A is for Arbitrage

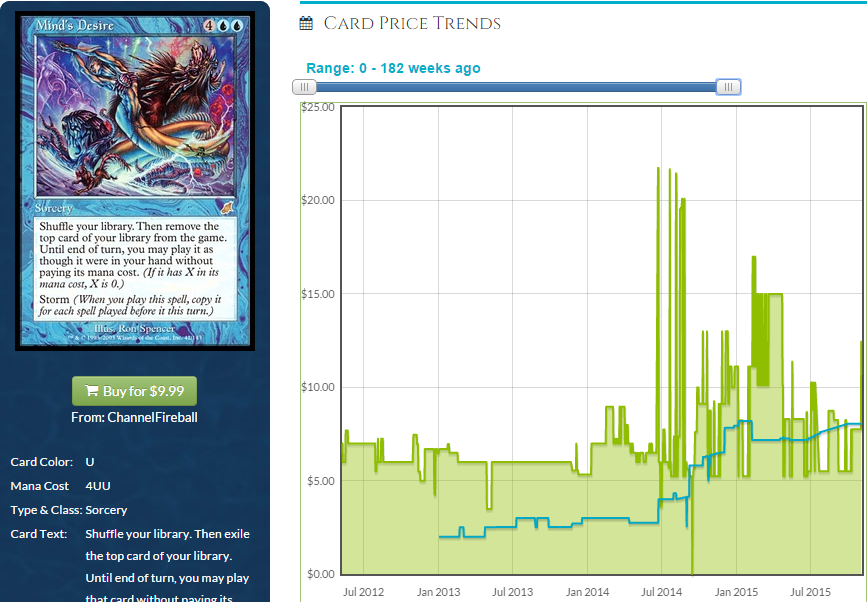

Arbitrage is a favorite topic of ours around here, and it’s especially favored by Sigmund Ausfresser and Jason Alt. It’s a simple concept wherein one buys an item from one party and sells it to another party for a higher price. Essentially, it’s a matter of identifying market inefficiencies and capitalizing on them. Here’s an example from a recent Jason Alt article:

You see where the buylist price (the blue line) is above the retail price (the green line)? That’s an arbitrage opportunity. Taking these opportunities is as close to “free money” as you can get, though obviously there are risks if you’re waiting for mail.

B is for Buylists

Buylists are beyond important to the MTG community. For store owners and independent operators, they’re the prices one is willing to pay for cards. For hobbyists and players, they’re the prices one can get for one’s cards at a moment’s notice. For financiers, they’re the indicators that might help one decide whether or not to buy in on a speculation target or avoid it. The existence of buylists is what makes Magic cards one of the most liquid non-currency assets you own.

