Not all speculation targets are created equal. Each card has a price, a trajectory, context within various formats, a buy-sell spread, historical baggage, print run considerations, and ever more factors influencing to what extent a spec is a “good buy” or not.

It’s because of all these factors that you might choose to go deep on an unproven bulk rare rather than an established format staple, or to buy a staple even when most in the community believe it has hit its peak.

At its core, all speculating comes down to one basic question: how risky is speculating on this card?

Examplesville

Today’s article will be entirely a case study of Abrupt Decay, a card highlighted fairly frequently on MTGPrice in the last few weeks. We’ll be looking at many of the factors influencing this card’s price, all to determine: is this where we should be putting our money?

The current Fair Trade Price on this card is $12.48 and the top buy price is $9.40. So, as a baseline, if we bought into this card today, the risk would be $3.08 per copy. Yes, the buy price can absolutely go down—and it probably will during the summer lull—but assuming no major unforeseen events, it’s hard to see demand for Abrupt Decay declining.

Reprint Incoming?

Importantly, Return to Ravnica is not slated to be included among the sets drawn upon for Modern Masters 2015. As more players look into playing Modern, the staples that don’t get reprinted this year will all of a sudden have a little extra demand focused on them.

Abrupt Decay doesn’t have any particular flavor that would make it difficult to reprint, but it’s also not the type of card that Wizards green-lights every day. The chance of a reprint seems extremely low to me, especially in a normal set. The most likely place, if any, we’ll see new copies of this in the next year or so is through judge or GP promos.

Reprint risk: Low.

Metagame Risks

How likely is it that Abrupt Decay declines in price due to its place in various metagames?

Let’s start by pointing out that this is a two-color card, and one of those colors is not blue, which limits the amount of decks that can play it. That said, this is a very powerful effect, especially in eternal formats where low-drops rule, and it is not unreasonable to build your deck specifically to have access to this card.

How it does in individual formats is important, too:

Standard: Crucially, this is not legal in Standard, so we don’t have to worry about rotation causing a sudden drop in price.

Modern: MTG Goldfish lists Abrupt Decay as the 39th-most-played card in Modern. The last Modern Pro Tour saw a field of 30 percent Abzan decks, and it’s fair to say that most of if not all of them had access to this card somewhere in the 75. With Jund and straight Golgari decks also fairly prevalent, Abrupt Decay seems fairly safe to continue seeing action in Modern.

Legacy: Abrupt Decay is the tenth-most-played card in Legacy, which is crazy, given that it can’t be pitched to Force of Will. Still, Jund and Sultai decks are big in the format, and Decay is important to keeping Counterbalance decks in check, too. It certainly doesn’t seem like the card is going anywhere.

Vintage: Due to a serious lack of players and events,Vintage playability doesn’t necessarily impact a card’s price in a huge way (foils excepted), but it can indicate a card’s power level. In this case, Decay is the 38th-most-played card in Vintage, so there you go.

Casual: Abrupt Decay is a fine card in Cube, and probably playable in Commander, though not exactly an all-star. Kitchen-table players will probably play any copies they own, but this doesn’t strike me as a card a casual player will see and think she must go out and purchase for her deck.

All in all, I think it’s fairly safe to call Abrupt Decay an eternal-format staple, with little to no value coming from casual formats or Standard. In my mind, this means there is very little risk of metagame changes completely crushing this card’s value.

Contextual Clues

Let’s look at the blocks before and after Return to Ravnica to give ourselves a little context of what is possible and what we’ve seen before.

