which I’ve taken my sweet time getting to, is that “the customer is always right” is not just a business strategy, but almost a moral compunction. As a customer, and subsequently a human being, you should try not to be a jerk face. Don’t do things like order cards, wait for the B&R announcement, and then cancel while they’re in the mail because the update didn’t have what you wanted to see. Don’t be extremely unpleasant for no reason. If you’re a business, forgive the customer for these things, and continue to provide him good service. Back around to the Painter’s Servant, it should be easy to see where I’m going with this. Does cancelling an order within 11 minutes make me a bad person? No, of course not. We should try not to do that, but at the same time, it’s not a particularly heinous crime. I don’t feel any guilt over it. There’s a humongous gap between what I did, vendors cancelling orders on unbanned cards, and even people waiting until cards are in the mail or the B&R updates happen to cancel orders. As someone that sells regularly on TCGplayer, I’ve had plenty of people cancel orders, and so long as they do it before I package the cards, I don’t have any real reason to care.

“That’s No Longer $5.”

This happened to me recently, and while I tried to shrug it off, it got under my skin enough that it’s half the impetus for having written this article. It was a quiet Monday evening and I was driving up to Chipotle to grab dinner and take a break from working on my thesis. There’s a card store on the way that I hadn’t visited recently, and I was in no rush to get home, so I figured I’d pop in and see what was in the case. Specifically, I was hoping to find some Alpha or Beta stuff, since that’s been getting hot online recently, and local stores and players are still likely to be totally in the dark. Looking through the case, I first saw several copies of Ezuri, Renegade Leader at $3. I asked the attendant to pull them aside and kept grazing. Then there was a copy of Through the Breach at $15, a completely fair market price at the time. I had just written that I expect this to jump in the near future, so I was happy to take it at that number. A few minutes later I found a playset of Disrupting Shoals at $5, so I asked for those as well. It’s one of the few Modern cards I don’t have a personal set of that I may actually use, so at $10 off from TCGplayer, it was a great time to pick them up. As the owner put the Shoals with the Ezuris and the Through the Breach, he informed me that, “We reserve the right to change these prices. These Ezuris are $10 now, and the Shoals…[he tapped on an iPad twice]…are $15.” I’m a bit flabbergasted, as I didn’t expect them to change the prices on me as I picked them out. I paused for a moment, rather indignantly shrugged my shoulders, said, “Fine, whatever,” and walked out the door. Later that night, I sent this tweet:

I like where I am in #MTGFinance, though it is a bummer that case prices are absolutely never honored for me — Travis Allen (@wizardbumpin) June 17, 2015

What rankles me about this is that the store is essentially trying to have their cake and eat it too. There are two methods available to a store when pricing singles.

The first method is to put no prices on any cards. When customers are interested in a card, they ask about the price, and the associate looks it up. This ensures that the store always has the most accurate prices, since they’re checking the numbers at the time of sale every single time.

There are several pitfalls with this strategy, however. Primary among them is the time it requires to do this. An inquisitive customer, especially more casually-oriented players that don’t know exactly what they want and haven’t memorized prices, may end up demanding a huge chunk of time of the employee who has to constantly look up prices on obscure cards. Another issue is that without prices listed, people may not bother to ask at all. Rather than pester the shopkeep, they assume that whatever they are looking at isn’t worth asking about and skip over it all together. A store misses a lot of incidental sales without prices on singles.

The second method is to put prices on cards. An overwhelming majority of stores do this. This way, employees don’t need to tell people the price on Flooded Strand nine times a day. Customers can process information and make purchasing decisions without bothering anyone first. People will overpay on cards that have dropped in price in the time since you initially stickered them. And the store will get sales on cards that may be a bit underpriced because someone feels like they’re getting a deal. Even though they aren’t maximizing their profit on those transactions, they’re keeping liquidity up, an important component of a successful MTG business. Losing a few potential bucks on cards that have gone up in price is well worth the amount of value the store gains by pricing the cards ahead of time.

What’s especially irritating about this event is just how easy it is to avoid the entire situation. Just assign staff to check the front page of MTGPrice each morning to check for any swings large enough to warrant price changes. The entire process would take less than five minutes each day, and there would never be a need for hurt feelings. Rather than set aside a small amount of time to for this process, though, the store has opted instead to let its customers work for free.

Further still, if a random guy off the street asks for a card in the case, they sell it to them at the posted number. However, if someone they suspect has a greater level of knowledge asks—say, a local player who happens to write for a site specializing in MTG finance—they check each and every price to make sure our handsome hypothetical never gets any good deals. Why bother to go through all the effort of updating prices every day when you can just let well-informed customers tell you exactly which cards you have marked incorrectly?

And by the way, you can bet your ass that if a card has dropped $3 since it was stickered, they aren’t passing the savings on to you. The sticker says $10 and MTGPrice says $15? It costs $15. The sticker says $10 and MTGPrice says $7? It costs $10.

As a private store, it’s the owner’s prerogative to change prices on people (well, probably. I’m not sure if it runs afoul of truth-in-advertising laws. I’ll give them the benefit of the doubt and assume it doesn’t). If a store wants to update its prices whenever people ask about a card, they’re allowed to.

However, there’s a big gap between “allowed to” and “should.” You’re allowed to spew hateful, racist rhetoric, but there’s no question that you shouldn’t. Changing prices on your customers from what is posted may save you a few bucks in the short term, but you will rapidly destroy any goodwill they have towards your establishment. Is it worth burning all future sales just to ensure you don’t lose $20 on a playset of Ezuris? After all, if a store is selling them for $3, it means it probably bought them at bulk rates. The store is still making a profit even if the card is underpriced, so it’s not even like it’s losing money.

If you’re a store owner, it’s probably legal to change prices on cards in your case when people ask. Even if it isn’t, nobody is going to get you into legal trouble. However, it’s just about the scummiest thing you can do to your customers. Train employees how to keep up on prices. Ensure that they have time to keep things in the case updated. And if something slips through the cracks, honor your posted price. It’s just good business.