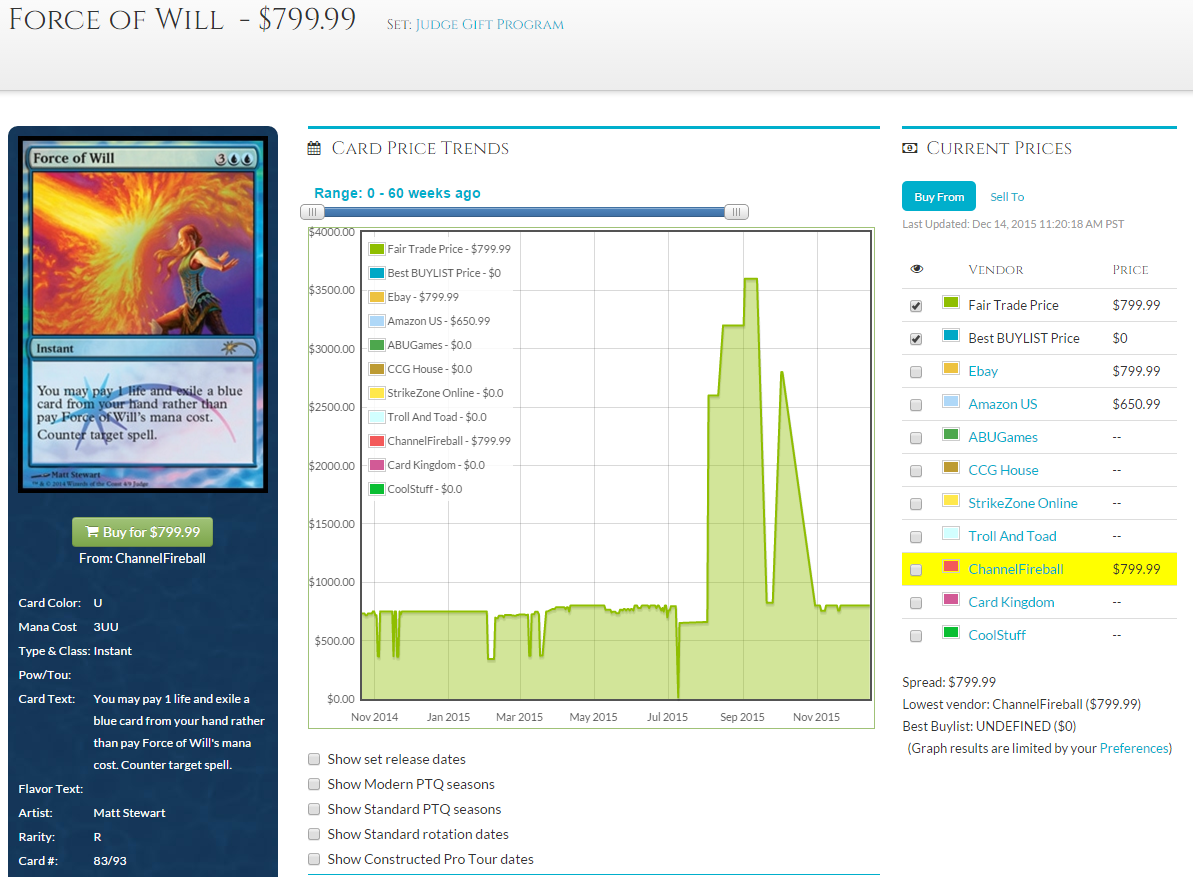

When you search for a card here on MTGPrice, you’ll see a list of retail prices from a bunch of different vendors on the right side of the screen. Click the “Sell To” button, though, and it will switch to the buylist prices for those vendors. This will show you who is paying the most, and will also give you a good indication of the current demand for the card in question. (The card above is Force of Will, in case you’re wondering. Demand is pretty tepid for this $115 card.)

C is for Canceled Orders

If you’re watching a tournament and see a card performing well, you may want to place an order for that card. However, in the climate of today’s Magic marketplace, prices swing quickly, and there’s a good chance your order will get cancelled by overambitious vendors who would rather make $3 extra than retain a loyal customer. It’s just a fact of the world, and you should be aware of it.

How can you combat this? A few tips:

- If you know you want a card, order it before the big tournaments are underway.

- If you’re ordering a large quantity, either order from many different vendors or order from a big-name player (Star City Games, Channel Fireball) who will honor your order.

- Run a Google search and check the MTGPrice forums to see if a store you’re considering buying from has a reputation for cancelling orders.

- If you do run into issues, report them in the various places Magic players gather online to warn other players who may be considering a purchase.