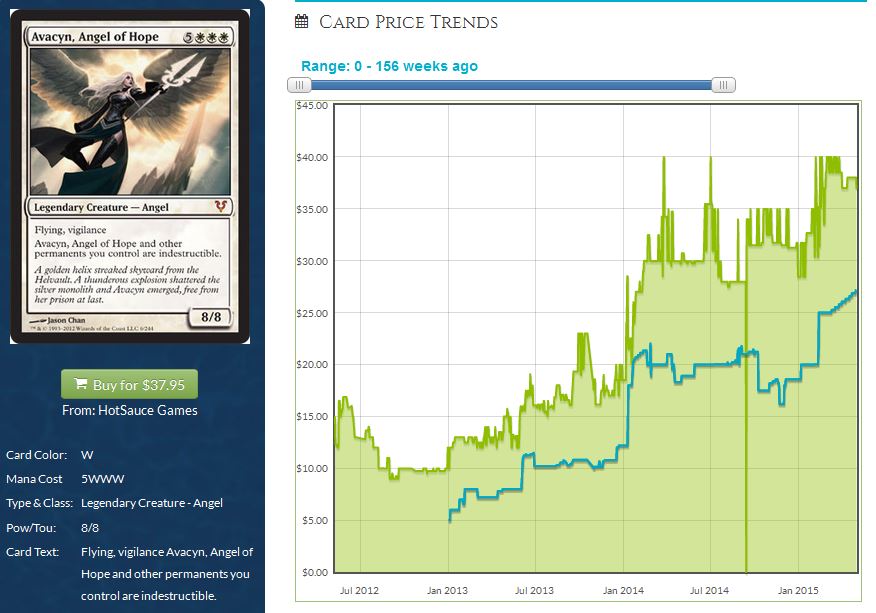

Remember, Return to Ravnica was a large fall set. It was the first of its block, and Abrupt Decay was printed at rare. If we look a year earlier, we can see the most expensive rare in Innistrad.

