By: Ross Lennon

Do you listen to a lot of podcasts? I do1. Most of them are Magic-related, and the rest are mainly football, news, and finance. I was listening to Freakanomics on Monday (or as I like to call that program, “Game Theory, Who Knew?”), and I instantly got an idea for something I wanted to write about. My original plan for this week was to finish up the Mirrodin block in our Modern set review series, and we will take some time to go through Darksteel, but that series is not terribly time-sensitive, so I say we ride with the hot hand.

The program I was listening to was about “Homo economicus,” the fictional character/species which embodies the “ideal” human in economic models. Basically, when economists say, “Well, X should happen, because people will know that it is the best option,” they are assuming that all humans know at all times what is best for them, or are able to quickly and cleanly compute the best fiscal course of action.

This, as anyone with a humanities background will tell you, is absolutely not true. Many economic theories and models are predicated on Homo sapiens acting like Homo economicus, which is why some academic economists can seem out of touch with how the world really works. Meanwhile, the entire field of advertising is intended to make us do the opposite of what Homo economicus would—the reason why new cars are literally always on sale is because nobody needs a new car. The Freakanomics program was interesting and you should check it out if you haven’t already.

Talk About Magic Now

What I want to discuss today is whether Magic finance has its own inaccurate views of how the market works compared to our expectations. For the sake of me needing a title for this article, let’s call our little best case scenario straw-man Homo magiconimus.

I’m going to tell you a short story about how Magic finance finally “figured out” casual Magic, with some brief justifications why Homo magiconimus missed out on it.

It may seem crazy today, but for a very long time, the casual Magic community got no respect. Even though Wizards “discovered” the Invisibles during Time Spiral, it really took a while for the community as a whole to embrace them (and for Magic finance to adjust to their needs). At the time, cards that only saw casual or non-sanctioned play didn’t command high prices. For example, during its time in Standard, I bought a couple of foil copies of Woodfall Primus for 25 cents each. They weren’t bent-up copies tossed in a vendor’s foil box at a PTQ, and they weren’t scummy trades where I ripped off some doe-eyed little kid—these were NM copies listed on the website of one of the largest Magic retailers on Earth (to protect that company’s privacy, let’s just call it… “Pool Stuff Games”). And honestly, I wouldn’t have even thought to buy them, except the non-foil copies were out of stock, and I needed them because I was starting to get into Type 4. Homo magiconimus would have bought one copy (even though he probably doesn’t like foils as much as I do), but it’s unsure if he would have grabbed the second one. My gut instincts on getting both were a combination of “mise” and thinking, “I can always give it to a buddy for his Type 4 stack,” two sentiments a “strictly upside” sentient being isn’t likely to be moved by. In the end, however, I was able to move the cards for about $30 each, which is something Homo magiconimus can get behind, so hopefully he used that quarter for the foil rare and not jelly beans.

At the time, dealers and finance people weren’t as diversified as they are now. Their goals mostly revolved around making sure they could meet the needs of the tournament players, as well as learning what they could from that group to know what the good buys were.

“Casual staples” at the time weren’t things like Primus, they were just Extended and Legacy staples. I remember trading Mutavaults (which were about to rotate) for Maelstrom Pulses to a friend/vendor (who later went on to open a couple of Florida’s best Magic stores), because I knew I would need the Pulses, and that he would have better luck moving the Mutavaults at a GP booth or something out of state. Was this the correct trade to make? The prices at the time were similar, but I had extra utility in trading for the card with the longer lifespan in Standard. Homo magiconimus, or at least those of the “plays a bunch of Standard” tribe, would have likely taken the deal, since the ability to roll the upfront investment made on the Mutavaults into two more years of Standard is a great way to avoid continuing to spend money.

Prior to the explosion of popularity for Commander, most dealers had a very poor idea of what cards were popular with casual players. This is likely due to the lack of a uniform format (which we got with Commander), so cards that were good in Emperor but not massive Free-For-Alls didn’t seem to garnish a premium. The only card that sticks out in my mind from that era is Underworld Dreams, which was the de facto casual staple. It seemed that anyone who wasn’t interested in playing “real” Magic just wanted to try and kill people with Megrim.

Cards like Wrath of God were obviously still good (more so when you are killing seven other players’ creatures), but most of the price there was because of Standard, or so I assumed. As a low-level binder grinder at the time, I wasn’t exposed to the casual community as much as I am now, even before factoring in great equalizers like PucaTrade. It wasn’t worth servicing the casual community at the time, because so few people understood that there even was a casual community worth serving!