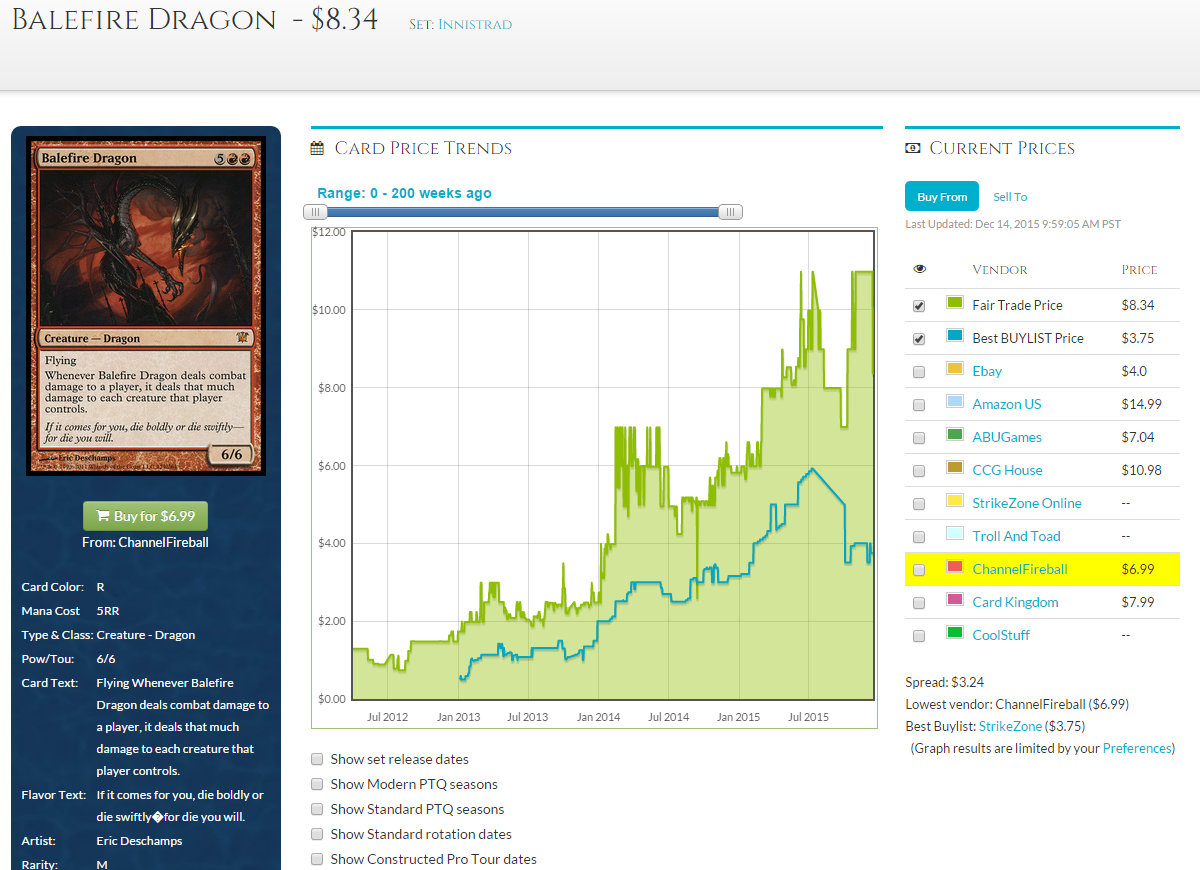

D is for Dragons

Not just dragons, though. As an MTG financier, you should know that dragons, angels, elves, goblins, and a few other tribal creature types get a premium from a certain subgroup of players. If a sweet new card comes out with one of these creature types and seems underpriced, this is another factor that may convince you to buy in. This chart will probably convince you not to sell your mythic dragons at bulk prices:

E is for EV

You’ve probably heard people talking about “EV,” but it may have taken you a while to figure out that it stands for “expected value.” This is a term that you’ll hear quite often, and not just in Magic circles, either. It refers to the average gain or loss one can expect after performing an action many times, while taking known variables into account.

For example, the EV of opening a booster pack of Battle for Zendikar would be the average value of ten commons, three uncommons, one rare or mythic, one basic land, and the possibility of a foil, maybe even of the Expeditions variety, replacing a common. Most often, you’ll hear people discuss the EV of playing in particular events, weighing the cost of entry versus the value of the prizes, tournament materials, and added perks. The better your EV, the more you should want to do something.

F is for Formats

Knowing which format(s) a card on which you are speculating is played in is absolutely key to being successful in Magic finance. Cards that are played in Standard perform differently than those that are played in Vintage, and the same is true of Legacy, Modern, Commander, Cube, and basically any other format you can think of.

If you’re buying a card for speculative purposes, you need to know in which formats the card sees play, how in demand it is in those formats, and how those formats generally impact prices (e.g., Standard moves prices more quickly than Vintage, but Vintage-playable foils could end up worth more than your car if you acquire a few of them).

G is for Grading

You should know the difference between near mint (NM), slightly played (SP), moderately played (MP), heavily played (HP), and damaged. You should know how these different grades impact card prices. You should be able to grade your cards accurately. You should know who grades harshly when buylisting (Strike Zone Online, Card Kingdom) and whose SP cards are often NM (Star City Games). DJ Johnson wrote a great piece on getting value from less-than-NM cards. You should read it.

H is for Homo Magiconimus

In this article, Ross Lennon took the economics term homo economicus and applied it to Magic, creating a new, fancier term for “magical human.” The concept of homo economicus/magiconimus is basically that economists/MTG finance writers predict things as if everyone will act rationally at all times—despite all evidence to the contrary.

