A long while ago, I made a set of predictions about From the Vault: Angels. I was right about eight out of the 15 cards. And while I think my picks are better, Wizards is always going to do what it wants.

And that’s something we need to keep that in mind going forward. Wizards of the Coast employs some very intelligent and very confusing people. Trying to predict what will and won’t get printed/reprinted/banned/unbanned is an exercise fraught with peril and likely missteps.

Today I want to look at some…curious decisions they have made and see if there’s lessons we can glean.

FTV: Angels

While all of the choices are defensible, there’s a couple of pieces of information that are very clear: Wizards isn’t trying to just increase circulations of cards. This is the third piece of art for Akroma, Angel of Wrath and the second ‘special’ foil printing. If you count the reprint of Duel Deck Anthologies, then that’s the fourth.

That’s not the strangest choice in the set, though. That honor goes to the inclusion of Iona, Shield of Emeria just two months after having her as a mythic in Modern Masters 2015. Iona is a worthy choice to go into the FTV set, but it’s almost as though each of the two sets didn’t know the other was including her. Just one of these two sets would have been enough to increase her copies in circulation, and she was only at $20/$80 before.

From the outside, it’s impossible to say if this was a communication error or a conscious decision to really push Iona into a low price. But since we are on the outside, we are left to wonder what the motivation was. There was a slot in either set that could have been another card, but who knows what could have been.

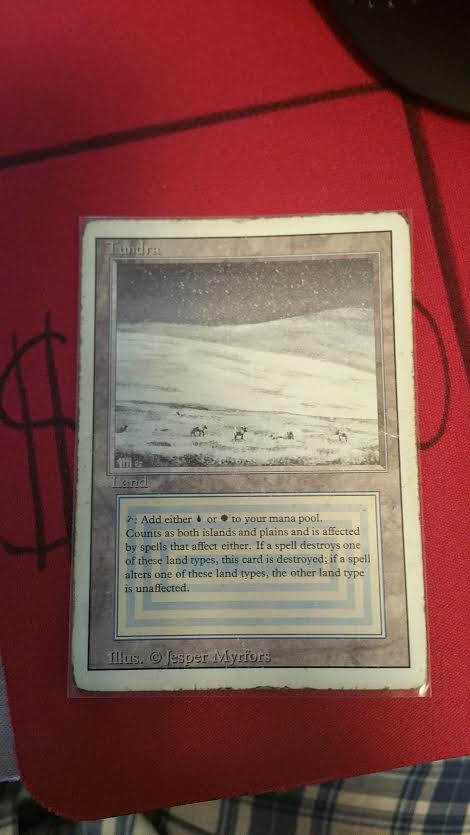

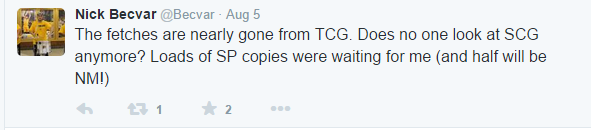

Fetch lands and Battle for Zendikar

When the name of the fall set was revealed as Battle for Zendikar, the five enemy fetch lands immediately took a dive on price, losing more than half their value in some cases. Writers and financiers and players all jumped to the conclusion that the cycle would be in BfZ.

And then, Mark Rosewater dropped this bomb via tumblr:

Was there a voice anywhere that said the fetches were NOT in BfZ? Would you have listened if you’d heard one?

For that matter, who had any inkling that Wizards wanted the allied fetches in Modern and would put them in Standard?

Again, we are forced to confront a very basic truth: Wizards works at their own level. This is true of why Duels is now only on the newest Apple versions, why Magic Online has all of its changes (including the still-missing Leagues!) and when it comes to what is and isn’t in any set or product, outsiders are merely tossing darts at the wall while blindfolded.

Building decks at the end of Standard

What would the last two years have been like if Herald of the Pantheon or Starfield of Nyx had been in Theros block, or even way back in Dragon’s Maze? I can’t remember seeing as many cards dedicated to upgrading an archetype as what showed up in Magic Origins. Granted, this is the last core set, and it’s only legal together for a few brief months, but wow. This is another thing we never saw coming. What is the next two sets going to bring for Abzan or Megamorph decks?

Takeaways

So if we can’t accurately predict what Wizards will do, what can we do to gain a little power over the future?

The easiest course of action is to do nothing. Don’t attempt to speculate or predict and don’t attempt to gain from foreknowledge. We’re all just guessing now.

With a little thought, though, we can make some inferences based on negative information. For example, we know that Commander 2015 will be enemy colors. Instead of trying to predict what will be in those sets (my gut tells me to get out on Prophet of Kruphix, for one) we can infer that allied-color cards are safe for now, so go ahead and stock up on things like Privileged Position or Oona, Queen of the Fae.

Keeping today’s lessons in mind, don’t presume that this winter’s Commander decks will have Arid Mesa and its buddies. We need the set of filter lands just as badly from a price perspective, especially the enemy ones that were only in the barely-bought Eventide. There hasn’t really been a big land present in each of the Commander releases so far, but today’s whole point is that we can’t predict accurately what Wizards of the Coast will do.

Still, though, keep in mind that everything will get reprinted eventually. There’s too many outlets. We have Conspiracy, Modern Masters, Clash Packs, Event Decks, judge foils, GP promos, and special releases like foil Force of Will or the foil promo Genesis Hydras being given out when you buy two old packs at my Target. Everything not on the reserved list will be redone. It’s only a matter of time.