Lorwyn was when WOTC was first getting its data back on Time Spiral, and when Maro and the gang were just figuring out that the Invisibles existed. Time Spiral’s failure in terms of mass appeal spurred the change to New World Order design, which first manifested around Zendikar, which led to the Zendikar Boom, which led to unprecedented player growth and grew the casual base, too. It’s easy to know all that now, but those are a lot of factors (some private) that led to the discovery and growth of a previously unknown market. Homo magiconimus is an animal that acts on rational thought and logic, but he can’t tell the future. This is the reason why so many financiers and dealers were completely surprised when Commander and casual Magic took off, and why I sold all my Tarmogoyfs at $25.

Enough of that for today—let’s hit Darksteel.

Darksteel

Something that gets thrown around a lot is the “death” of Magic. Newer and less enfranchised players claim that Magic‘s expensive secondary market and rapid product releases will be its imminent undoing. Tournament veterans assert that a broken format, a woeful Magic Online offering, or greener pastures (Hearthstone, SolForge, poker) could possibly mean the end of MTG. Of all of these doomsday scenarios, the “broken format,” has probably come closest. There have definitely been some close calls, but the impact that Darksteel made could have very likely become a killing blow.

The set’s salvation was very likely its namesake: Darksteel introduced indestructible, which is something that reads very well to all levels of players. Something like scry or cycling may or may not immediately make sense, nor does it excite younger or newer players the same way that, “THIS ROBOT IS INDESTRUCTIBLEEEEEE!!!!!!!” does. The set sold pretty well, despite tournament attendance driving off a cliff Thelma and Louise-style about a month after release.

Non-Foil Cards of Note

Sword of Fire and Ice: This is the most expensive card in the set by about $20. This card was actually a Legacy staple for a long while, but Batterskull and Jitte now get higher billing. This is still one of the better Cube swords, and the limited printings it has gotten in the last eleven years have only helped bolster it as a chase rare. The judge promo is gorgeous.

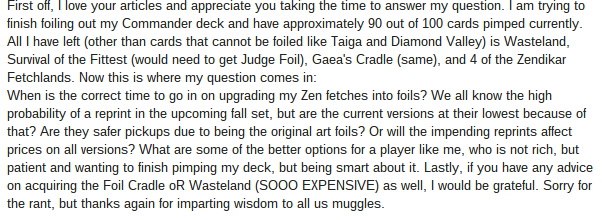

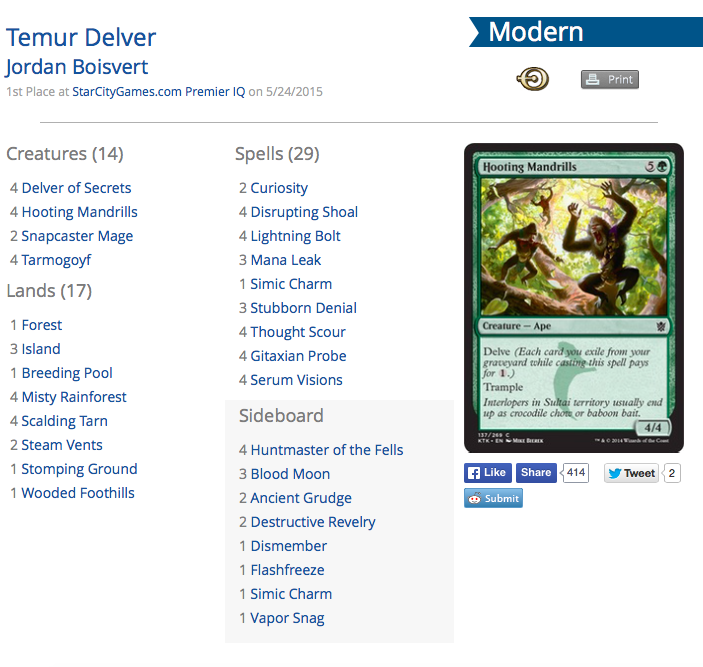

Aether Vial: This uncommon clocks in at about $27, although it’s been in the twenties for a good long while. Like Sword of Fire and Ice, it has really only gotten reprinted in Modern Masters, along with a very small promo offering (an early From the Vaults in this case). Any tribal deck in Legacy or Modern is going to need four of these, as well as the deplorable Death and Taxes archetype (seriously, that deck is dumb). These trade well though, and are a “four or zero” card much like Tarmogoyf is.

Sword of Light and Shadow: According to the free market, this sword is worse than its in-set cousin by about twenty bucks. That sounds about right, as this card really doesn’t see the same kind of play that Fire and Ice does, which in today’s Magic is pretty limited anyway.

Arcbound Ravager: I am shocked that this card wasn’t in Modern Masters 2015. I will talk about this card in the analysis section at the end (spoiler: it’s pretty good!), but here is a little financial nugget for you: since most of the non-Ravager pieces for Affinity were in MM2, you can expect that deck to be out in large numbers at Modern PPTQs. Plan on selling many Ravagers in the near future.