We want to be the magical human of legend, but alas, humans are not rational creatures, but emotional ones. Knowing that you will be misled by your emotions, however, can help you plan for just such a contingency. We can all aspire to be magical humans, and being self-aware of our biggest weakness in this respect is a huge step toward this goal.

I is for Interests

MTG Stocks has a section called “Interests” that shows the daily and weekly movement of the cards with the largest changes in that time period. MTGPrice has similar pages called “Today’s Gainers and Losers” and “Week’s Gainers and Losers.” Both sites seem to have slightly different algorithms, so you’ll see a few different cards on each list, but the information is great on both. MTGPrice offers a format sorting ability, too, which you know is extremely helpful if you’ve been reading along.

Checking the finance interests every day is a highly efficient way of getting a handle on the market. DJ Johnson paid proper homage to this aspect of MTG finance in this article.

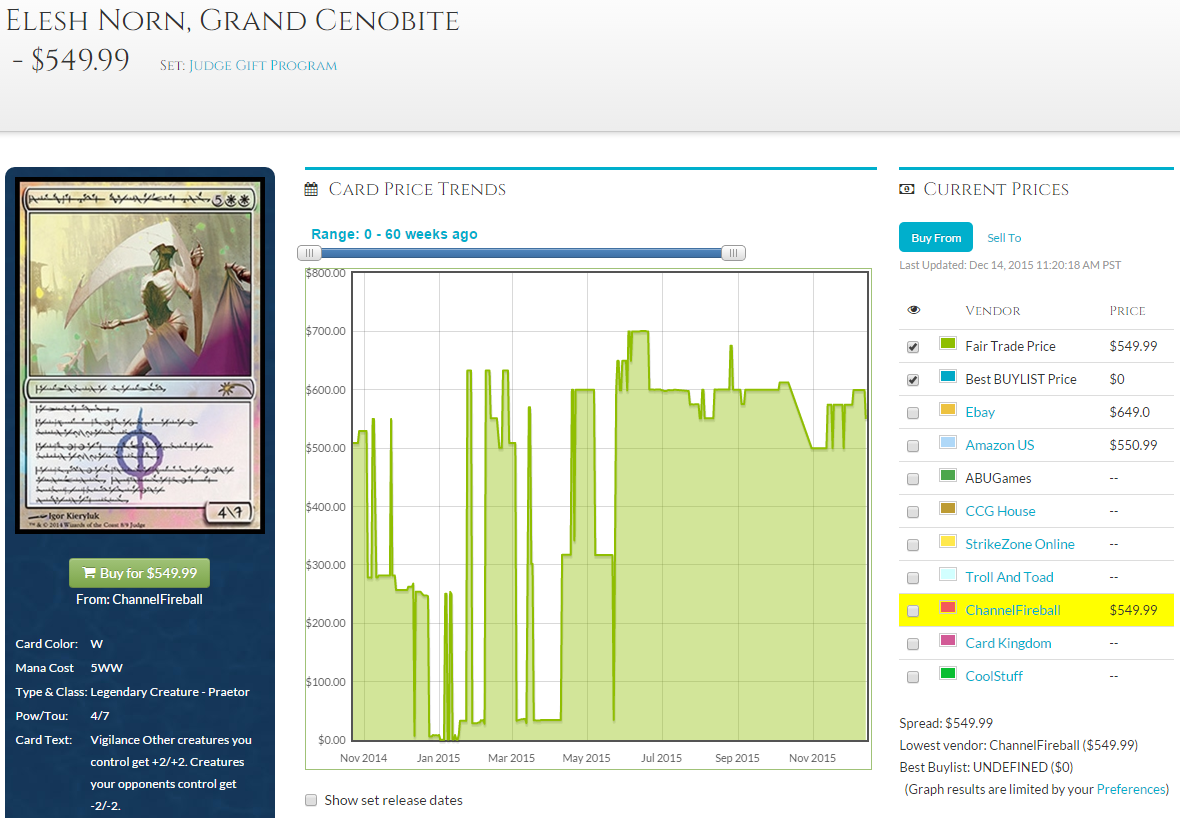

J is for Judge Foils

Judge foils are important because they are one of very few ways to inject truly high-end cards to the Magic market without just crashing those cards’ values in the process. Two recent examples:

You’re not going to find prices like that on cards from recent booster packs (even Expeditions are dwarfed by these), yet these ridiculously expensive cards were just printed in the last couple years. The point is: if you care about high-end cards, you should probably get friendly with a judge—or become one yourself.