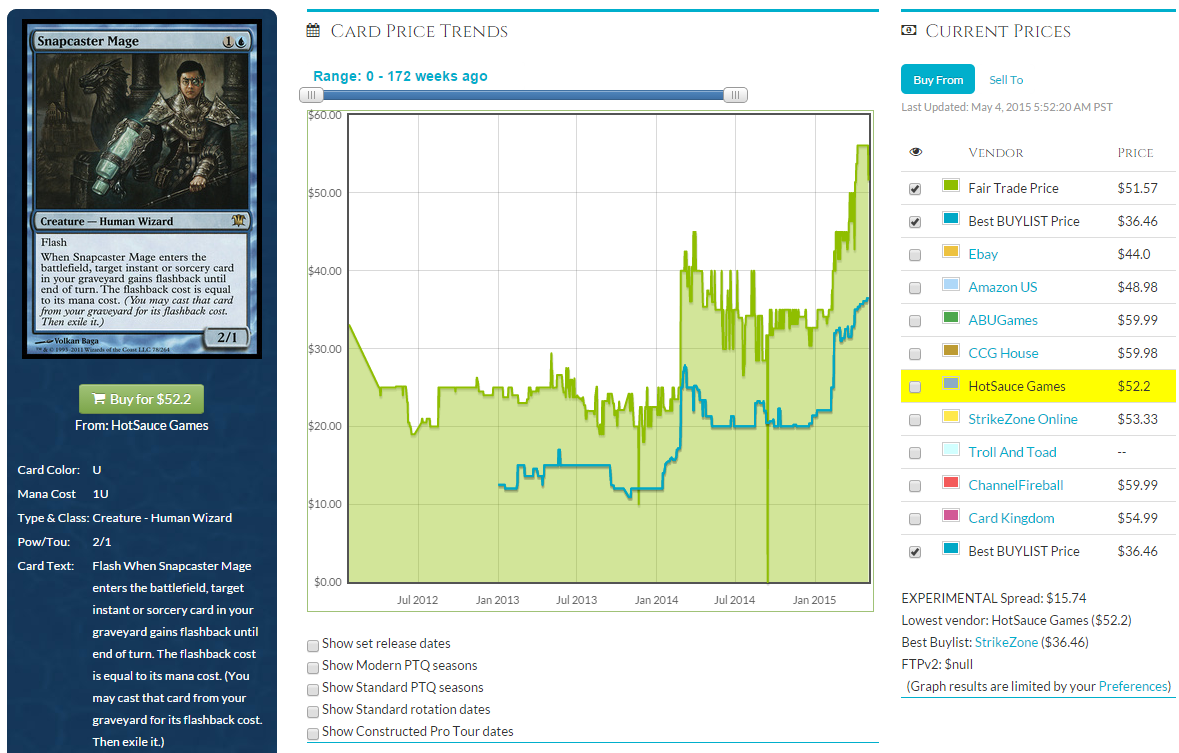

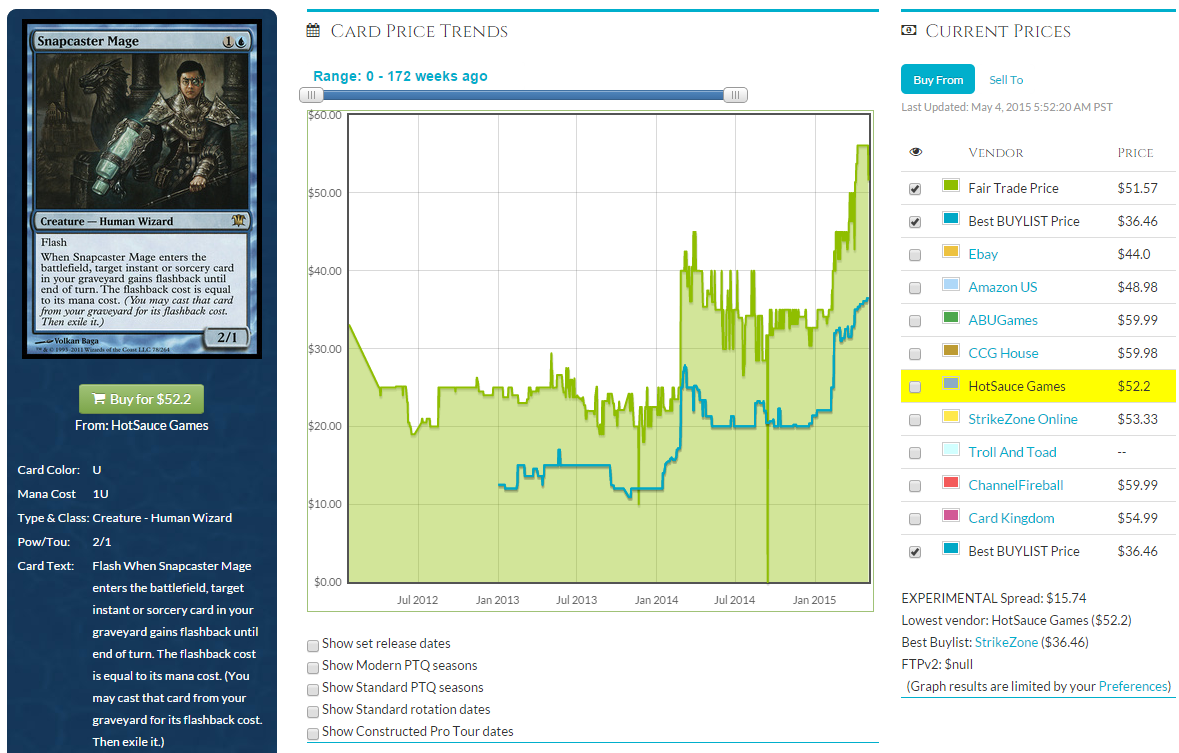

This bodes well. Thinking Abrupt Decay will hit $51.57 is ambitious—far too ambitious, if you ask me—but seeing Snapcaster this high at least shows us that Decay has room to grow. Innistrad and Return to Ravnica were similar in a lot of ways, especially with regards to the timing of their releases, the size of the playerbase, the popularity of the sets, the power level of the top cards, etc.

Snapcaster Mage and Abrupt Decay are very different types of cards, but they are both similarly staple-tastic in all of the eternal formats. Snapcaster is probably a little more attractive in casual formats and it does pitch to Force of Will, which means that all other things being equal, Abrupt Decay probably never moves past Snapcaster in price.