Mycosynth Lattice: MTGPrice has the Fair Trade Price listed at $21 for this card, but that number has been there for a long while, and I had a copy that I felt like I couldn’t give away for years. The $12 buylist price is tempting. I really don’t know how much demand there is for this card.

Blinkmoth Nexus: Reprinted twice, and the higher price here is likely for the original art. Don’t expect these copies to hold a premium when people still need Mox Opals to play the deck.

Memnarch: One of the best mono-blue commanders, which is saying something. I can’t wait to see what his foil price is… $25… huh. That… seems very low.

Foils of Note That Aren’t Just the Same as Above

HAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHA.

*takes deep breath*

…AHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHAHA.

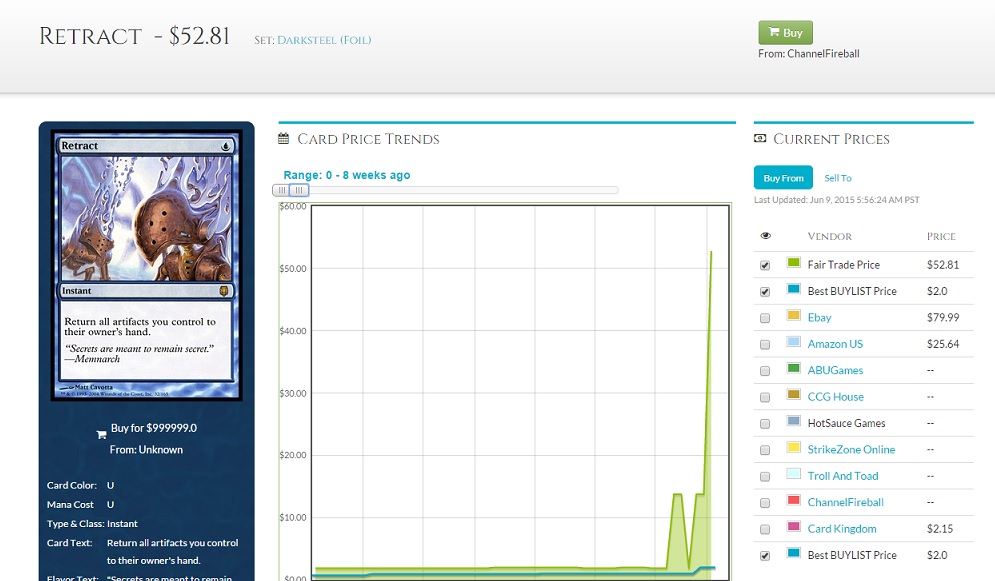

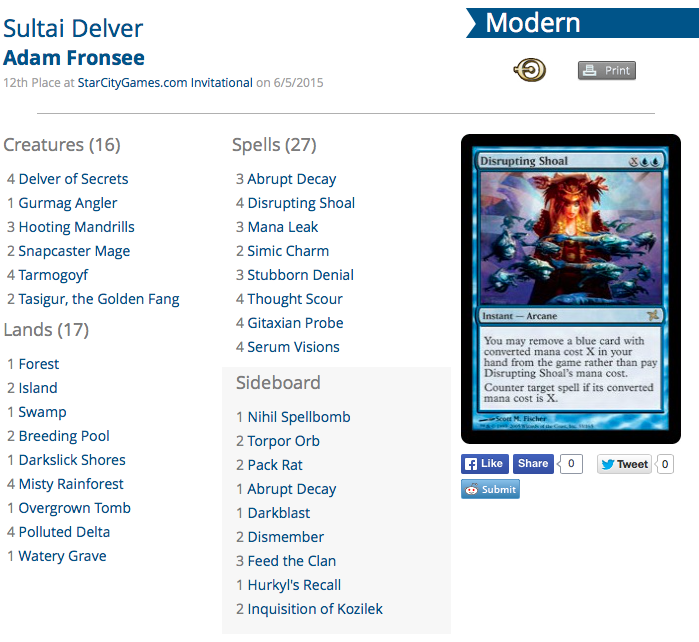

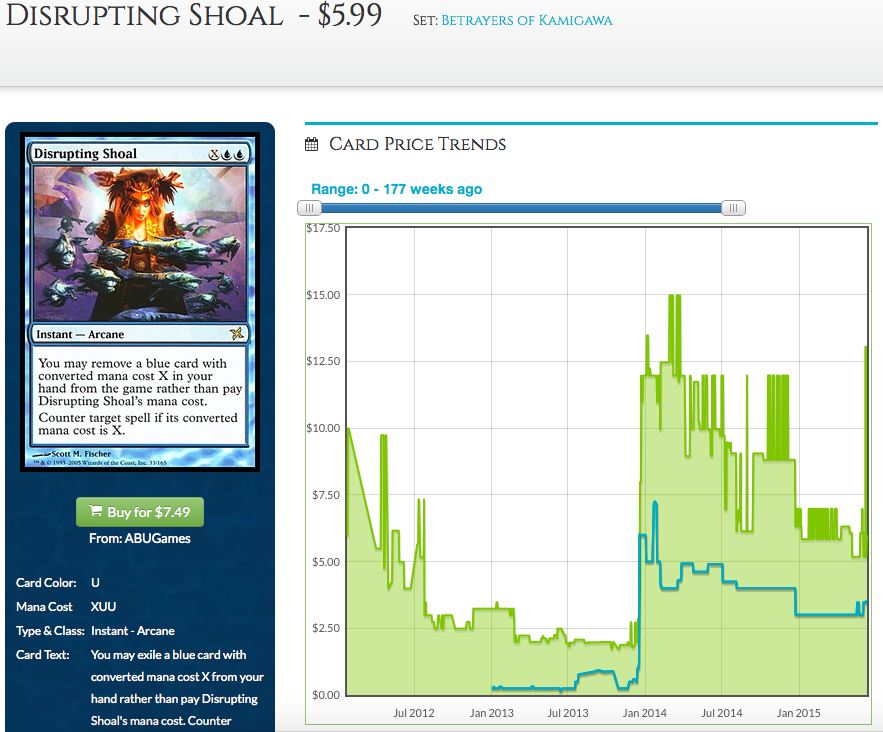

We talked about this card already recently, so I won’t rewrite last week’s article, but notice that the blue line (the most important one!) has barely moved at all, and that the only vendors selling foil Retract at this absurd new price are eBay and Amazon vendors, which means they are speculators and financiers trying to cash out on their (soon to be failed) spec.

Leonin Shikari: I wasn’t sure which section to put this card in, but I went with foils because its foil multiplier is higher than two. The price on this card is impressive, considering I had forgotten that the card exists shortly after I stopped opening Darksteel boosters. It also sees zero competitive play, so this card is only being kept alive by casual players. I wouldn’t even consider it for Cube. I’m trying to figure out if a “Shikari” is a thing, or if the creative team got this name by switching the “i”s and “a”s in “Shakira.”

Slobad, Goblin Tinkerer: Commander. Not sure if you really even want this guy if you’re playing a mono-red deck, but whatever.

Sundering Titan: This card sees a little play in Modern and Legacy,and is somehow banned in EDH, most likely for being a card that I like. The Commander banned list is very dumb.

Trinisphere: Somehow only $13 for a foil that is restricted in Vintage. I bet they’re super hard to find, too.

Skullclamp: FTV foils are pretty controversial (unless they are the only version available), but the set foil of this card is still just shy of $20. Impressive, given how insanely broken this card is. Speaking of insanely broken…