K is for Knowledge Capital

From Investopedia:

An intangible asset that comprises the information and skills of a company’s employees, their experience with business processes, group work and on-the-job learning. Knowledge capital is not like the physical factors of production – land, labor and capital – in that it is based on skills that employees share with each other in order to improve efficiencies, rather than on physical items. Having employees with skills and access to knowledge capital puts a company at a comparative advantage to its competitors.

Hey, this is what we offer at MTGPrice! With a team of some of the best finance minds in the business as well as a bevy of tools at your disposal, we are offering our knowledge capital to you at the price of less than $5 per month. Could you do it without us? Sure. Will we make it easier? Count on it.

L is for LGS

You’ve definitely run into this term, and if you were too embarrassed to ask after all these years, let me finally enlighten you: it stands for “local game store.”

Your LGS is not essential to your success in Magic finance, but it can certainly be helpful. Here, you will have access to a local buylist (hopefully), meet people to play and trade with, get to test out formats and decks, be able to purchase Magic products without waiting for shipping, and more. Your LGS is a resource to you, so don’t let it go to waste.

M is for Mill

I could have put this under the dragon umbrella, but mill cards are unique enough that they deserve their own letter on this list. Mill cards are, inexplicably, hugely popular among the casual crowd. Take a peek at Glimpse the Unthinkable‘s unfathomable price for the prime example. That’s not the only one, though, as we see abnormally high prices on cards like Mind Funeral, Archive Trap, Consuming Aberration, Traumatize, Hedron Crab… you get the idea.

If it’s blue, black, or both, and it puts cards from your opponent’s library into his or her graveyard, there’s a reasonable chance that card will be worth money someday. This is a fact you should we aware of.

N is for Negotiation

Considering the fixed-price nature of most retail establishments, it’s rare to get to negotiate for items these days. That said, you get to negotiate all the time in Magic finance.

Making a trade? Every step of the process is negotiation. Buying a pile of cards from a vendor at a Grand Prix? If you’re not offering a lower price than what’s listed, you’re doing it wrong. Looking to sell some cards? Negotiation skills will help you get the most possible for them.

This is a skill you should be developing, period.

O is for Out of Stock

Star City Games is well known for having too-high prices on its cards (but compensating with stellar customer service and Magic‘s best tournament series), and as such, I have never actually bought cards from the company. That said, SCG is huge and can thus swing the marketplace single-handedly. When SCG is out of stock of a card, that probably means the card is in high demand, as SCG’s coffers are deep. Often, the card is not sold out at all, but SCG is merely taking some time to determine what the new market price should be. Currently, most of the Expeditions lands are out of stock. A sign of high demand and/or a pending price increase? It’s hard to say for sure, but keep an eye on it.

P is for PucaTrade

I love PucaTrade, as I’ve expressed on this very site. In fact, PucaTrade has been a recurring topic for more than a year now here at MTGPrice. While there has been some recent controversy after Cliff Daigle’s last couple articles, the site is growing by leaps and bounds and has proven itself to be a fantastic place to exchange Magic cards for other Magic cards. My cube would be an untuned mess without the service, I can promise that.

PucaTrade is another of those tools available to you that is not essential for your success, but is helpful to it. There’s a high time cost associated with getting started (PucaTrade is at its best when you list your entire collection), but once you’ve begun on the path of Puca, it’s hard to look back.

Q is for Quarterly Reports for Hasbro Shareholders

The Magic community doesn’t get a lot of hard numbers regarding number of players, the growth of the game, or how sales are doing. We get broad platitudes like “the best-selling set ever,” but rarely do we get a glimpse at hard numbers.

The one exception to this is the information provided to Hasbro shareholders, which is available (at least in part) to the public. Realistically, the annual reports are more important than the quarterly ones, but come on, I needed a word that starts with “Q”. (Just wait until we get to “X”.)

Incidentally, Anthony Capece drew heavily on Hasbro shareholders reports for his research in two of my all-time favorite MTG finance articles: “Rare is the New Uncommon” and “Size Matters.”