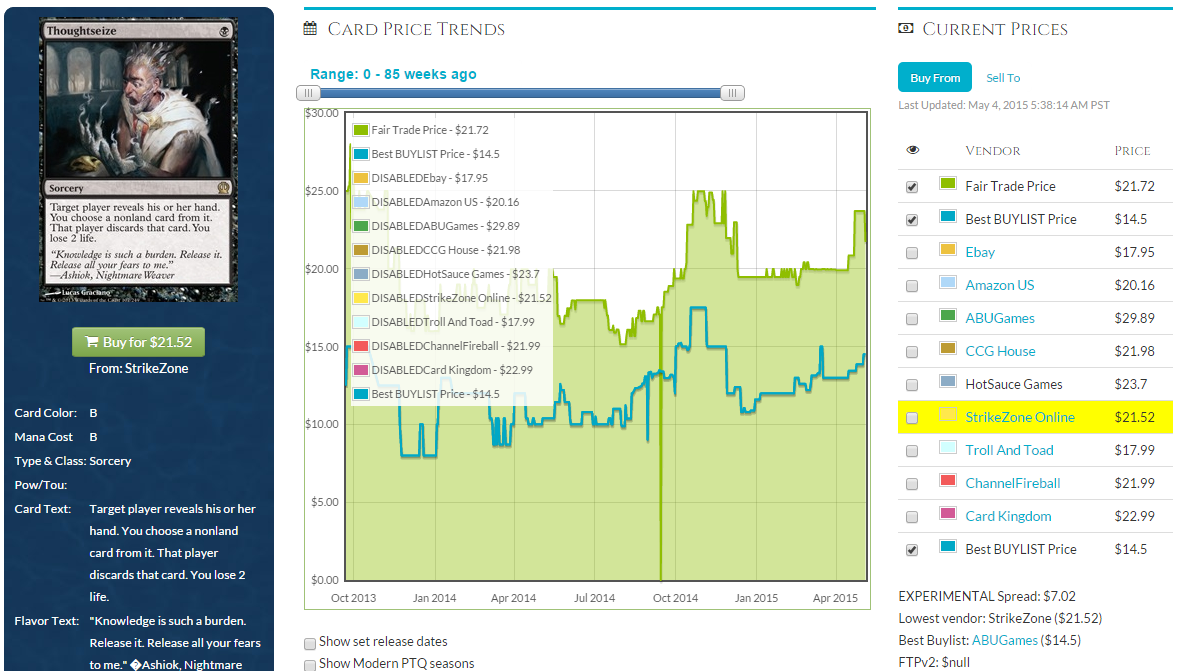

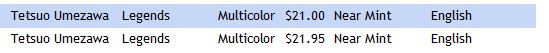

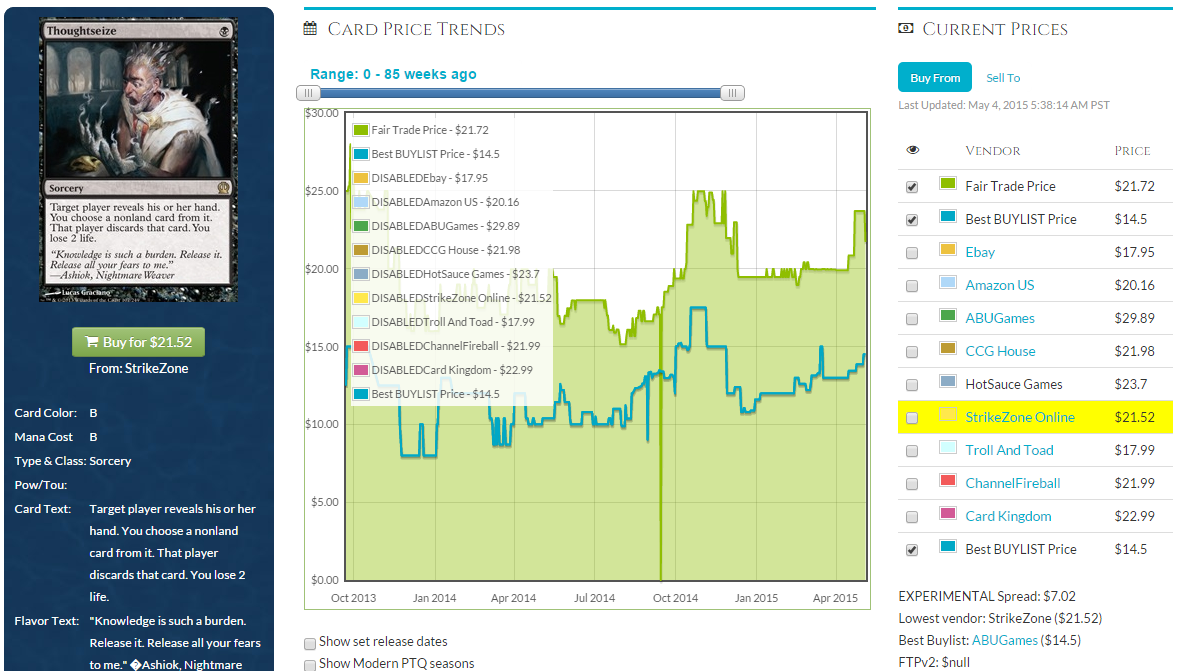

Now for the most expensive rare in Theros, which you can see is Thoughtseize. This is similar to Snapcaster and Decay in some ways, but also different in many.

The similarities are easy: this is an eternal staple played in every single format in which it’s legal, and it is a rare from a large fall set in the same general era as Return to Ravnica and Innistrad.

But the differences add a few twists to the situation. First off, this is a reprint. Before it was reprinted, the Llorwyn version was up to an insanely high $70. This was probably due more to supply factors than demand, although obviously both play a role to hike a card price up so high.

Also, importantly, this card still sees lots of play in Standard. Will it drop at rotation? Maybe. But players in general are getting more savvy regarding MTG finance—thanks in large part to MTGPrice!—and many are not selling their eternal staples upon rotation from Standard. Snapcaster didn’t dip as much as we expected, nor did Abrupt Decay, and I frankly do not expect Thoughtseize to drop much at all.

So although Standard is creating a demand for the card, it’s likely that Thoughtseize is never again available for lower than its current price—and if it is, it will only be slightly lower.