Noteworthy Standard Decks

Ravager Affinity: It is important to remember that the Magic hive mind (or “cultural zeitgeist,” if you’re a pretentious jerk) existed in 2004, but not in the same way that it does now. There were not nearly as many tournaments as there are now, Magic Online was still fairly new, and the lack of modern social media meant most discussions of Magic were still relatively private. This is why it took about a month or so for Arcbound Ravager to be “discovered” by the Magic world as a whole. Sure, some people may have known on day one, and others (like myself) found out when the card shot up to $20. Ravager would go on to be banned in Standard, along with seven (!) of its closest friends, all of which were commons. The majority of all decks before that point were either Affinity or “Beats Affinity.” It was a dark time.

Literally Anything With Skullclamp at One Point: I mentioned that it took longer to figure stuff out, which was at least in part because Skullclamp was Standard-legal for three months, which seems about four months too long. For the brief time that this card was legal, it made seriously every deck—good, bad, or otherwise—playable. Factor in that some of the strongest decks from the previous block (Onslaught) had small, aggressive creatures, and you can see how out of hand things got.

Beats Affinity: Literally there where decks with just a bunch of Shatters and Oxidizes. It was awful. No wonder so many pros went over to poker.

Analysis

Ultimately, Darksteel is going to be remembered more for its failures than its successes. There are a few cards worth money in this set that I didn’t mention, but many of them are Commander (Savage Beating) or eternal (Serum Powder) cards with limited upside. Ravager, Swords, and Aether Vial are going to buoy packs of Darksteel for the foreseeable future, which are $11 a pop, and there is not much else to be had besides those headliners.

Darksteel was also the first small set to have 165 cards, and trust me when I say they aren’t all winners. To put it bluntly, Ageless Entity (foil) and Steelshaper Apprentice are probably the two cards with the most potential (although this is largely because they are basically free).

Thanks as always for reading, and let me know what you think of Homo magiconimus—I have a feeling we’ll be seeing him again.

1Hopefully you do too, because [REDACTED] with [REDACTED] is going to be [REDACTED] [REDACTED].