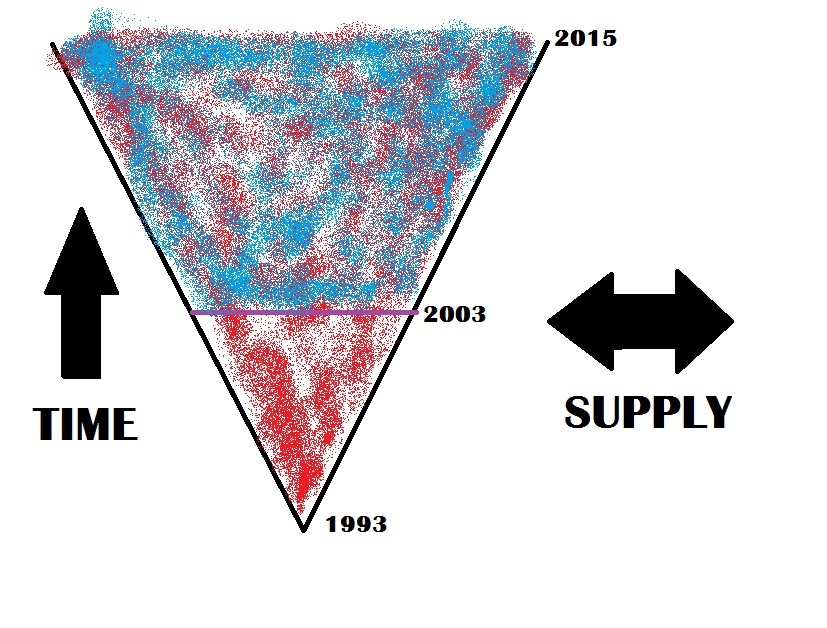

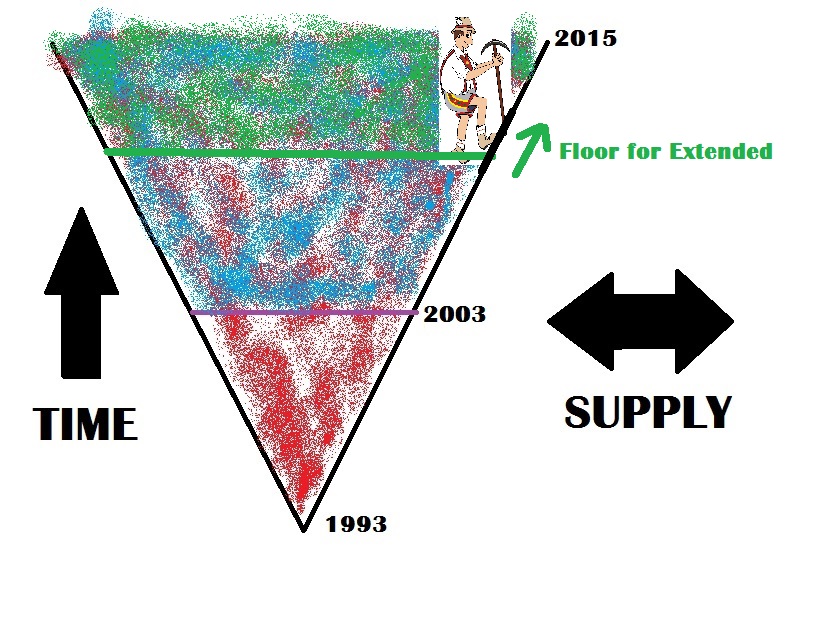

R is for Reserved List

Back in the ’90s, Wizards made a stupid promise in order to appease collectors: it will never reprint cards that are contained on this list, colloquially known as “the Reserved List.” The Reserved List includes the power nine, the ten original dual lands, and tons of great cards from the first five or so years of Magic‘s existence (and also Wood Elemental).

In 2011, after some controversy, Wizards removed a loophole that allowed the company to print premium versions of these cards. The company has maintained that it will never violate the letter or the spirit of the Reserved List again.

This has a two-pronged effect: cards on the Reserved List are some of the safest investments in Magic, since we have a guarantee they will never be reprinted. On the other hand, formats that need cards like the power nine and dual lands are dying because of the ever-decreasing numbers of these cards in existence, which we might expect to lead to card devaluation over time. Not too long ago, Travis Allen wrote a great piece about the effect this is having on Legacy.