Could the $20 price tag on Thoughtseize be an indicator of what to expect for Abrupt Decay? Maybe, although the reprint and Standard-legal angles certainly make it hard to call this a direct analogue. Also, being two-colored as opposed to mono-colored makes Decay more narrow, which lessens demand. Despite these potential pitfalls, it doesn’t seem unreasonable to suggest that Decay should be between $20 and $50 based on similar-ish cards printed at similar-ish times.

Unless there are other factors at play, that is.

Set Value

Cards’ individual values are often influenced by how valuable their home set is as a whole. This is in large part because singles are priced by retailers to make opening boxes of product worth it. This is a big reason why Voice of Resurgence started and remains so expensive: Dragon’s Maze didn’t have any other good cards!

So if we look at Thoughtseize, we can see that Theros is generally a low-value set. Thoughtseize is the single most expensive card in it, and the ones that follow are mythics that are only good in Standard and casual formats. As far as eternal staples go, Thoughtseize is basically it. If it weren’t a reprint, how pricey would the card be, I wonder?

Similarly, Snapcaster Mage comes from a set with only a few cards that see eternal play: Liliana of the Veil (at mythic), Geist of Saint Traft (also mythic), and Sulfur Falls are the top three. There’s plenty of casual goodies in the set, but the prices are top-heavy with the excellent competitive cards at the top of the list. In many cases, prices for the casual cards in this set are far lower than I would expect in general.

And here’s where thing kind of fall apart for Abrupt Decay. Check out the eternal playables in Return to Ravnica (listed by descending price):

- Abrupt Decay

- Steam Vents

- Deathrite Shaman

- Temple Garden

- Sphinx’s Revelation

- Overgrown Tomb

- Blood Crypt

- Hallowed Fountain

- Supreme Verdict

- Jace, Architect of Thought*

- Rest in Peace

- Loxodon Smiter*

Jace and Smiter are fringe players at Modern at best, but they do see occasional play and are worth mentioning here.

Note that every card on this list is probably a little bit lower than we might otherwise expect. Coincidence? I think not. Because there is so much value in Return to Ravnica—and I’m not even considering the top casual cards like Utvara Hellkite and Chromatic Lantern—I believe the prices of all cards are suppressed. This probably explains in part why the shock lands have failed to perform so miserably.

Now, as we get further away from booster boxes of RTR being commonly available, the price of the box will matter less and less to the prices of individual cards. But the box price is where card pricing derives from originally, and price memory is a powerful thing. Once the playerbase “knows” how much a card is worth, it’s hard to impact that without some major shakeups in supply or demand.

What Does All This Mean?

Let’s say Abrupt Decay hits $20. Its current spread (the difference between the Fair Trade Price and the top buy price) is about 25 percent. So if its retail price hits $20, we can assume the buy price will settle in somewhere around $15.

We’ve already determined the current risk is $3.08 to buy in today. And the gains if we hit $20? Only $2.52 per copy.

Can Abrupt Decay go higher? Sure it can. We’ve seen Snapcaster climb as high as $50, but with the plethora of valuable cards in Decay’s set, the more narrow uses and decks it has compared to Snapcaster, and being from a set that was more opened than Innistrad, it seems highly unlikely to get anywhere close to Snapcaster.

Now for my gut feelings: I don’t see a world where Decay hits $30 any time soon, but $25 may be possible. If it hits $25, then you’re making, what, $6.25 a copy?

So now it comes down to whether you feel like it’s worth it to spend $12.48 to make $6.25 in about six months. Personally, I am not. If I had lots of extra dollars at my disposal, that might be a play I made, but with very limited funds I am willing to dedicate to Magic, I prefer opportunities where I can reasonably hope to double up, and I just don’t think that’s possible with Abrupt Decay.

However, trading for copies is still totally on the table, especially if people are interested in soon-to-rotate Theros cards. And by no means should you be selling or trading copies of Abrupt Decay you already own—it’s basically free money to hold these until Modern Master 2015 is released. I just don’t think it’s worth buying.

The Real Point of It All

This article focused heavily on Abrupt Decay, but it really wasn’t about the individual card at all. My goal here was to show you the thought process behind choosing a speculation target and deciding whether or not it’s worth buying in.

Do you have specific targets your’e looking at? Consider everything: the set they’re in, the supply, the demand, the formats they’re good in, how upcoming rotations and releases will impact them, the similar cards to other sets, etc. The more you analyze your potential spec targets, the more informed your purchases will be. And when you’re spending money on cardboard with pretty pictures, you generally want to be making informed purchases.

Have comments? You know what to do.

[/hide]