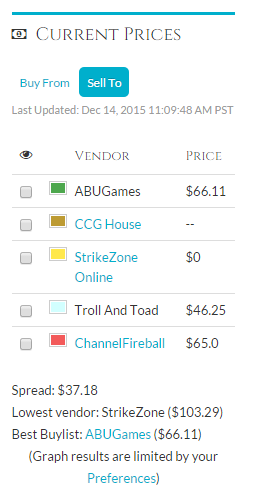

S is for Spread

The difference between the retail price and the highest buylist price is what we refer to as spread. For example, if a card is selling for $10 and you can sell it for $5, the spread is 50 percent.

In MTG finance, we use spread to determine dealer demand for a card, which in turn gives us some insight into the larger demand for a card. If a dealer is paying $9 on a $10 card, that’s a 10-percent spread, and indicates that the dealer is having no trouble at all moving copies of the card and just wants to move through as many of them as possible.

In general, the lower the spread, the more we’re interested in buying in. A very low spread often acts as an indicator that a retail price is about to go up.

T is for Twitter

There’s a whole bunch of MTG financiers on Twitter, some with podcasts, article series, blogs, or other platforms, and some that post only to Twitter. The #mtgfinance hashtag is one you should be well familiar with. If you’re not on Twitter, you’re giving up a whole bunch of free information (and sometimes entertainment).

Jason Alt once wrote an article series at Gathering Magic focusing on the best people to follow on Twitter. That seems like a fine place to start if you’re just now registering for an account.

U is for Unrealized Gain

This is perhaps my biggest weakness in MTG finance. An unrealized gain is one where you have successfully made an investment, but haven’t actually secured the capital that equals profit. The eight copies of Wingmate Roc that I bought for $2 each and never got around to outing? Those are great (and shameful) examples of unrealized gains.

Don’t get caught by this trap—be a homo magiconimus and sell your cards at the right time. In this case, laziness was my downfall, but it’s been greed in the past. Lock in those profits and don’t let greed or laziness lose you money.

V is for Value

If you don’t know why V is for value, then I don’t know why you’re reading this website.

W is for Watching and Waiting

MTG finance is all about watching and waiting. If speculation is your style, you need to watch for targets and wait for them to hit. If you’re the type to buy collections and piece them out, it’s all about waiting for that perfect customer or Craigslist post. If you’re a player looking to get cards for their best prices, you’re waiting for December or the summer, when prices are traditionally at their lowest.

You need to watch what’s going on in the marketplace and wait for predictions you’re counting on to come true. It’s just part of the hobby.

X is for Xenaphobia

As opposed to xenophobia, xenaphobia is the fear of strong, powerful women, such as a certain warrior princess. The Magic community has a strong case of this affliction, as we see in the responses every time an article about women in Magic gets published (examples here, here, and here).

I don’t know that the Magic finance community is particularly unwelcome to women, but we also lack (m)any prominent female voices, so maybe there’s something we could do better. On a purely selfish level, more women in the game simply means more customers and trading partners, but there’s plenty of arguments for why diversity in games (in both content and audience) will make the hobby more fun for everybody.

Y is for You

Everything in Magic finance comes down to you. Your preferences, your beliefs, your ideas, your actions, and your money.

MTG finance writers are here to point out trends, strategies, theories, and suggestions, but we never tell you that you have to go buy this or that you have to go sell that. We give advice—usually good, but occasionally bad—but you’re the one who ultimately vets what we have to say and takes action based on your opinion of it.

Mark Rosewater often says that the best way to get better at Magic is to own your losses and always be asking yourself what you could have done better. This exact same practice can—and should—be applied to Magic finance, too.

Z is for Zero Balance

Zero balance means exactly what it says: the balance of your debts is zero.

Of course, I hope you’re not going into debt to buy Magic cards (unless you’re opening a business, I suppose). However, we all know Magic cards can make us money. Can you pay off your home, car, student loan, and other outstanding balances with our proceeds? Sure, if that’s your goal.

Maybe your ambitions aren’t to pay off your real-life debts with your Magic hobby, which is fine! In that case, the dream can be a zero balance on your MTG wants list. That’s something we can all agree would be awesome, right?

I’ll update this list periodically, and if you have any links to content that is especially relevant to any of the above, please leave them in the comments and I will add them to the post.